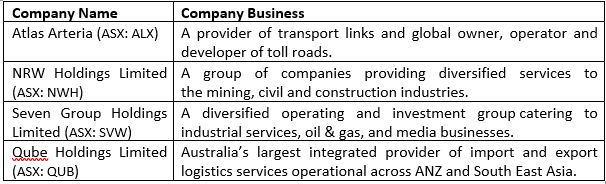

The Industrial Sector

The industrial sector is among the 3 sectors that make up an economy. It is the section of the economy, inter-changeably referred to as the secondary sector, which makes finished products that are utilised by the manufacturing and construction industries. The industrial sector, hence, makes complete products to be used further for the enhancement of the economy. Few divisions of the industrial sector include automotive, textile, industrial equipment and telecommunications.

The other two components of this stand are the primary sector including mining, agriculture and likewise activities, and the service sector, which comprises of consultancy, hospitality and likewise services.

In this article, we would browse through four companies, listed and trading on the Australian Securities Exchange, and learn about their recent updates and stock performance:

Atlas Arteriaâs 1H19 Report

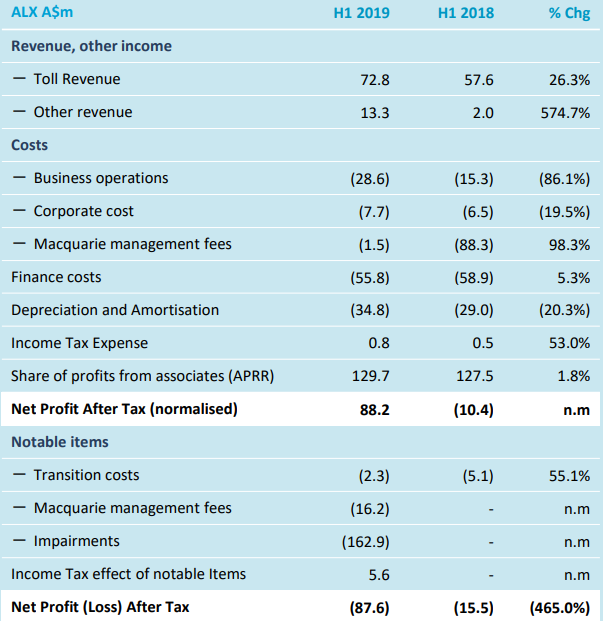

On 29 August 2019, operator and manager of toll road assets, Atlas Arteria (ASX:ALX) pleasingly announced its results for the six months ended 30 June 2019. For the period, the companyâs normalised NPAT was $88.2 million, while statutory net loss after tax was $87.5 million.

The APRR networkâs revenue grew by 1.3% to â¬1,250.8 million and EBITDA went up 1.7% to â¬955.3 million in the first half of the year 2019. Additionally, the customer experience and operational performance have been following a growth trajectory for APRR. APRR is presently working on increasing worker safety through technology. Moreover, it has developed an app, which would be rolled out by the end of December 2019 and would make employees immediately aware of risky situations and hot alerts about traffic conditions surrounding them. However, the Dulles Greenwayâs operating revenue was down 0.4% to US$44.4 million, while EBITDA was up 0.1% to US$35.9 million.

ALXâs Income Statement (Source: ALX Report)

Meanwhile, the company reaffirmed distribution of 15 cents per share in relation to H1 2019, up 25% on H2 2018, which brings the total distributions to 30 cents per share for CY19. The payment of the H1 2019 dividend is expected in early-mid October 2019. Besides this, ALX announced the H2 2019 forecast distribution guidance of 16 cents per share, and the 12 months forward distribution guidance would be outlined in the companyâs year end results announcement in February.

NRW Holdingsâ Dividend Distribution and New Contract

Regarded as a civil and mining contractor of choice, NRW Holdings Limited (ASX:NWH), on 29 August 2019, declared an ordinary fully franked dividend of A$ 0.02 per share, relating to a period of six months, which would be paid to its shareholders on 16 December 2019.

Besides this, the company pleasingly notified that it had successfully bagged the Koodaideri Mine Pre-strip contract by Rio Tinto (ASX: RIO). The project with a value of circa $95 million, is expected to have a duration of nearly 78 weeks. Through this contract, NWH would support Rio Tinto in its iron ore operations in the Pilbara region.

The work would begin in November 2019. The scope of the project includes the development of initial mining pre-strip and earthworks infrastructure which would aid in the mining operations. Mobilisation and site establishment, drill and blast operations, bulk earthworks and drainage construction, clearing and stripping topsoil and subsoil, construction of Rom Pad and Skyway, pre-strip mining operations, construction of access roads and haul roads and in pit facilities are some of the inclusions of this project. For the same, the company would use a major plant from its current fleet.

