Logistics services provider Qube Holdings Limited (ASX:QUB) achieved solid financial results in H1 FY19 with the statutory Net Profit After Tax of $61.5 million, up 36.1% compared to the previous corresponding period. The news sent the stock price to rebound and trade at $2.845, up 1.246% on 21 February 2019 (12:25 PM AEST).

The Groupâs statutory revenue has increased by decent 5% to $837 million on the back of high cash inflows from its terminal business, Patrick, driven by the higher container volumes and increased market share. The underlying EBITA and NPAT grew 11.7% and 20.3% to $93.6 million and $64.6 million, respectively, reflecting the increased earnings contribution from all principal divisions and improved results from Qubeâs Associates.Â

The encouraging interim results led the company to unbox the special dividend of 1.0 cents per share to its shareholders along with the interim dividend of 2.8 cents per share, up 3.7% on H1 FY18, both fully franked.

Qube Managing Director Maurice James stated, âThe solid first half-year results demonstrate the Qubeâs strong market positions and the essence of its diversification strategies.â

It has been seen that the companyâs diversification strategy again mitigated the impact of challenges in some parts of its business relating to the declining motor vehicle volumes and the ongoing effect of the drought. As a result, the increased contributions from bulk activities, high container volumes and project work enabled the company to deliver 35.7% growth in statutory Earnings Per Share (EPS) to 3.8 cents for the half year ended 31 December 2018.

Moreover, Joint Venture Patrick has been the highlight among all the divisions of Qube. It distributed $40 million cash to each of its shareholders in the period, driven by the high cash flows and pleasing progress with key lease extensions and Port Botany rail automation.

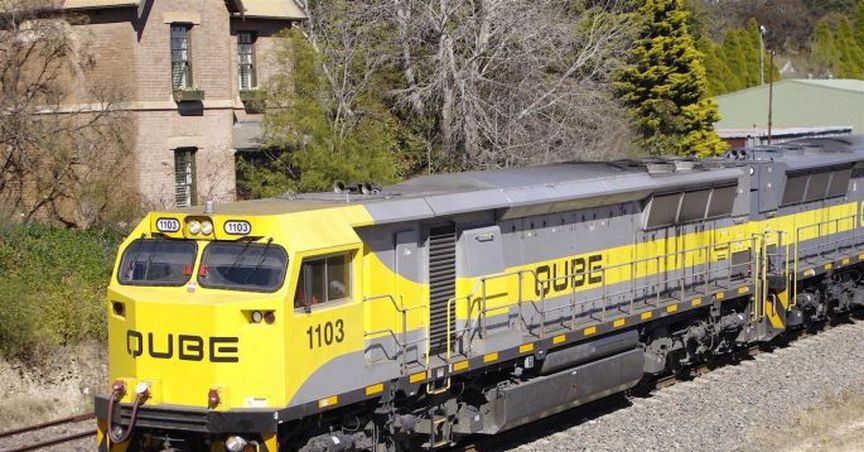

Qube further informed that the rail operations are on track to be operational in the third quarter of the calendar year 2019 with the construction of the Target warehouse to be complete prior to this date. With the sound progress relating to the development, planning, and leasing activities at Qubeâs Moorebank Logistics Park, the company continues to expand its warehouse activities.

The company has managed to maintain a strong balance sheet and liquidity position with the overall weighted average maturity of Qubeâs debt facilities extended and debt facilities increased. Leverage ratio of 28.1% at 31 December 2018 remains below Qubeâs long term target range of 30%-40%.

Outlook:

Qube decides to maintain its previous guidance unchanged. Earlier in AGM, the company revealed its expectation of Fiscal 2019âs total capital expenditure to range within $350 million and $450 million, including around 80% growth capex and 20% maintenance capex.

However, it expects its underlying NPATA to slip in the second half of fiscal 2019, compared to the first half underlying NPATA of $72.6 million. The downgraded outlook reflects several factors including seasonality in parts of the companyâs business and reportedly expected slowdown in container volume growth in the second half of FY19.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.