Entities around the globe are facing challenges in projecting the impact of COVID-19 on their business activities and financials. The nature of coronavirus is unpredictable in terms of its coverage, speed, duration and extent of the damage.

During the last couple of months, companies have struggled to keep their regular operations going, led by the falling demand products and services. Travel bans across the globe, lockdowns in several countries, and closure of public places to avoid large gatherings have hurt the financials of countless companies forcing them to modify their strategies and also revise or withdraw their full-year guidance.

Let us have a look at nine companies from different sectors, that have recently provided their business update on COVID-19.

Consumer Discretionary firm JBH closes NZ operations temporarily

JB Hi-Fi Limited (ASX:JBH) is an operator of two retail brands, namely, The Good Guys and JB Hi-Fi.

Closure of 14 stores in New Zealand:

Concerning the alert level 4 restrictions imposed by the New Zealand Government, JBH had temporarily closed all its 14 stores in the country. Additionally, commercial and online operations of JB Hi-Fi in New Zealand are also shut from 26 March 2020 for the next four weeks.

On the financial front, the Company’s New Zealand business does not make a material financial contribution to the Group. The FY 2019 sales and EBIT loss from New Zealand operations were NZD 236 million (3% of JBH’s total annual sales) and $1.9 million, respectively.

Outlook and COVID-19 Update:

On 23 March 2020, JBH had withdrawn its previously stated sales guidance for FY 2020. The Company has taken several measures to make sure the safety and wellbeing of its employees and customers. JBH’s balance sheet remains robust with a significant headroom in its covenants and facilities.

The Company also highlighted that for March quarter till date (01 January to 22 March), Australia witnessed a robust momentum with 8.8% growth in comparable sales. The Good Sales were up 10.4%.

FLT focusses on reducing costs, preserving cash

Flight Centre Travel Group Limited (ASX:FLT) is a travel group with more than 30 brands.

Impact of COVID-19

FLT has developed a three-step plan to deal with the ever-changing market scenario. The focus is on reducing costs substantially across the globe, preserve cash wherever possible, and in the short-term gain access to liquidity.

The Company’s senior leadership team would give up 50% of their salaries to low down the costs by saving cash and protecting shareholder value in the long run.

The Company estimated that around 6,000 sales and support roles would be lost on a global scale, either temporary or permanent. While in Australia, 3,800 people were temporarily stood down.

PMV shuts operations provisionally

Premier Investments Limited (ASX:PMV) owns and operates a range of consumer products, retail and wholesale businesses.

Supporting the Prime Minister direction, Premier Investments has temporarily closed all its retail stores in Australia effective from 26 March 2020 until 22 April 2020. Additionally, other stores located in New Zealand, the Republic of Ireland and the United Kingdom are shut. From this closure of operations, more than 9000 employees had got impacted on the global front.

The Company highlighted that it has a highly experienced management board, a robust balance sheet with a strong cash position, and minimal debt. FLT has seven distinctive brands which presented a record first-half FY 2020 result.

Gold Producer RSG sticks with its production and cost guidance

Resolute Mining Limited (ASX:RSG) is engaged in exploring, developing and operating gold mines. The Company has produced over eight million ounces of gold from its mines located in Africa and Australia.

RSG had taken measures to mitigate the impact of coronavirus across all aspects of its operations. Resolute has not modified its current production or cost guidance due to coronavirus.

The Company believes it is fortunate that government-imposed coronavirus restrictions do not impact its gold production units. Thus, RSG’s mining and processing operations at Mako Gold Mine in Senegal (Mako) and Syama Gold Mine in Mali (Syama) are progressing normally.

On 27 March 2020, RSG announced its 2019 financial results with a significant improvement in revenue and underlying EBITDA, at $770 million and $208 million, respectively.

On 26 March 2020, RSG notified the market about the completion of its refinancing which followed the first drawdown under its new US$300 million loan facility.

SOL stock resilient to COVID-19 impact

Washington H. Soul Pattinson and Company Limited (ASX:SOL) is an investment house that holds a portfolio encompassing many companies from a wide range of industries including agriculture, building materials, corporate advisory, investments, natural resources, property equity, retail and telecommunications.

