Jewellery has been an emblem of social status since time immemorial, given that it is made from precious metals and stones. The global luxury jewellery market was a big hit in the previous years and is projected to expand at a high CAGR in the days to come as the demand for fashion products throughout the globe is anticipated to be a promising factor for market growth. Luxury jewellery products are fairly expensive owing to the value and usage of precious materials including diamond and gold.

The market is expected to witness a surge in jewellery sale due to increased purchasing power of the urban class customers. There are certain other factors that may propel the growth in the jewel market:

- High disposable income of the customers

- Increasing consumer preference for the branded jewellery

- The desire to make an own style statement, new designs and colours

- High demand for moral, high-quality, and up-to-date designs.

Gems and jewellery comprise of the sub-sectors including- diamonds, gemstones, pearl, gold, silver and platinum jewellery. The glittering market can also be segmented into necklaces, rings, bracelets, and earrings on the basis of the product. The ring market is anticipated to take the lead in global market due to elevated impact of western culture and the desire to demonstrate onesâ social status.

Even when the vibrant world of jewels and charms is booming at a healthy pace, the market is not exempt from challenges that are impeding its growth. Some of the major challenges encountered by the market are:

- Negative Perceptions about the Jewellery Industry

- Need for Financial Transparency

- Generic Promotion of Diamonds & Jewellery.

The jewellery industry appears to be prepared for a glittering prospect. Apparel brands were leading the industry for the previous years and jewellery market seems to follow the similar trend.

Brands in the gems and jewellery space are targeting the millennial shoppers who are often eyeing for something elite to flaunt. The major performers leading the jewellery market are:

- Pandora

- Tiffany & Co.

- Cartier

- Swarovski

- Chow Tai Fook Jewellery Group Limited

- Signet Jewellers Ltd.

One of the six companies, Tiffany & Co has been summarized in this report providing detailed evaluation of their financial information and business tactics:

Tiffany & Co. (NYSE:TIF)

Tiffany & Co. (NYSE: TIF) is a luxury jewellery and specialty retailer engaged in product design, manufacturing and retailing activities, well-known for its luxury goods and is particularly famous for its diamond and sterling silver jewellery.

Tiffany Confirms Receipt of Uninvited, Non-Binding Proposal from Louis Vuitton

The French fashion house, Louis Vuitton made a bid of ~$14 billion to buy the renowned jeweller for its profligate rings, Tiffany & Co., for $120 per share in cash.

The company said the parties are not in discussion, but it is their fiduciary responsibility to thoroughly evaluate the proposal with the support of independent financial and legal advisors, to ascertain the course of action, in the best interests of the Company and its shareholders.

The stock of the company soared by almost 33% after the unsolicited acquisition proposal of 30% premium to where the tiffany stock was trading. Market experts note that Louis Vuitton approached Bulgari in a related manner and paid 60% premium on its share price.

The Company, in the previous periods, has dealt with plunging sales and ever since it is toiling to improve its image to attract and allure young shoppers. Adding up Tiffany to its trove of companies makes strategic logic for Louis Vuitton as there are few hard jewellery players to buy. The deal would boost up the presence of Louis Vuitton in the United States, accounting for about one-fourth of its revenue. It would also bolster the French company's jewellery and watch line-up, which comprises European legacy brands such as Bulgari, Hublot and TAG Heuer.

Luxury Gifting, Reinvented- Tiffany Introduces A Very, Very Tiffany Holiday

The company launched a catalogue featuring 12 exceptional gifts and experiences, a first in the companyâs history. The catalogue introduces a curated selection of the best, with everything from a class custom high jewellery design to an extraordinary adventure in Kenya and new jewellery, collections and gift ideas to make it a happy holiday for one and all. These include a four-foot-tall Advent calendar, custom design ring, which is handcrafted by Tiffanyâs artisans, solid sterling silver greenhouse, etc.

Plans to bring Tiffany to India

The company plans to enter the Indian market through a joint venture and open stores in Delhi in fiscal 2H 2019 and Mumbai in 2H 2020.

Dividend

The company announced a regular quarterly dividend/distribution of $0.58/share of common stock, which was paid on October 10 this year.

2nd Quarter Highlights

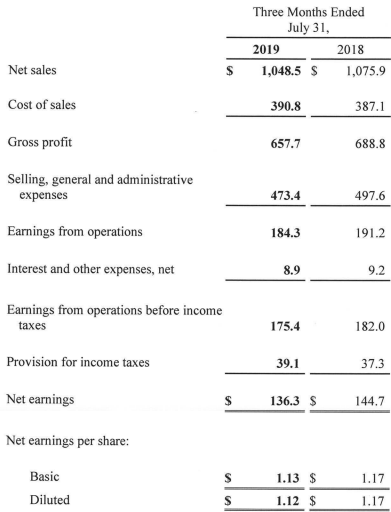

- The company has reported its financial results for the 2nd Quarter where the net sales went down by 3% to $1.0 billion from the prior period.

- Tiffany also reported a decrease in operating margins, a higher effective income tax rate for the second quarter, reflecting the changes in sales mix toward higher price point jewellery.

- During the quarter ended 31 July 2019, the net earnings standing at $136 million witnessed 6 percent of decline compared to the previous year's $145 million. The selling, general and administrative expenses went down by 5% in the second quarter due to a reduction in marketing spending and a drop-in labour and incentive compensation costs, counterbalanced by increased store occupancy and depreciation expenses.

Financial Performance (Source: Companyâs Financial Statements)

Outlook

The company is prioritising to magnify an evolved brand message and enhance in-store presentations. Tiffany is expected to offer a more economical operating model and inspire an allied and agile organization to win. By pursuing its key priorities, the top management of the company is committed to the following long term objectives of achieving sustainable sales growth, to increase retail productivity and profitability, to achieve improved operating margins, through both improved gross margins and efficient expense management, to improve inventory and other asset productivity and cash flow, to maintain a capital structure that provides financial strength and the ability to invest in strategic initiatives.

On 30 October 2019, Tiffany & Co. stock last traded on NYSE at a price of USD123.89, down by 2.27 % from its prior close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.