Penny Stocks

Penny stocks, also known as micro-cap stocks, nano-cap stocks, small cap stocks or OTC stocks are the common shares of small companies which trade at a very low price and have a market capitalisation below $300 million. Penny stocks are generally seen to be quoted on OTC exchanges.

They are associated with a high level of risk in terms of making a profit. In such a case, investors need to do their homework before investing their hard-earned money on penny stocks.

In this article, we would acquaint ourselves with four penny stocks and understand their recent updates.

Alcidion Group Limited

Company Overview

Alcidion Group Limited (ASX:ALC) is a provider of software solutions for high performance healthcare. The software solutions provided by the company enable clinicians with decision support tools which help them in providing superior quality of care for their patients.

Recent Update

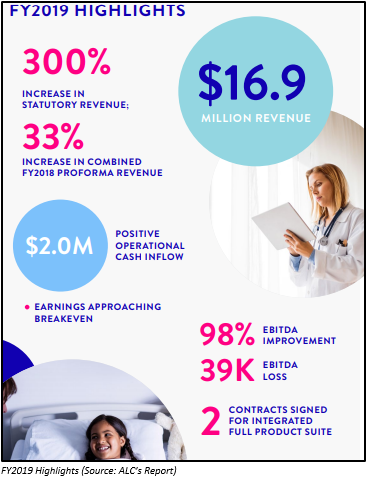

On 23 September 2019, Alcidion Group Limited released its FY2019 annual report for the period ended 30 June 2019.

- ALC reported a 300% growth in its statutory revenue to $16.9 million during the period;

- Combined FY2018 proforma revenue went up by 33%;

- Operational cash flow for the period was $2 million;

- EBITDA improved by 98%;

- Net loss after tax during the period was $84,165;

- The net asset of the company increased from $3,333,246 in FY2018 to $13,242,586 in FY2019 as a result of an increase in the total asset of the company;

- The net cash inflow from operating activities and financing activities was $1,990,959 and $31,353, respectively;

- The net cash used in the investing activities was $1,740,808.

- The net cash and cash equivalent by the FY2019 ended 30 June 2019 was $3,171,843.

Stock Information

The shares of Alcidion Group Limited have generated a YTD return of 453.19%. The shares on 27 September 2019 opened at a price of $0.27, slightly up by A$0.01 as compared to its last closing price. The shares by the end of the dayâs trading closed at a price of $0.300, zoomed by 15.38% from its previous closing price. Around 4,661,813 shares of ALC traded on ASX. ALC has a market capitalisation of $212.07 million and approximately 815.67 million outstanding shares.

Bigtincan Holdings Limited

Company Overview:

Bigtincan Holdings Limited (ASX:BTH) supports sales and service team in increasing the win rates and customer satisfaction through its AI-powered sales enablement automation platform.

Recent Updates:

Trading Halt:

On 26 September 2019, the shares of BTH were on a trading halt awaiting a market release from the company related to the outcome of a Placement and its systematic stance. The company expects that the trading halt would last until an update from the company or prior to the opening of the normal trading on 30 September 2019.

$2.8 million Contract:

Recently, on 10 September 2019, the company has secured a contract worth $2.8 million for a period of 3 years with the leading global sports apparel retailer, Nike.

Stock Information:

The shares Bigtincan Holdings Limited have generated a YTD return of 121.07%. The BTH stock last quoted $0.60, with a market cap of $157.16 million, on 25 September 2019.

Whispir Limited

Company Overview:

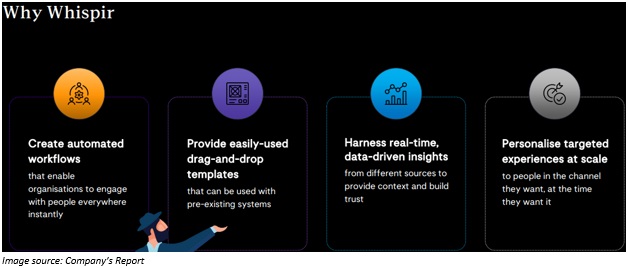

Whispir Limited (ASX: WSP) is a global scale software-as-a-service (SaaS) company which provides a platform that supports communications workflow and helps in automating communications between businesses and individuals.

Recent Update:

Wilsons Investor Seminar Presentation:

On 26 September 2019, Whispir Limited released its Wilsons Investor Seminar Presentation covering information about the company, its present position, its partners, its market opportunity, FY2019 highlights, Q1 FY2020 achievements, FY2020 outlook and the revenue model.

- WSPâs Position: At present, WSP supports 1.5 billion interactions per annum. It has more than 500 blue chip clients and interacts with over 55 million unique people yearly.