SOL had released its half-year FY 2020 results for the period ended 31 January 2020. The key highlights include:

- Group Regular PAT and Group PAT were $124.7 million (-33.2%) and $51 million (-71.5%), respectively.

- Net asset value (pre-tax) was $5.5 billion, an upsurge of 0.2% compared to pcp.

- Net regular cash from operations was $92.7 million, an increase of 0.7% on the previous year.

- A fully franked interim dividend was 25 cents per share, an increase of 4.2%.

SOL has seen a rise in demand for TPG Telecom, closure of specific businesses for Brickworks Limited, resilience from coal prices and demand, falling zinc and copper prices, and a decent performance from its pharmaceutical portfolio.

Outlook: SOL believes it will be resilient during the current difficult times, but they remain cautious.

GMA withdraws FY2020 guidance

Genworth Mortgage Insurance Australia Limited (ASX:GMA) is a lenders mortgage insurance provider. GMA has two subsidiaries - Genworth Financial Mortgage Indemnity Ltd and Genworth Financial Mortgage Insurance Pty Ltd.

On 26 March 2020, Genworth updated the market that it had suspended its guidance for FY 2020 from the market as it’s inappropriate to predict the earnings in the prevailing environment.

As of 31 December 2019, the Company holds a robust balance sheet having an investment portfolio of $3.1 billion. 81% of the portfolio was held in fixed interest securities and cash wherein, the securities were having a rating of ‘A-’ or better. GMA assures that it is well capitalised at 1.91x the Prescribed Capital Amount on a Group Level 2 basis.

GUD highlights impressive YTD performance, still withdraws guidance

GUD Holdings Limited (ASX:GUD) comprises several product companies across Australia and New Zealand. The Company’s YTD demand has been solid with consistent operating performance in line with the guidance FY 2020.

A range of businesses will close with the advent of level 4 restrictions in New Zealand and more stringent guidelines imposed by the Australian Government to lessen the spread of COVID-19, although the Company is waiting for clarity by the Australian Government to categorise water supply chain and automotive repair businesses as under essential services or not.

On 26 March 2020, the Company withdrew its previously released Guidance for FY 2020. Due to the prevailing uncertainties witnessed in the potential demand for the Company’s products had made it difficult to predict performance for the remaining FY 2020. GUD expects an impact on EBIT in FY 2020 mainly due to lower sales and the recent decline of the Australian dollar.

SUL reports sturdy performance, withdraws guidance

Super Retail Group Limited (ASX:SUL) is a retailer of sport, auto and outdoor leisure products in New Zealand and Australia.

On 26 March 2020, SUL notified the market that its interim dividend distribution for FY 2020 is cancelled to preserve liquidity and protect the value of its stakeholders. The cancellation of the dividend would result in saving of $43 million as retained earnings to the business.

SUL’s stores operating in Australia are trading as usual with the availability of online services. However, 81 New Zealand stores are shut for the next four weeks.

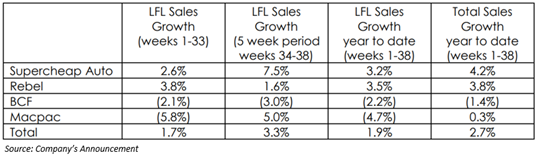

As at week 38 (week ended 21 March), the like-for-like trading update of Super Retail Group is mentioned below.

Super Retail has bank debt funding facility of $635 million with maturities in December 2023. Additionally, SUL has secured credit approval of $100 million with ANZ Bank. Despite the strong performance, the Company is not able to provide an estimate for the remaining year due to the unknown extend of coronavirus outbreak.

AX1 sees decline in demand, withdraws profit guidance announced in February 2020

Accent Group Limited (ASX:AX1) is a distributor and retailer of performance and lifestyle footwear.

On 25 March 2020, the Company notified the market that to maintain the safety of its employees and customers, it would be closing all its stores from 27 March 2020 for four weeks. Accent Group would resume its trading via its 18 websites and wholesale business.

AX1 mentioned that its retail employees and near to all its support office employees would stand down without pay during the store closure. Also, the Company gave an option that its employees may use their long service and annual leave entitlements.

AX1 had earlier announced the withdrawal of its guidance driven by the unknowns around the virus spread.

_09_03_2024_01_03_36_873870.jpg)