Lithium Applications: Lithium compounds are used in the manufacturing of glass, consumer electronics, and ceramics. These compounds are the essential material for long-life lithium-ion batteries used in hybrid and electric vehicles, as well as mass energy storage systems.

Lithium Outlook: The China Association of Automobile Manufacturers (âCAAMâ) reported total new energy vehicle (NEV) production and sales of c.278,000 and c.275,000 vehicles respectively in Q1 2019, representing decent growth of 88% and 95% year-on-year as compared to the same period in 2018. The CAAM recently reported an upward revision of its China NEV sales projections from the previous level of 1.6 Mn to 1.7 Mn vehicles for 2019, which would represent a 35% increase (Year-on-Year) and put the country on track to achieve its 2 million-vehicle per annum target by 2020.

Two important companies in this segment are Core Lithium Ltd (ASX:CXO) and Piedmont Lithium Ltd (ASX:PLL). Letâs see how the stock of these companies are performing based on their recent updates.

Core Lithium Ltd (ASX:CXO)

On 18th June 2019, Core Lithium Ltd (ASX:CXO) made an announcement that it has provided the assessment report associated with the Grants Lithium project to the Hon. Eva Lawler MLA, who is the Northern Territory Minister for Environment and Natural Resources. With this development, the company completed its environmental impact assessment process for its flagship Grants Lithium project, enabling CXO to apply for authorisation under the NT Mining Management Act. Now, the company would be submitting a mining management plan (MMP) for assessment by the Department of Primary Industry and Resources. All the recommendations from the Northern Territory Environment Protection Authority (NTEPA) were within expectations and will be incorporated into the mining management plan. In the coming quarter, the company is likely to get the authorisation under the mining management plan.

In a previous announcement in early June 2019, the company updated the market that Canada-based royalty business Lithium Royalty Corporation would be investing around $8.1 Mn for royalty at 2.5%, over the production from the Finniss Project. The company will direct the capital raised from the Share Purchase Plan along with the non-dilutive finance received from the sale of the royalty towards the progress of the Finniss Project. The funding would help in development and near-term resource exploration, growth and conversion drilling focused on further improving the production profile and extending the life of Finniss.

Stephen Biggins, CXO Managing Director, stated that the positive assessment report from the Northern Territory Environment Protection Authority would help the company in its journey towards becoming the next lithium producer in Australia in 2020. The approval, along with the soon-to-close $2 Mn Share Purchase Plan and non-dilutive finance from the $8.1 million royalty investment by Lithium Royalty Corporation, will help CXO in achieving its milestones before the likely start of construction in late-2019.

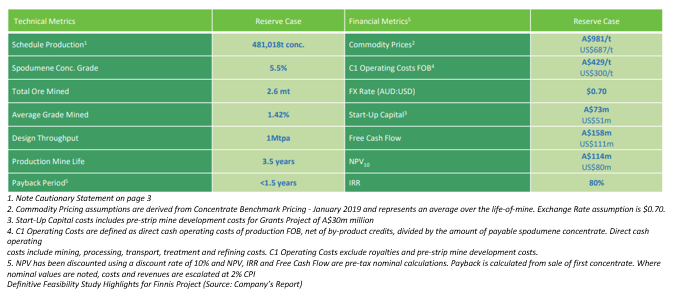

The company, in its investor presentation in April 2019, gave updates related to the definitive feasibility study of the Finniss Project. Main outputs have been summarised below:

On the stock information front:

On 18th June 2019, the stock of Core Lithium closed at $0.044, up by 2.326% with a market capitalisation of ~$29.86 Mn. Today, it made dayâs high at $0.045 and dayâs low at $0.043. Its 52 weeks high was at $0.065 and 52 weeks low at $0.037, with an average volume of 1,566,304 (yearly). Its absolute return for the past 1 year, 6 months, and 3 months are -2.27%, -29.51%, and -25.86%, respectively.

Piedmont Lithium Ltd (ASX:PLL)

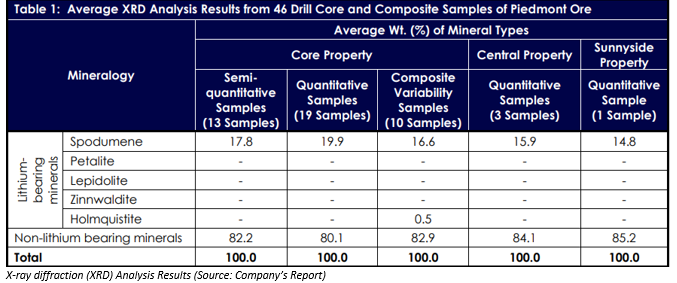

In an ASX announcement on 18th June 2019, Piedmont Lithium Ltd (ASX:PLL) unveiled the completion of a mineralogical analysis on samples of mineralized pegmatites and composite samples from Piedmontâs Core, Central, and Sunnyside properties. All test-work done till date has demonstrated that lithium occurs almost exclusively within spodumene in the companyâs mineral resource. The XRD (mineralogical testing, comprising semi-quantitative and quantitative x-ray diffraction) analysis has advised PLL that the relatively pure spodumene character of its ore body is unusual and highly positive, allowing for a simplified flowsheet to produce substantial lithium recoveries. Specific hard rock lithium projects are understood to contain multiple lithium-bearing minerals (petalite, lepidolite, zinnwaldite, etc. as well as spodumene).

According to Keith D. Phillips, Piedmont Lithium President and Chief Executive Officer, sectors like mineralogy and metallurgy are the fundamental building blocks of a lithium business that is successful and hard rock. Outcomes from the test work have demonstrated that the Carolina Tin-Spodumene Belt is extraordinary in terms of scale as well as in mineralogy. The company is looking forward to updates from the upcoming resource, metallurgical and scoping studies, factoring in the development, shallow nature of its ore bodies, and locationâs capital and operating cost advantages.

H1FY19 (ended on 31st December 2019) Financial Performance: The company reported a net loss for the period at US$3,921,521 from a loss of US$4,141,214 in H1FY18. In the balance sheet, cash and cash equivalents were reported at US$9,584,024 as at 31st December 2018, as compared to US$7,238,489 on 30th June 2018. The exploration and evaluation assets were reported at US$1,538,262 on 31st December 2018, up from US$742,017 on 30th June 2018. Its trade and other payables were reported at US$1,023,598 in the first half of FY2019, as compared to US$1,989,084 in the second half of FY2018.

As per the cash-flow statement, PLL reported net cash outflows from the operating activities at US$4,746,244 in six months to 31st December 2018, as compared to cash outflows of US$3,078,306 in the previous corresponding period. The net cash outflows from investing activities were reported at US$731,306 in H1FY19 as compared to cash outflows of US$349,070 in the previous corresponding period. The net cash inflow from financing activities stood at US$8,078,600 in H1FY19 as compared to cash inflow of US$11,648,408 in the same period a year ago.

On the stock information front

The stock of Piedmont Lithium closed at $0.170 on 18th June 2019, up 6.25% from its last close. With a market capitalisation of ~$107.26 Mn, the stock made dayâs high at $0.170 and dayâs low at $0.165. Its 52 weeks high was at $0.210 and 52 weeks low at $0.091, with an average volume of 968,158 (yearly). Its absolute return for the past 1 year, 6 months, and 3 months are -20.00%, 45.45%, and 52.38%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.