Artificial Intelligence is a broad reaching branch of computer science involved in developing smart machines which are skilled of executing tasks which normally entails human intellect. This technology makes its easier for the machines to learn from the past experiences and adjust new inputs, accordingly, helping in performing tasks just like humans do. It majorly works on natural voice processing or by recognising patterns in the data. It makes routine of rhythmic understanding and innovation from patterns of data.

However, Artificial Intelligence is unique from hardware-focused, mechanised automation. Rather than computerising physical tasks, Artificial Intelligence performs regular, high-volume, automated tasks unfailingly right and that too with no exhaustion. It also builds layers and detects fraud using big data. The more data you input, the more accurate your results would be. Since the algorithms used are self-learning, you just have to apply the data to get the output. This offers competitive advantage.

Artificial Intelligence holds many benefits, some of which are mentioned below:

- It is a great help to economy and is helping people to perform the task in a better way. This unstoppable combination of man and machine is aiding businesses and industries with increased efficiency and reduction in human error.

- It also helps creating new opportunities and creating new jobs and ways to earn revenue and jobs. It has resulted in elevation of human condition and is paving the way for solutions to more complicated problems.

Although it offers amazing benefits, some outcomes of AI can be devastating. In the hands of wrong person, these can create massive casualties. To avoid such situations, these would be designed in such a manner which would be difficult to turn off. This would result any human to lose control of the situation. However, a super intelligent Artificial Intelligence program would accomplish its goal, but those goals have to be aligned to the needs which are beneficial for the humanity. It is also important to understand that we are not being supported by a super-human and is essential for one to not overhype any situation.

Let us see how some companies incorporate AI, and what is their effect on the business:

Appen Limited (ASX: APX)

Substantial Increase in NPAT: Appen Limited (ASX: APX) provides quality data solutions and services for machine learning and artificial intelligence applications for global technology companies, auto manufacturers and government agencies. The company majorly operates through two operating divisions - Relevance and Speech & Image. Relevance provides interpreted data used in search technology for the purpose of improving accuracy of the search engine whereas speech and image provides interpreted data which helps the machine learning technologies.

As on 17 January 2020, the market capitalisation of the company stood at $3.03 billion. The company has recently announced that it will release earnings information for the year ended 31 December 2019 on 25 February 2020.

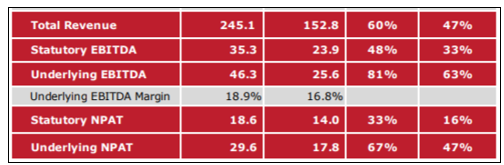

Moreover, for the first half ended 30 June 2019, revenue of the company went up by 60% to $245.1 million and underlying EBITDA margin improved from 16.8% to 18.9%. In addition to high revenue growth, underlying NPAT witnessed an increase of 67% and stood at $29.6 million. The strong financial performance of the company enabled the Board to declare a partially franked dividend of 4 cents per share.

Financial Performance (Source: Company’s Report)

What to Expect from APX Going Forward: The company has recently given its improved EBITDA guidance for FY19 and expects it to be in the range of $96 million to $99 million. This improvement is a result of increase in monthly relevance revenue and margins, driven from existing projects with existing customers. The company has also confirmed its ARR guidance and expects it to be in between $30 million to $35 million.

Stock Performance: The stock is currently trading at $25.6, up by 2.4% on January 17, 2020 (at AEDT 1:41 PM). As per ASX, the stock of APX gave a return of 9.11% on the YTD basis and a return of 7.13% in the last 3 months. The stock is also moving towards it 52-weeks’ high level of $32. In terms of valuation, the stock is trading at a P/E multiple of 59.2x and is earning a dividend yield of 0.32% (annualised basis).

Xref Limited (ASX: XF1)

Business Model: Xref Limited (ASX: XF1) is an online automated solution which delivers data-driven candidate insights, and the customer-centric platform and team offer the flexibility and scalability clients need to hire the best talent. Under the business model of XF1, customer buys credit for the purpose of using its candidate referencing platform. These credit sales are initially reported as unearned income and when clients pay for the credits, these are recognised as cash receipts.

CVCheck and Xref form Strategic Alliance: The company has recently announced that it has issued 10,593,939 new fully paid ordinary shares at a consideration of $0.33 per share. CV Check Limited and Xref Limited has recently formed a strategic partnership which will create a challenging offering that will greatly benefit each other’s customers. The company achieved record credit usage of $2.24 million with record cash receipts of $3.53 million in Q120. Net cash outflow for the quarter stood at $1.946 million as compared to $1.519 million in Q4 FY19.

New Opportunities Offering Growth: The company has entered the new year with positive outlook. The company is focusing on platform diversification and is on track to build robust and reliable service for organisations looking to validate the claims made by candidates. The number of active Xref platform users went up by 55% to 6,021 during FY19.

Stock Performance: The stock is currently trading at $0.340, up by 3.03% (at AEDT 1:55 PM) on January 17, 2020 and is also trading very close to its 52-weeks’ low level of $0.310. As on date, the market capitalisation of the company stood at $58.76 million. As per ASX, the stock of XF1 gave a negative return of 34.00% in the past 6 months.