Social media giant, Facebook’s proposed cryptocurrency Libra has been making headlines for quite a long time with its unique features as well as struggling central banks of multiple countries to set up the regulations for controlling the dealings in the currency.

Paralleling with several other central banks’ view, the Reserve Bank of Australia (RBA) is doubtful about the strong demand for global stablecoins even though they might fulfil all regulatory requirements, especially intended for domestic payments.

Although banks in Australia might not have been effective in providing cross border payment services in the past, there are new non-bank digital players (fintech companies) that have significantly influenced the market in recent years with their unique, cheaper and faster money transfer services.

Since Libra is backed by giants like Facebook that may leverage their large existing user base and technological abilities, RBA anticipates that the currency has the potential to become a broadly used cryptocurrency.

According to RBA,

Shift Towards Electronic Payment Methods

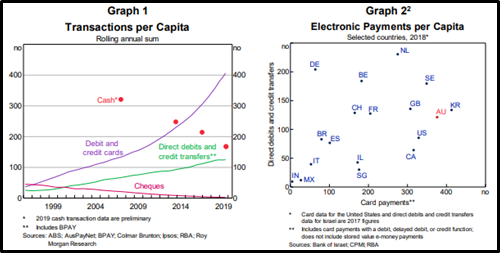

Disruptive technological innovations in the supply of payment services have transformed the way payments are made domestically as well as across borders away from cash and cheques to electronic payment methods over recent years, as users increasingly opt for newer and more convenient payment solutions.

Source: RBA

- Most notable aspect of the growth in electronic payments to date has been the growing use of debit and credit cards for lower-value payments;

- Widespread acceptance of contactless ‘tap and go’ card payments accounts for approximately 80% of consumer card transactions at the point of sale;

- Increase in online card payments has also fuelled the growth in e-commerce

Cryptocurrency Not a Perfect Substitute to Money

In recent times, Australia has witnessed growth in the number of fintech entities that offer services relating to cryptocurrencies, both as a means of payment and as a speculative asset. Although RBA has closely monitored the developments in cryptocurrencies, such as Bitcoin, these developments have the potential to affect the Bank’s mandates as:

- Issuer of Australia’s banknotes,

- Operator of Australia’s real-time gross settlement system,

- Its responsibilities for the stability of the financial system, and

- Stability and efficiency of the payments system.

RBA’s current assessment of the cryptocurrencies leads to the view that the inability of cryptocurrencies to provide for the typical functions of money justifies its failure to be widely used in Australia as a means of payment.

This is so because the first-generation cryptocurrencies such as Bitcoin demonstrate significant price volatility, meaning that they are a poor store of value, but money normally requires an instrument to serve as a store of value, unit of account, and means of payment.

Interesting Read: Bitcoin for Beginners: 5 things you need to know

In addition, goods and services are typically priced in the relevant national currency, thereby reducing the cryptocurrency’s ability to be used as a unit of account. Although, cryptocurrencies can facilitate payments and be a medium of exchange, they are presently not accepted widely for everyday sales.

Still there are newer cryptocurrencies emerging or are under pipeline with an aim to address some of the flaws of previous generations and have the potential to be more readily and broadly employed in future.

The G7 report on global stablecoins in October 2019 recognised stablecoins’ potential to be more competent and all-encompassing than existing payment methods, especially for cross-border payments, while noting that they amplify significant legal and regulatory risks for consumer/investor protection, data privacy, monetary policy, and financial stability.

RBA agrees with G7’s opinion of keeping the approvals for the private sector’s stablecoin proposals, globally, on hold till the time all risks and regulatory requirements associated with the same have been addressed.

In line with the innovative financial solutions offered by new and existing companies, there has been an escalation in the regulators examining the suitability of present supervisory and regulatory frameworks in tackling the risks posed by global stablecoins.

Several Regtech players have also emerged in the wake of time to ease the compliance process for the fintech companies as well as consumers.

The key considerations for regulators that the RBA believes are:

- Ensuring private sector stablecoin initiatives operate under a comparable regulatory regime to existing payment systems;

- They do not lie beyond the existing regulatory framework.

RBA is actively engaged with related agencies locally as well as internationally to comprehend recent proposals to ensure they will be effectively regulated and supervised.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.