Australia, as we know, is one of the largest material suppliers across the globe due to its high natural resources. Every major commodity from metals to gas flows from Australia to land across the international market, which makes the continent a crown gemstone of the worldwide material sector.

The S&P/ASX 200 Material is closely tracking the S&P/ASX 200 Index, which recently marked a record high of 7,144.90 on 22 January 2020. While the S&P/ASX 200 had demonstrated a strong rally for over a decade, the material index is closely tracking it from last five years with a total return of 49.15 per cent (ASX 200 50.61 per cent).

Also Read: Amidst Multiyear Index Highs, Resource Stocks-PRU, AWC, and S32 Announce Quarterly Report

XJO and XMJ Total Returns (5 Years) (Source: Thomson Reuters)

The recent breakout of the coronavirus has had a negative impact on the demand for base metals such as copper, zinc; however, the Australia miners and global investing communities are hoping that the virus would be contained soon, which would keep the demand for the basic materials such as oil, copper, zinc going across the global front.

Also Read: Base Metals and Iron Ore Turning Red Hot as Coronavirus Turns into a Pandemic Threat

In the wake of future hopes, the Australian material sector companies such as Aurelia Metals Limited (ASX:AMI), Alta Zinc Limited (ASX:AZI) and many others are progressing across their respective prospects.

As per the data from DMIRS (Department of Mines, Industry Regulations and Safety (WA)), the current estimated value of projects under construction stands at $25 billion (as on September 2019 quarter), while the value of planned or possible projects is estimated at $82 billion (as on September 2019).

While the tougher market conditions for some metals such as lithium had exerted slight pressure on the planned and under construction project as compared to the March 2019 estimates, the mining companies are now increasing the overall exploration amid upcoming estimated demand for the basic material group such as cobalt, lithium, gold, copper.

ASX Mining Companies Exploration & Development

Aurelia Metals Limited (ASX: AMI)

AMI is an ASX-listed multi-commodity mining and exploration company with prospects of gold, silver, lead, and zinc. The operational portfolio of the Company includes Hera and Peak gold and base metals mines.

AMI recently conducted exploration activities near Hera mine at the Federation prospect and in Peak North and Kairos areas at the Peak mine.

- Development at the Federation Prospect

Post intercepting a very strong polymetallic mineralisation through shallow step-out drilling along the strike at Federation, which resulted in 18 metres at 24.7 per cent of lead and zinc (drill FRC043), AMI now received the encouraging results from the rest of the drill holes, which are as below:

- The drill hole identified as FRC046 intercepted 3 metres at 5.8 per cent of lead and zinc, 21.8g/t of gold, 7g/t of silver, and 0.1 per cent copper from 72m; and,

The intercept further includes; 10 metres at 24.4 per cent of lead and zinc, 14.2g/t of gold, 12g/t of silver, and 0.2 per cent copper from 92m, incl. 4 metres at 23.2 per cent of lead and zinc, 30.2g/t of gold, 10g/t of silver, and 0.2 per cent copper from 95m.

- The drill hole identified as FRC057 intercepted 29 metres at 26.6 per cent of lead and zinc, 0.4g/t of gold, 14g/t of silver, and 0.7 per cent copper from 159m; including,

10 metres at 55.6 per cent of lead and zinc,0.8g/t of gold, 26g/t of silver, and 0.6 per cent copper from 162m.

As per the company, both the drill holes are relatively shallow, with high-grade zones starting ~65m and 130m below the surface, respectively.

AMI is now progressing towards a JORC-compliant resource estimate for the deposit

- Development at the Peak North Prospect

AMI continued the underground drilling at the prospect, which prior to the exploration activity consisted of low-moderate grade Inferred Resources.

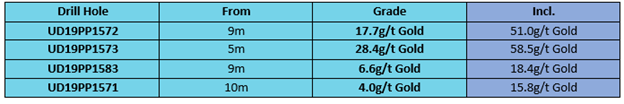

The recent drill results from the prospect includes

As per AMI, the area is favourably placed with respect to existing underground infrastructure and the Company is currently reviewing potential development options at the prospect.

- Development at the Kairos Prospect

AMI completed the first surface hole (DD19PK0142A), which tested the level below the high-grade Kairos lode and was drilled to the depth of 1,929.7m. The hole passed through various rhyolite-sediment contact zone, and all assay results are currently pending.

The stock of the Company last traded at $0.410, down by 2.3 per cent against its previous close on ASX.

Alta Zinc Limited (ASX:AZI)

AZI is an emerging ASX-listed zinc exploration and development company, and the operational portfolio of the Company includes Gorno in the Bergamo Province of Italy, which has a long history of mining, and Paterson & Macarthur in Western Australian and Northern Territory, respectively.

The Company reported the December 2019 quarter update today and emphasised on the drilling program undertaken for its Pian Bracca prospect at the Gorno Zinc Project.

- Pian Bracca Mineralisation and The Second Layer Underneath

AZI commenced a 30-hole diamond drilling program during the quarter, which targeted some high priority targets which previously returned high-grade assays. The first two holes were drilled at the central part of the prospect, which intersected the Pian Bracca mineralisation along with a highly mineralised lower lens.

The results further confirmed the high-grade nature and thickness of the mineralisation with sustained assay results as compared to the assay result from nearby channels, and the Company inferred that the mineralisation is continuous both beneath and between the multiple levels of historical development.

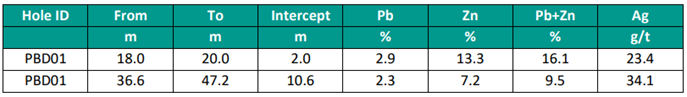

The results from both the drill holes are as below:

(Source: Company’s Report)

Post the December 2019 quarter; the Company announced further results for various drill holes, which remained as below:

The drill hole identified as PBD02 intersected 12.1 per cent of zinc and lead, 38g/t pf gold over 12.0m from 56.9m.

The drill hole identified as PBD023 intersected 14.8 per cent of zinc and lead, 52g/t pf gold over 10.7m from 58.0m.

The drill hole identified as PBD05 intersected 19.4 per cent of zinc and lead, 60g/t pf gold over 12.1m from 59.5m.

These intersections also suggested a second-layer of high-grade mineralisation beneath the Pian Bracca, which includes

19.1 per cent of zinc and lead, 19g/t pf gold over 8.5m from 23.4m from PBD02, ~ 20m below from the existing Pian Bracca mineralisation.

- Corporate Highlights

During the December 2019 quarter, AZI completed a successful Placement to raise ~$1.9 million via issuing 342.3 million shares (along with additional 30 million of the Managing Director- Geraint Harris) at an issue price of $0.005 a share. The Victor Smorgon Group- the strategic investor in the Company, maintained its shareholding of ~ 15.7 per cent, which as per the Company, further validates the Gorno Project and AZI’s strategy of brownfield exploration and resource growth.

AZI also suggests, that the raised capital along with the existing cash reserve of $1.985 million (as on 31 December 2019), is sufficient to fund the ongoing drilling at Pian Bracca and working capital.

The stock of the Company last traded at $0.007, down by 12.5 per cent against its previous close on ASX.