Nowadays, every listed company is providing earnings guidance, which is nothing but management comments about what it expects from the company in the future. The management also discusses about its long term or short-term goals in the guidance. These earnings guidance act as one reference point among many that enable an analyst to make a buy or sell call. This is because the earnings guidance is a subjective view of the company’s future performance, which is exposed to many risks and uncertainties in the future. Let’s look at three financial sector stocks, with their latest results and earnings guidance.

QBE Insurance Group Limited

QBE Insurance Group Limited (ASX: QBE) is an international general insurance and reinsurance company which is engaged in underwriting general and reinsurance risks, investment management and management of the economic entity’s share of the NSW and Victorian workers’ compensation scheme.

QBE Announces Full Year Results for FY19

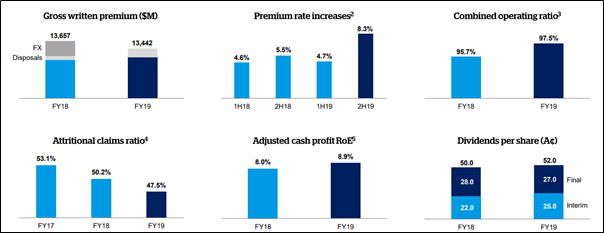

The company reported net profit after tax of $550 million, a jump of 41% from $390 million in the prior year. Adjusted net cash PAT was $733 million which was up 6% against $692 million in the prior year, while adjusted cash profit ROE was 8.9%, an increase from 8.0% in the prior year. Despite a 2H19 result heavily impacted by weather, the 2019 final dividend of AUD27¢ps reflects the company’s confidence in the balance sheet and outlook. The company has given full-year guidance for 2020, and combined operating ratio is expected to be in between 93.5% to 95.5%. The net investment return is expected to be in between 2.5% to 3.0%.

Results Snapshot (Source: Company Reports)

Stock Performance

The stock of QBE closed the day’s trading at $14.760 per share on 17th February 2020, up by 4.311% from its previous closing price. The company has a market capitalisation of $18.47 billion as on 17th February 2020. The total outstanding shares of the company stood at 1.31 billion, and its 52-week low and high prices are $11.010 and $14.790, respectively. The stock has given a total return of 12.84% and 17.14% in the time period of 3 months and 6 months, respectively.

Money3 Corporation Limited

Money3 Corporation Limited (ASX: MNY) is an expert provider of vehicle finance for the maintenance and purchase of a vehicle in New Zealand and Australia. The company’s unique approach and business model for customers care draw creditworthy customers that are underserviced by conventional lenders.

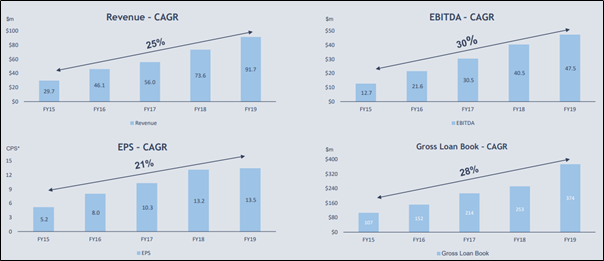

Money3 Corporation Reports Double-Digit Growth in Revenues

Money3 Corporation Ltd has posted a strong 1HFY20 result on the back of record growth in loan originations and cash collections. Australian operations revenue grew by 28.8% (on pcp) to $52.1 million supported by a 23.1% growth in cash collections to $114.3 million (on pcp).

- The company reported a 55.0% increase in revenue to $62.7 million;

- EBITDA increased by 36.9% to $30.5 million;

- New Zealand operations continue to make a solid contribution with $10.6 million in revenues in 1HFY20;

- The company declared a fully franked 5 cents per share interim dividend payable on 20 April 2020.

Growth Story (Source: Company Reports)

Outlook for FY20

The company is expecting NPAT of more than $30.0 million for FY20 and statutory NPAT of more than $32.0 million. The loan book is expected to more than $475.0 million in 2HFY20. The company maintains its stand to pay a minimum dividend of 10 cents per share for FY20. The company has headroom of $50 million in existing debt facilities, which can be deployed in the Australian or New Zealand markets.

