The renowned American investor, Warren Buffett, has very well said, “A market downturn doesn’t bother us. It is an opportunity to increase our ownership of great companies with great management at good prices.”

Amidst worsening stock market correction due to dual threats of oil price falls and growing concerns over coronavirus outbreak, the Australian equity market is certainly providing one of the best opportunities to invest for long-term investors. After observing its worst trading day since the global financial crisis, the stock market seems to become much more captivating for investors targeting potential returns in the long-term.

Given this backdrop, let us discuss three stocks which can potentially be investors’ choice for buy and hold in the present scenario and that are likely to deliver lucrative returns over the long run:

This Gold Stock Outpaced S&P/ASX 200 in Last One Year

As investors seek to hedge against the growing uncertainty arising from COVID-19 epidemic, gold stocks have become one of the most favourite pockets for investors. Moreover, a plunge in crude oil prices has sent investors rushing for safe haven.

In a span of last one year (up till 9th March 2020), gold stock Newcrest Mining Limited (ASX:NCM) outperformed S&P/ASX 200 by delivering ~17.3 per cent return against the Australian benchmark index which produced negative return of ~7 per cent.

To recall, the Australian stock market was highly volatile during the last one year period due to geopolitical and economic concerns such as the US-China trade war, falling interest rates, subdued inflation and high unemployment rate.

The Company recently delivered decent financial results in its 1H FY20, reporting a statutory profit of $236 million and an 18 per cent rise in underlying profit to $280 million. The improvement in the Company’s underlying profit was driven by a higher realised price of gold, a lesser depreciation expense and the positive impact on operating costs from the weakening of the AUD against the USD for the Australian operations.

In addition, the Company announced gold production of $1.1 million ounces during the period. The Company also determined a fully franked dividend per share worth US 7.5 cent payable on 27th March 2020.

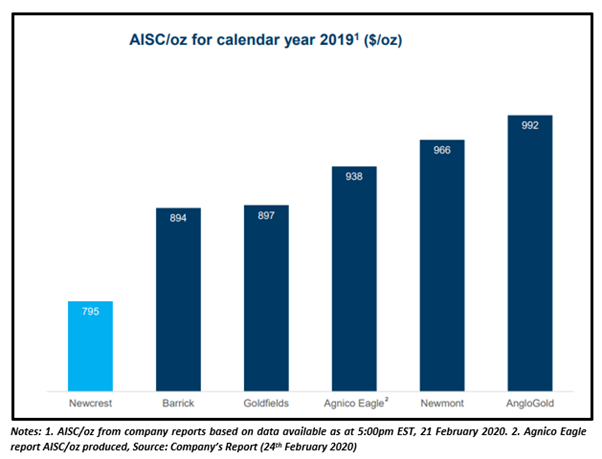

It is worth noting that Newcrest became the lowest cost major gold producer of Australia in 2019 (see figure below):

On an operational front, Newcrest continues to take challenging and strong business decisions in line with its long-term objectives. The Company recently finalised the sale of 100 per cent of Newcrest Singapore Holdings Pte Ltd to Indotan Halmahera Bangkit for $90 million.

Moreover, the Company also entered into a farm-in agreement and associated exploration JV agreement worth $60 million with Antipa Minerals Limited (ASX:AZY) with regard to a 2,180 sq. km southern portion of the Antipa’s wholly owned ground in the Western Australia’s Paterson Province.

The Company also entered into a subscription agreement with Antipa by virtue of which it will acquire a 9.9 per cent stake in Antipa via a placement of new shares at 1.7 cents per share to raise $3.9 million and have the right to appoint a director to Antipa’s board (but not the obligation).

Backed by strong exploration & technical capabilities, gold producer Newcrest is progressing considerably well on operational as well as financial front and seems to be well-positioned to deliver competitive returns to its stockholders.

Is COVID-19 Benefitting this Healthcare Player?

