Australasia’s leading self-storage owner-operator, National Storage REIT (ASX: NSR) has received a confidential nonbinding indicative proposal from Gaw Capital Partners, an equity fund management company, for 100% of the issued stapled securities of NSR.

As there is no certainty that the discussions between both the parties will lead to a final recommended offer, the Board of NSR has advised the securityholders to take no action at this time in respect of their securityholdings in NSR.

J.P. Morgan and Allens has been selected as the financial advisor and legal advisor, respectfully.

Following the release of this news, NSR stock witnessed an uplift of 7.5% intraday (AEST 2:28 PM).

What is a REIT?

Real Estate Investment Trusts (REITs) have been a popular product worldwide for many decades. A REIT is basically a company which owns income generating real estates. We have made a list of few popular REITs currently trading on Australian Securities Exchange (ASX).

NSR Performance Summary

Being a REIT (Real estate Investment Trust) NSR is known for providing consistent distributions mainly derived from the rental income earned on the trust’s properties. During the last year, NSR delivered distributions in line with guidance at 9.6 cents per stapled security. This includes, a final distribution of 5.1 cents per stapled security for the 6 months to 30 June 201 9, paid on 5 September 2019 and an interim distribution of 4. 5 cents per stapled security for the period 1 July 201 8 to 31 December 2018, paid on 1 March 2019.

Last year was a year of growth for NSR, as the company continued to deliver outcomes across multiple revenue streams to maximise returns. During the year the company completed two institutional placements and offered a security purchase plan, raising $358 million which allowed it to reduce gearing, maintain funding flexibility as well as support future growth. This record growth has seen assets under management climb more than 36% to $1.95 billion. Further, more than 180,000 sqm of net lettable area has been added to the portfolio through 35 acquisitions, which averaged a new acquisition every ten days across the year – a credit to the team.

During FY19, NSR was focussed on the active revenue management platform that has delivered growth across previous years. The refinement of the company’s advanced revenue management modelling system, together with a storage specific data analytics platform continues to deliver efficiencies and enhance scalability across the operating platform.

The company has successfully transacted 35 acquisitions and 4 development sites in FY19 and continues to pursue high-quality acquisitions across Australia and New Zealand. The ability to acquire and integrate strategic accretive acquisitions is one of National Storage’s major competitive advantages and a cornerstone of its growth strategy. This active growth strategy also strengthens and scales the National Storage operating platform which drives efficiencies across the business.

The key drivers of the business are:

- Asset Management – driving an appropriate balance between rental rate and occupancy growth and actively pursuing other business development initiatives in complementary areas such as wine storage, document storage and mini-logistics for SMEs;

- Portfolio Management – acquiring and integrating quality self-storage assets into the NSR portfolio;

- Development Management – development / refurbishment / redevelopment of new and existing centres and actively managing portfolio recycling opportunities;

- Centre Management – effective operation of individual self-storage assets and the expansion of the National Storage Centre Management platform (revenue from third parties);

- Capital Management – maintaining an appropriate and efficient capital structure with a focus on risk minimisation and the development of long term sustainable and growing revenue streams; and

- Product and innovation – exploring opportunities for revenue exploring opportunities for revenue generation across new sales channels, digital strategies and ancillary product ranges.

Outlook - The company’s Board is confident that National Storage is well placed to execute its strategy and deliver stable and growing returns for its investors. In FY20, the company expects its underlying earnings to grow more than 25% and Underlying EPS grow over 4%.

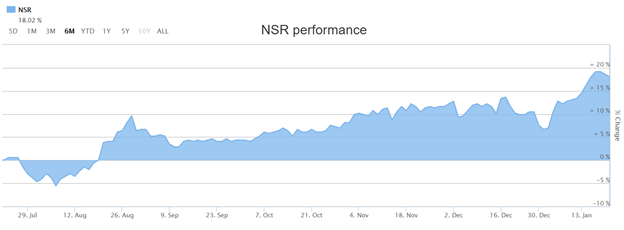

In the past six months, NSR stock has witnessed an uplift of over 18% in its share price. Notably, the stock is trading at a PE multiple of 248.190%.

NSR Six-months Performance (Source: ASX)

Peer Analysis

Let us look at few other REITs currently trading on ASX.

Cromwell Property Group (ASX: CMW)

Diversified real estate investment manager, Cromwell Property Group is running its operations in Australia, Singapore and Europe. Cromwell recently announced an extension of its on-market buyback as part of its ongoing capital management programme to maintain the maximum amount of flexibility with regard to its capital management strategies to enhance value for stapled securityholders.

CMW stock is currently trading at $1.222 (AEDT 2:28 PM) with a market cap of around $3.21 billion.

Rural Funds Group (ASX: RFF)

Rural Funds Group (ASX: RFF) is a real estate investment trust (REIT) which derive its revenues from long-term leases across six sectors:

- Almond orchards,

- Cattle assets,

- Poultry infrastructure,

- Vineyards,

- Cotton assets

- Macadamia orchards

As announced in December 2019, the company is planning to sell its poultry assets and has already struck a deal with ProTen Investment Management Pty Ltd for the sale of RFF’s 17 poultry farms for $72 million which will be partially used to fund the acquisition of three WA cattle properties for $22.6 million, which are expected to settle in January 2020.

At the time of writing RFF stock was trading at a price of $1.885 with a market cap of $636.45 million.

Centuria Industrial REIT (ASX: CIP)

ASX-listed specialist investment manager, Centuria Industrial REIT (ASX: CIP) recently noted that the sssue Price of the units to be allotted to eligible participants in the Dividend Reinvestment Plan (DRP) for the interim dividend payable for the quarter to 31 December 2019 is $3.5038 per unit, payable on 24 January 2020. Last month, the company confirmed the settlement of its two industrial assets.

CIP is currently trading at $3.720 (AEDT 2:28 PM) close to its 52 weeks high price of $3.730.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

.png)