In the below article, we are discussing three ASX-Listed metals and mining contractors and service providers - MACA Limited, CIMIC Group Limited and Worley Limited. MACA Limited specialises in mining, crushing, civil construction, infrastructure and mineral processing equipment, while CIMIC Group Limited works on project related to construction and mining & mineral processing. Worley Limited caters to a wide range of sectors including mining and minerals, infrastructure and chemicals with full lifecycle services.

Letâs have a look at the recent developments of these three companies.

MACA Limited (ASX: MLD)

MACA Limited (ASX: MLD) is involved into three businesses and two geographical segments including provisioning of contract mining, civil contracting and mineral processing services across Australia. The company also offers contract mining services in Brazil, South America.

Letter of Award

MLD, through a release dated 20th November 2019, announced to have secured a letter of award from a subsidiary of First Quantum Minerals Ltd, namely FQM Australia Nickel Pty Ltd. The letter of award is related to open pit mining services at the Ravensthorpe Nickel Project.

- Under the contract, MACA would provide open pit mining services, which include drilling and blasting, and loading and hauling;

- The final contract award is dependent on the finalisation of documentation with all major terms having been agreed;

- Mobilisation to site is anticipated to begin in December 2019, with operations scheduled to start from January 2020;

- The company expects to generate revenue amounting to around $480 million over the initial term of 5 years;

- The companyâs total position for work in hand currently stands at $2.5 billion and revenue for FY20 is now anticipated to be around $770 million.

While commenting on the selection of the company as the preferred contractor, MACA Operations Director Geoff Baker stated that MLD is looking forward to developing a long-term working relationship with the First Quantum team at the project, which would generate 230 job opportunities, thereby aiding the local and regional communities.

Issue of Securities

On 19th November 2019, MACA updated the market regarding the issue of 1,906,909 performance rights, granted as equity compensation benefits to senior executives pursuant to the Performance Rights Plan of the company. The rights are vesting on 30 June 2022.

Also Read: MACA Limited reported a decline of 27% in its EBITDA in 1H FY19.

Stock Performance

The stock of MLD was trading at $1.115 per share on 21st November 2019 (AEST 01:26 PM), with a rise of 4.206%. Market capitalisation of MACA stood at $266.77 million. The total outstanding shares of the company stood at 268.01 million, and its 52-week low and high is $0.830 and $1.130, respectively. The company has generated a total return of 15.68% and 7.00% in the time period of three months and six months, respectively.

CIMIC Group Limited (ASX: CIM)

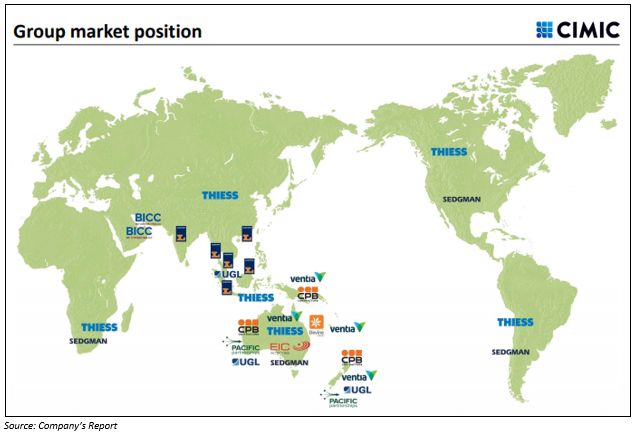

CIMIC Group Limited (ASX: CIM) is one of the leading global contractors, operating as a construction, mining and project development group.

CPB Contractors Wins Design and Construct Contract

In a market release at the end of October 2019, CIMIC informed that its segment CPB Contractors won a design and construct contract, under which it would work on an upgrade to a northern section of Melbourneâs M80 Ring Road.

- Work scope includes widening and realignment of ramps, construction of additional lanes, and structural works;

- CPB Contractors would also install a smart freeway management system, street lighting, traffic barriers, noise walls and landscaping;

- The upgrade work is being financed by the Governments of Australia and Victoria;

- The upgrade work would boost capacity and decrease congestion as well as enhance safety for drivers;

- Construction is scheduled to commence in early 2020 and is due for completion in early 2023;

- When it comes to revenue, this contract would deliver approximately $331 million.

Financial Performance and Guidance

Recently, the company updated the market with results for nine months to 30th September 2019, wherein it reported growth in net profit after tax (NPAT) and solid operating cash flow.

- CIMIC posted stable revenue amounting to $10.7 billion;

- NPAT of CIMIC witnessed a rise of 2% and the figure reached to $573 million;

- Solid operating cash flow of $811 million, up $500 million year on year pre-factoring;

- CIM reported strong financial position in the nine-month period with net cash of $826 million;

- In the 3rd quarter, shareholders received a total of $294 million in the form of dividends and share buyback.

For the remaining 2019, the company unveiled a pipeline of construction, mining and services opportunities worth $20 billion. Subject to market conditions, the company affirmed guidance for NPAT in the ambit of $790 million to $840 million during FY19.

Stock Performance

The stock of CIM was trading at $32.970 per share on 21st November 2019, with a rise of 0.396%. Market capitalisation of CIM stood at $10.63 billion. The total outstanding shares of the company stood at 323.73 million, and its 52-week low and high is $28.800 and $51.500, respectively. The company has generated a total return of 3.76% and -29.56% in the time period of three months and six months, respectively.

Worley Limited (ASX: WOR)

Worley Limited (ASX: WOR) provides professional services in order to help its customers with project engineering, procurement and construction. The company is also engaged in offering consulting and advisory services.

EPCM Framework Agreement

The company through a release dated 19th November 2019 announced to have secured a framework agreement by Covestro Deutschland AG.

- Under the contract, the company would provide services to Covestroâs leading chemicals sites in Germany.

- Worley would deliver engineering, procurement and construction management or EPCM services for Covestro´s portfolio of medium and large investment projects.

JV for Microgrids and Distributed Energy Systems

The company with the help of a release dated 12th November 2019, stated that XENDEE Inc. and Worley Group Inc (a wholly owned subsidiary of Worley Limited) have created a USA incorporated joint venture, named as VECKTA Corporation

- VECKTA would own and operate a cloud-based market platform for microgrids as well as distributed energy systems.

- The platform would connect XENDEE Incâs core energy configuration software with a global network of equipment, finance and project delivery providers supported by the company.

- The platform is expected to be a valuable service offering to the power sector.

- In the joint venture, Worley and XENDEE shareholdings stand at 51% and 49%, respectively.

Contract Extension with BP

- Worley Limited secured an extension of two years by BP Exploration (Alaska) Inc. in order to provide wells support services and fluids hauling for the latterâs North Slope operations;

- The scope of work includes maintenance, modifications, operations as well as drilling support for new and existing wells and well sites for BPâs Alaska wells and fluids organisation;

- The contract was originally awarded in 2012.

Also Read: WOR witnessed a growth of 25.8% in NPAT in 1H FY19.

Stock Performance

The stock of WOR was trading at $13.595 per share on 21st November 2019 (AEST 02:06 PM), with a rise of 1.912%. Market capitalisation of WOR stood at $6.94 billion. The total outstanding shares of the company stood at 520.36 million, and its 52-week low and high is $10.720 and $16.450, respectively. The company has generated a total return of -7.75% and -6.25% in the time period of three months and six months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.