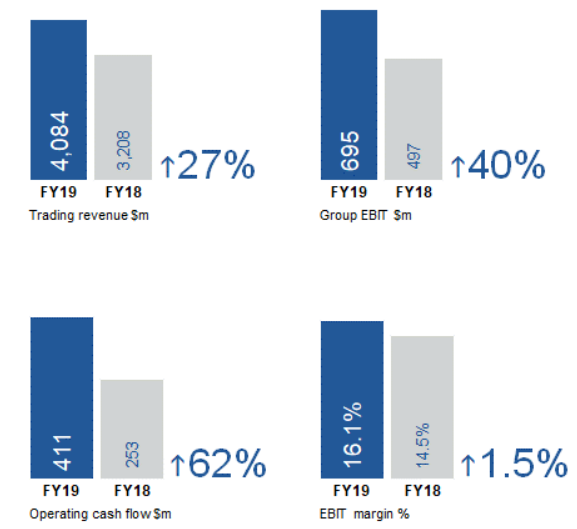

Seven Group Holdingsâ FY19 Results

On 21 August 2019, Seven Group Holdings Limited (ASX: SVW) released its FY19 results, reporting an increase in revenue and underlying profitability. The trading revenue of the company stood at $4.1 billion, up 27 per cent on pcp, while underlying EBIT was $695 million, up 40 per cent on pcp. The company posted an operating cash flow of $411 million, up 62 per cent on pcp and an NPAT of $479 million, up 49 per cent on pcp. SVWâs EPS was 143 cents per share, soared by 47 per cent. Its statutory EBIT of $436 million was impacted by significant items of $291 million which related to Seven West Media (SWM).

During the period, Beach Energy, in which the company has a 28.6 per cent shareholding, delivered record production and earnings result, enabling reinvestment from strong cash flow and $172 million net cash.

SVWâs FY19 Highlights (Source: SVWâs Report)

The company also declared a fully franked final dividend of at 21 cents per share on 21 August 2019, which would be paid to shareholders on 11 October 2019. Besides this, the company notified that Mr Bruce McWilliam, one of its Directors, would retire from the Board at the AGM, though he would continue to focus on his Seven West Media role.

As outlook, the company stated that subject to no change in trade conditions, the FY20 underlying EBIT growth would likely be in the mid to high single digits against the FY19 underlying EBIT.

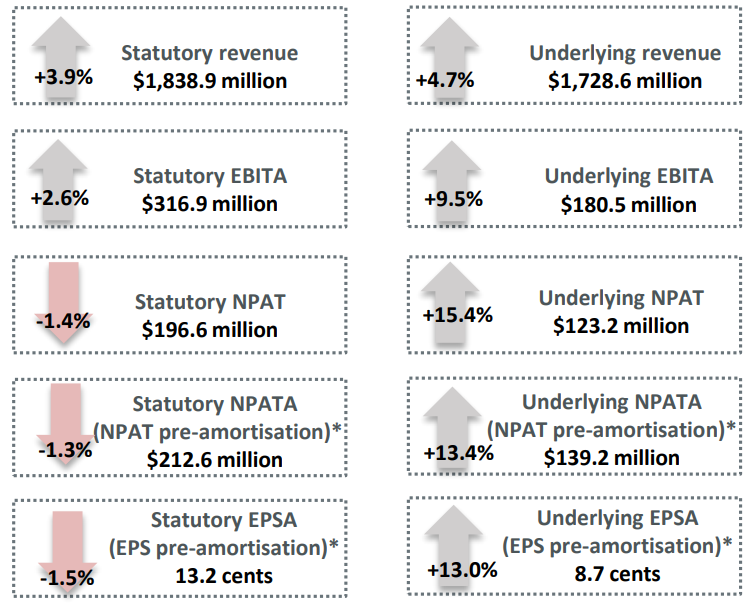

Qube Holdingsâ FY19 Results

An Australian player comprising of three business units including Ports, Bulk & Logistics division, Strategic Assets division and Infrastructure & Property division, Qube Holdings Limited (ASX:QUB) released its FY19 results on 22 August 2019. The underlying NPAT attributable was up 15.4 per cent to $123.2 million and underlying revenue was up 4.7 per cent to $1.73 billion. The statutory NPAT attributable was $196.6 million. The EBITA was $180.5 million, up 9.5 per cent whereas underlying EPSA was 8.7 cents, up 13 per cent on pcp. The company maintained a leverage ratio of 32.5 per cent, which was at the lower end of its long term target range of 30-40 per cent.

QUBâs FY19 Financial Metrics (Source: QUBâs Report)

The full year dividend of the company stands at 6.7 cents per share. Meanwhile, the company announced a final ordinary dividend of AUD 0.029, which would be payable to the shareholders on 18 October 2019.

Besides this, QUB notified that after a comprehensive recruitment process, it had on-boarded Mr Stephen Mann to its Board, w.e.f. 1 September 2019, who would primarily cater to the ongoing development and operation of the Moorebank intermodal project. As outlook, the company expects similar overall economic and competitive conditions in FY20.

Share Performance on ASX, 29 August 2019

| Company Name | Stock Price (A$) | Stock Performance (%) | YTD Return (%) |

| Atlas Arteria (ASX:ALX) | 8.520 | Up by 2.15 | 38.08 |

| NRW Holdings Limited (ASX:NWH) | 2.390 | Down 0.41 | 50.00 |

| Seven Group Holdings Limited (ASX:SVW) | 16.410 | Up 0.18 | 18.95 |

| Qube Holdings Limited (ASX:QUB) | 3.190 | Down 1.23 | 29.16 |

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.