- Partners: Some of its partners include Telstra, IBM, aws, telkomtelstra, StarHub, Juvare, nexmo and twilio.

-

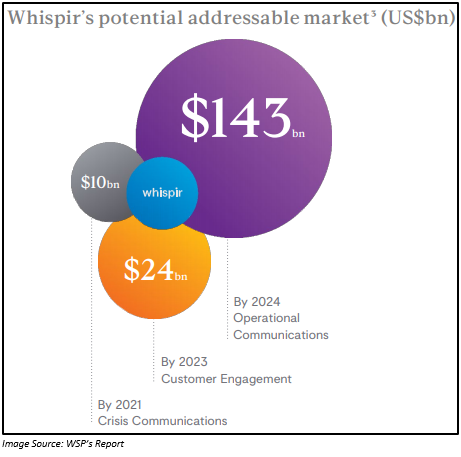

Total global market opportunity: WSPâs total addressable market comprises of Operational Communications market and the Customer Engagement market besides the Crisis Communications market. The company expects its total addressable market to be above US$170 billion by 2024.

- FY2019 Highlights:

- FY19 annualised recurring revenue increased by 22% as compared to the previous corresponding period (pcp)

- FY19 revenue increased by 12% to $31.1 million.

- WSP incurred a loss of $15.282 million during the period.

- The balance sheet of the company continues to remain strong with the net cash and cash equivalent by FY2019 end of $26.8 million.

- Q1 FY2020 New and Growth Customer wins:

- New: TasmaNet, Maritime NZ, ElectraNet and HealthEngine.

- Growth: AusNet, Miele, Thompson Health Care, The APA Group.

- Outlook:

- In FY2020, the company expects its revenue to increase to $37.8 million.

- The company would be investing a total of $8.4 million in its product research and development.

- The company expects its pro-forma EBITDA to improve to $(9.4) million.

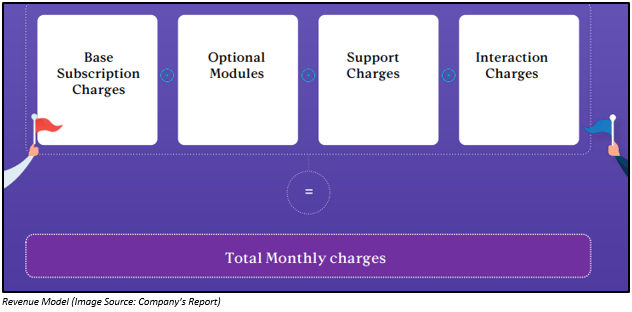

- Revenue Model:

Stock Information:

The WSP stock have generated a six-month return of 6.71%. The shares on 27 September 2019 opened at a price of $1.590 and closed the trading day at $1.690, up by 6.28%. Around 174,410 shares of WSP traded on ASX. WSP has a market capitalisation of $164.46 million and approximately 103.43 million outstanding shares.

Arq Group Limited

Company Overview:

Arq Group Limited (ASX:ARQ) provides its customers with the cloud-based technology services to conduct online business successfully.

Recent update:

On 23 September 2019, Arq Group Limited released an announcement to the market related to the amendment made to the full year guidance based on the weakening trading conditions for its Enterprise division. It has also hired Macquarie Capital (Australia) Limited to explore possibilities for shareholder value creation.

ARQ expects its Group underlying EBITDA to range between $16.8 million to $19.3 million. Earlier this range was $27.0 million to $30.5 million.

As per the guidance provided by the company in June 2019, the expected growth from existing as well as the new account is likely to be below expectation. The margins in the Enterprise division is impacted by an overhead structure that is suitable for a larger business. In late June 2019, the company removed $1.2 million of overhead costs. A further $1.1 million of annualised costs is expected to be removed in the remaining part of the year. Based on this, the underlying EBITDA for the Enterprise division for FY2019 is expected to range between $1 million to $2.5 million.

The SMB division is trading in line with the prior forecast.

ARQ announced that its CEO, Martin Mercer and the Board have decided that Mr Mercer would be leaving the organisation in a systematic way. He has resigned from the position of director with immediate effect.

The search of New CEO is under process.

Stock Information:

The shares ARQ Group have given a negative YTD return of 83.90%. The shares on 27 September 2019 opened at a price of $0.340, up by $0.01 as compared to its last closing price. The shares by the end of the dayâs trading closed at a price of $0.355, up by 7.5% from its previous closing price. Around 942,310 shares of ARQ traded on ASX, with a market capitalisation of $40.3 million and approximately 122.13 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.