With over 780,000 confirmed cases and more than 37,000 deaths across 178 countries on 31st March 2020, no wonder, COVID-19 has wreaked havoc on the entire globe. Be it consumers, businesses or government, it has become a cause of headache for each one of them.

The coronavirus pandemic has left the world in dire straits, with several businesses standing down their workforce and numerous others withdrawing their earning guidance. Similar is the case in Australia, wherein multiple retailers have shut their doors to the general public to stave off COVID-19 pandemic.

However, the federal government and policymakersare making every possible effort to support businessesbeat the impact of COVID-19. In turn, the businesses are also supporting the government’s attempts to curb the spread of the virus, keeping the health of their customers and team members as the top priority.

Amidst escalating spread of COVID-19, three ASX-listed retailershave grabbed investors’ attention for various reasons. Let’s discuss each of them below:

Wesfarmers Announced Sale of 5.2 per cent of Coles

Australian conglomerate Wesfarmers Limited (ASX:WES) has recently executed a trade for the sale of 5.2 per cent of the issued capital in supermarket firm, Coles Group Limited (ASX:COL) for total pre-tax proceeds of $1,060 million. The Company signed an underwriting agreementwith two lead managers for selling the stake.

The sale will continue at $15.39 per share with settlement anticipated on 2nd April 2020. The Company is likely to recognise a pre-tax profit on sale of about $130 million. The Company has also agreed to keep its remaining shares in the supermarket entity for 60 days from completion of the sale, conditional on customary exceptions.

Following the sale, the Company will retain 4.9 per cent interest in the supermarket entity and will not have the right to nominate a director to the board of Coles anymore. This is because of the termination of the Relationship Deed agreed between the Company and Coles during the demerger.

Both Coles and the Company will continue their flybuys JV, retaining a 50 per cent interest each in the business, permitting continued strategic collaboration between the two companies with regards to mutually advantageous growth initiatives.

Besides, the Company is also dealing with the coronavirus pandemic in the best way possible. The Company has recently made some changes to its NZ operations following the restriction on operation of ‘non-essential’ services in NZ last week. The Company closed its Kmart’s 25 New Zealand stores and Bunnings’ 53 locations in NZ for the general public.

It is worth noting that the Company has maintained its decision to pay its previously announced interim dividend (fully franked) of $0.75 per share on 31stMarch 2020.

Woolworths GroupReported Unprecedented Demand Amidst COVID-19

In its latest update on the ASX, Australia’s popular retailer, Woolworths Group Limited (ASX:WOW) notified that the sales growth throughout all its retail businesses has been robust in recent weeks (except hotels), signifying unprecedented demand for a variety of goods as customers have stocked their pantries and consumed more at home.

The Company mentioned that this was predominantly noticeable in Australian and New Zealand Food, resulting in supply chain challenges against unparalleled demand, leading to shortages on store shelves. However, the Company highlighted that this is just a short-term shock to its system induced by intensified demand.

The Company is making good progress together with its logistic partners and suppliers, in enhancing the flow of goods into stores. Moreover, it is trying every possible course to support the most vulnerable people in the community.

Besides continuing its dedicated early shopping hour facility at the Australian stores, the Company has implemented a Priority Assist serviceonline to support the people with disability, elderly and those that are needed to self-isolate.

Focussing on team and customer safety, the Company has also applied social distancing measures in all its stores across the nation, which includes informative signage requesting consumers to follow social distancing in retail stores and further cleaning and hygiene measures.

The Company has started installing plexiglass screens at its registers around its store network as an additional safeguard for its customer sand team members.

Though the Company is unable to accurately forecast the complete impact of coronavirus pandemic on FY20 results, it has a strong balance sheet, with access tofunding and liquidity. Moreover, it is well endorsed by its lenders, with substantial headroom in existing facilities and lending covenants.

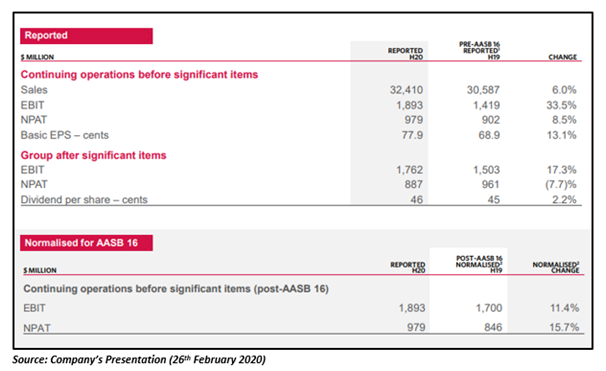

Have a look at the Company’s HY20 results summary below:

NCK Declared Temporary Closure of its Stores

In response to the spread of COVID-19 pandemic, retail company, Nick Scali Limited (ASX:NCK) has decided to temporarily shut its all stores for an initial period, from the close of business on 30th March 2020 to 1stMay 2020.

The Company notified that the decision has been taken considering the risk to its staff and customers in case of continuing store operations. The Company added that it is supportive of the Australian and New Zealand government’s move to curb COVID-19 spread via communities by launching social distancing and isolation measures, includingurging people to stay at home.

During its period of temporary shutdown, the Company will remain targeted at the delivery of current sales orders, that will continue to produce revenue for the business over the next months.

In view of these operating changes, the Company has also stood down most of its retail team members throughout the support staff and store network from 30th March 2020. Moreover, in order to reduce its cost base during coronavirus crunch, the Company has:

- Lowered marketing expenses in accordance with trading.

- Postponeddiscretionary capex and store roll-out in FY20.

- Engaged with landlords regarding rent relief.

- Reduced non-essential operating expenditure (general).

As per NCK, the Company has always tried to maintain a conservative balance sheet to position itself positively during periods of a prolonged downturn in the retail landscape. In its update on 23rd March 2020, the Company mentioned that it has $39 million of cash in hand and $34 million of gross debt outstanding, securedagainst the property it owns, on a non-recourse basis.

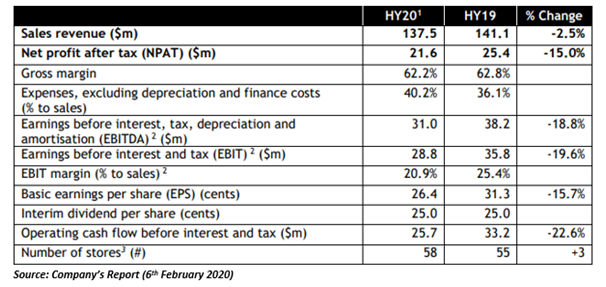

However, it is worth noting that the Company remains uncertain of the existing level of consumer confidence amidst the coronavirus crisis, due to which it has not yet declared profit guidance for FY20. The Company highlighted this uncertainty over a month ago, when it announced its financial results for the six months ended 31 December 2019.

Have a look at the summary of NCK’s financial results below:

Stock Performances

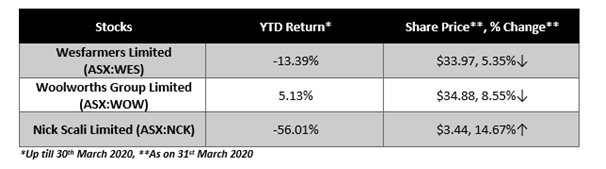

Before concluding, let us take a quick glance into these companies’ stock performances in the table below: