Indonesia banned the export of Nickel ore starting 1 January 2020, preponing the action which was earlier scheduled for 2022 along with all the minerals. The country is set to start at least 4 new NPI smelters and HPAL plants.

The smelters will produce mostly NPI (Nickel Pig Iron) with Nickel percentage ranging from 4-15% and would feed the steel plants producing stainless steel, which is the biggest consumer of Nickel presently.

The demand from the battery sector are also rising with the increase in the EV adoption rates. The IEA has a goal of achieving 30% Global adoption rate by 2030 which on realisation would shoot up the Nickel demand.

With the nickel project in the pipeline and the delay in the start of the smelters and HPAL plants, Indonesia earlier continued to export nickel ore as per the previously allocated export quota system to the Chinese.

Indonesia's 1st HPAL plant in 2020

Indonesia, the world leader in Nickel, is expected to move forward with the commencement of battery-grade Nickel production using the high-pressure acid leaching (HPAL) technology by the end of 2020.

PT Halmahera JV is a joint venture between Harita Group and Chinese Ningbo Lygend, located on the Obi island and will have an installed annual capacity (phase 1) of almost 37,000 tonnes of contained Nickel in the battery product.

The HPAL projects in Indonesia have faced capital expenditure overruns and severe postponements, but following the successful completion of the project, the HPAL will feed to increased demand for class 1 Nickel across the globe.

The HPAL plants have had their fair share of operational issues and slow ramp-ups, but with steady investment inflows from China mostly, Indonesia could be the major site for the class 1 nickel products in future.

Chinese imports of the Nickel ore from Indonesia increased by almost 72% in 2019, as the Chinese traders hastily secured the Nickel ores before the ban came into effect from 1 January 2020.

Last September, Indonesia announced its plans to prepone the nickel ore ban by 2 years to the start of January 2020. In the last month of 2019, Chinese nickel imports increased by 60% y-o-y to 4.32 Million tonnes, with Indonesia experiencing a surge of 82% year-on-year to 2.47 million tonnes. However, Indonesia banned exports in the current situation of the stampede from shipping the cargoes.

Earlier, the Indonesian authorities allowed the export of lower-grade nickel grade (<1.7% Ni) in 2017 at a time when the country lacked infrastructure to process low-grade nickel ores to produce high-quality products, but with commencement of multiple HPAL (high-pressure acid leach) the country now can use its low-grade nickel ores to produce high-grade cathode material for battery.

ALSO READ: Nickel & the Australian market

Nickel Prices

Indonesia’s export ban has prompted fears of a market deficit. The nickel price averaged at US$16,000 a tonne in the December quarter.

Nickel was one of the best performing base metals of 2019 with median prices over US$15,000 a tonne.

The impact of lower stainless steel production from china puts a downward force on the nickel prices.

However, JP Morgan expects the Chinese stainless steel plants to shed capacity in 2020 with a price forecast to range in the US$ 12,000- US$ 13,000 a tonne. Goldman Sachs also expects the small fraction of high cost producers to stand off the unsustainable business units.

On the contrary, most Industry experts believe the Nickel price to average over US$16,000 a tonne mark in 2020.

Nickel Demand

In 2019, the consumption for Nickel is expected to be around 2.4 million tonnes, with a marginal increase of 2.5%. This is a slower growth as compared to previous years, mostly due to weaker economic conditions globally. The nickel consumption for the period till September grew in china by almost 13% due to the steel consumption but fell almost everywhere due to lower consumption in Japan and Indonesia.

For the long term, the nickel consumption would continue to increase at a steady pace, mostly due to the higher usage in China. Indonesia ban ores would be used for the domestically developing integrated NPI/FeNi projects such as Industrial Morowali Industrial Park, Weda Bay and many more upcoming complexes. Strong demand could be expected from energy storage and electric vehicles markets, with high-grade final cathode products from Japan, China and Indonesia.

ALSO READ: Nickel mining & its stocks

Australian Projects to add supply in Future

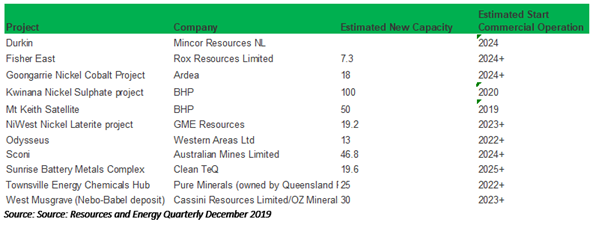

Australia expects to add major Nickel capacity in the next 5 years. Some of the ongoing projects are-

2020 so far

As per the Chinese research house Antaike, the Chinese refined Nickel production fell by 33.4% sequentially to 10,650 tonnes due to the Coronavirus outbreak, which has impacted all the business and industrial activities in China.

The output of the Nickel Pig Iron (NPI) fell by 4.8% during the month, NPI is the precursor to the stainless steel.

Many Chinese stainless steel plants have been stalled as the regional governments are putting efforts to contain the Coronavirus disease. But, the shortage of Nickel might actually plague the industry soon after the stainless steel plants resume operations and would require a high volume of NPI and with the Indonesian ban in place, only the supplies from Philippines and New Caledonia could saviour the stainless steel industry.

Amid Coronavirus and Indonesian ban on Nickel ore exports, the Nickel & stainless steel industry is hungry for feed and Philippines or other regions would need to step up to rescue once the steel plants resume