Sydney Airport (ASX: SYD) recently published its Annual General Meeting presentation where it highlighted its 2018 results. As per the release, total passengers number increased by 2.5% to 44.4 Mn in 2018. Sydney Airportâs revenue and EBTDA increased by 6.8% to $1,584.7 Mn and 7.2% to $1,282.6 Mn, respectively. Its net operating receipts increased by 9.4% to $860.9 Mn. Its full year distribution per stapled security increased by 8.7% to 37.5 cents.

In another update, SYD announced dividend/distribution (for the period of six months) of AUD 0.19500000 on security âSYD - FULLY PAID ORDINARY/UNITS STAPLED SECURITIESâ with record and payment date on June 28, 2019, and August 15, 2019.

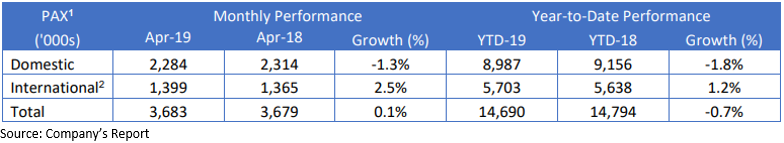

Sydney Airport in its traffic performance report for April 2019, highlighted that its total traffic increased by 0.1% pcp to 3,683,000, primarily due to an increase in the international traffic by 2.5% pcp at 1,399,000 passengers. Its monthly domestic traffic decreased 1.3% pcp to 2,284,000 passengers. Looking at the year-to-date (YTD) traffic performance, SYDâs total traffic declined by 0.7% pcp to 14,690,000, which was majorly on the back of a decrease in the domestic traffic by 1.8% pcp to 8,987,000. However, the international passenger YTD increased by 1.2% pcp to 5,703,000. The shift in Easter timing has positively influenced growth in the international passengers. A reduction in the domestic passengers was attributed to the subdued factors and continued capacity management by airlines despite the later Easter holiday. Moving to the 12 months traffic data, the total traffic increased by 1% pcp in April â19, whereas international traffic increased by 3.3% and domestic traffic decreased by 0.4% as compared to the previous period.

Interestingly, to shed some more light on the nationalities travelled through the Sydney airport, most of the monthly traffic growth was observed from the United States of America, Philippines and New Zealand in April â19 at 13.2%, 12.1%, and 6.6%, respectively, as compared to the previous period. In terms of YTD growth, traffic from the United States of America and India showed promising numbers at 10.5% and 7.7%.

Interestingly, to shed some more light on the nationalities travelled through the Sydney airport, most of the monthly traffic growth was observed from the United States of America, Philippines and New Zealand in April â19 at 13.2%, 12.1%, and 6.6%, respectively, as compared to the previous period. In terms of YTD growth, traffic from the United States of America and India showed promising numbers at 10.5% and 7.7%.

In its FY18 result, SYD reported an increase in its earnings before interest, tax, depreciation, and amortisation (EBITDA) by 7.2% to $1,282.6 million, which was attributed to a strong contribution from retail and property, reflecting new leasing deals, strong duty-free and good specialty store performances. Its net operating receipts (NOR) increased by 9.4% to $860.9 million as compared to the previous corresponding period. The Airport reported CapEx of $378.5 million in delivering aviation capacity, improvement in airport access and enhancing the customer experience. SYD reported a strong balance sheet with robust BBB+/Baa1 grade credit metrics.

The Airportâs revenue grew across all of its four businesses, majorly driven by an increase in the international traffic and decent performance from retail and property. Revenues from aeronautical, retail, property and car rental, and car parking and ground transport segments increased by 7.6%, 7.2%, 7.5%, and 1.7%, respectively.

The company estimates 2019 distribution guidance at 39.0 cents per stapled security, which is expected to be covered by net operating receipts, considering any external shocks to the aviation sector.

On the stock information front, at the time of writing i.e., 24 May 2019 the stock of Sydney Airport traded at $7.610, with a market capitalisation of ~$16.95 billion. Its current PE multiple stands at 45.430x, and its last EPS was noted at $0.165. Its 52 weeks high was at $7.900 and 52 weeks low at $6.240, with an average volume of ~5,804,641 (yearly). Its absolute returns for the past one year, six months and three months are 5.92%, 12.09%, and 1.21%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.