On the one hand, numerous stocks are under pressure in the wake of spreading COVID-19; while, on the other hand the Australian healthcare companies seem to be benefitting from the epidemic. One of such healthcare firms that has delivered a considerable return of ~140 per cent this year is Zoono Group Limited (ASX:ZNO).

It is imperative to note that Zoono’s stock price improved substantially over the period when the entire world was battling with the rising deaths from coronavirus outbreak. Not only its YTD return is surprising, its 1-year return of ~1876 per cent is more fascinating, which validates its considerable potential of generating significant returns with or without coronavirus.

Though Zoono’s sizable return in the last one year is driven by several robust developments, its latest updates on COVID-19 clarifies the reason behind its recent solid return.

Recently, the Company notified that its Z-71 Microbe Shield turned out to be over 99.99 per cent effective against COVID-19, which has become a global concern nowadays. The Company’s products were successfully tested against a variety of pathogens for up to 24 hours on hands and 30 days on surfaces, in comparison to COVID-19 which survives on surfaces for up to 9 days.

The results demonstrated the Company’s ability to be a part of the solution to protect and prevent the spread of the COVID-19 Virus.

Prior to reporting these results, the Company also executed a Distribution Agreement with Eagle Health Holdings Limited (ASX:EHH) for the distribution of Eagle and Zoono co-branded products and offline retail sales in China. Under the agreement, Eagle will import the Company’s products in bulk for labelling, packaging and distribution to its facility in Xiamen, China.

It is worth pointing out that there has been an unprecedented growth in interest in Zoono technology and its proven activity against ‘corona type’ viruses and bacteria as well as its ability to prevent cross contamination with its 24 hour to 30 day extended efficacy (by application).

Also Read Opportunities to be Tapped in the Healthcare Sector Amid Coronavirus

This High Yielding High-Quality Dividend Stock Grabbing Investors’ Attention

Dividend stocks have evolved as investors’ strategy to earn higher returns from volatile financial market instruments like stocks. The coronavirus outbreak is offering investors an opportunity to potentially add high yielding high-quality dividend stocks in their portfolio at discounted prices, like Fortescue Metals Group Ltd (ASX:FMG), whose annual dividend yield is 11.66 per cent (As on 10 March 2020).

The Company’s stock has also delivered a return of over 44.77 per cent return in the last one year.

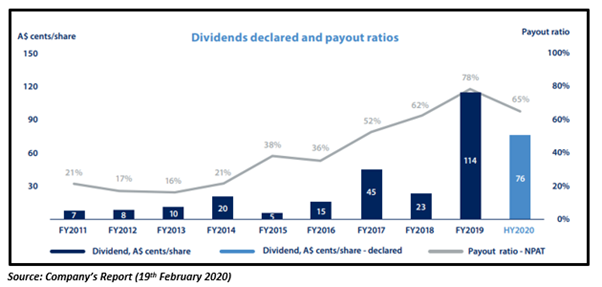

The Company has recently announced a fully franked interim dividend of $0.76 per share for the half-year period ended 31st December 2019. The declared dividend carries an ex-dividend and record date of 2nd and 3rd March 2020, respectively and is payable on 6th April 2020. The Company’s recently announced dividend is considerably higher than its dividend of $0.30 per share declared during the prior corresponding period, comprising interim dividend of $0.19 per share and special dividend of $0.11 per share.

The interim dividend for the current period represented a payout ratio of 65 per cent of net profit after tax in accordance with the Company’s policy of a payout ratio between 50 and 80 per cent.

It must be noted that up till 26th February 2020, Fortescue generated NPAT of USD 17bn and allocated USD 9bn of capital to debt repayment and USD 6bn to dividends, remaining a favorable choice for investors seeking high-dividend stocks.

Amidst volatile equity markets, crushed business and consumer confidence, charred investors’ sentiments and global growth concerns, choosing right mix of assets with judicious stock selection approach considering buy and hold strategy may be adopted to reap long-term returns.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.