Stock Performance

The stock of MNY closed the day’s trading at $2.900 per share on 17th February 2020, up by 7.011% from its previous closing price. The company has a market capitalisation of $499.19 million as on 17th February 2020. The total outstanding shares of the company stood at 184.2 million, and its 52-week low and high prices are $1.775 and $2.930, respectively. The stock of the company has given a total return of 33.50% and 27.83% in the time period of 3 months and 6 months, respectively.

AUB Group Limited

AUB Group Limited (ASX: AUB) is Australasia’s major insurance broker network running approximately $3.2 billion GWP throughout its network of 93 businesses, serving greater than 550,000 clients and caters to more than 600 locations where it services over one million policies.

The Company Announces Strategic Acquisition

The company has announced two strategic acquisitions, which will scale the company’s core business and enhance its ability to leverage technology and target new customer segments. The company has increased its ownership to 100% in the MGA Whittles Group, an existing Austbrokers member, by acquiring the remaining shares in the Group that AUB does not already own. In addition, AUB has acquired 40% of BizCover, Australia’s leading online insurance distribution platform.

AUB Group Reaffirms its Earning Guidance

The company is anticipating reporting toward the top of its earlier announced guidance range of 8-10% growth in adjusted NPAT in FY20. This guidance is centred on primary, unaudited 1H20 financial performance. It is reliant on the expectations made in the company’s FY19 results, as well as anticipations of trading for the rest of the financial year. The guidance includes smaller acquisitions and removals of shareholdings in Partner businesses. The company is thrilled to report strong business performance in the first half of FY20. It has made great improvement with its strategic initiatives, and in improving the underlying performance of the company. 1HFY20 results are expected to be released on 25 February 2020.

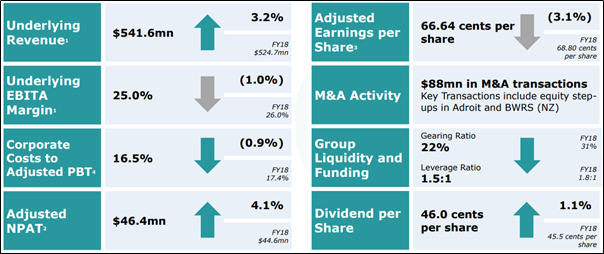

Financial Performance in FY19

In FY19, the company delivered a 4.1% increase in Adjusted Net Profit After Tax of $46.4 million, while maintaining a strong capital position and balance sheet. The company’s core insurance broking and underwriting agency business in Australia and New Zealand operated well, delivering double-digit growth. It continues to have substantial scale and footprint and excellent market status. The company’s Underwriting Agencies, Australian and New Zealand Broking businesses all worked well in FY19 with the Adjusted NPAT grew by 10% YoY, excluding the result of the Canberra fraud. Growth is anticipated to continue in FY20.

The adjusted EPS decreased by 3.1% due to the impact of the capital raised in November 2019 and will continue to have an impact in FY20 due to the full number of shares issued in FY19 taking effect for the purpose of calculation. The company declared a final, fully franked dividend of 32.5 cents per share. This, together with the interim dividend of 13.5 cents per share, results in a full-year dividend of 46 cents per share, being a payout of 72.9%.

FY19 Performance Snapshot (Source: Company Reports)

Financial Position of the Company

The company remains to be cautious in managing capital, with the group gearing ratio reducing to 22% in FY19. The business has a robust ongoing cash flow generation, while the corporate entity has access to cash and long-term corporate debt facilities to fund future acquisition and organic growth initiatives. The company’s leverage ratio compiled on a look-through basis has ranged historically between 1- and 2-times net debt to EBITDA and is currently at 1.5 times. The Group’s Interest cover ratio was 11:1.

Stock Performance

The stock of AUB closed the day’s trading at $13.080 per share on 17th February 2020, up by 2.267% from its previous closing price. The company has a market capitalisation of $943.86 million as on 17th February 2020. The total outstanding shares of the company stood at 73.8 million, and its 52-week low and high prices are $10.150 and $13.940, respectively. The stock of the company has given a total return of 5.53% and 16.38% in the time period of 3 months and 6 months, respectively.