Lithium is a versatile metal that finds a myriad of applications in the form of lithium carbonate such as in medicine to treat mental illness, formulation of lightweight alloys for the aeronautics industry, glass and ceramics, as a lubricant due to low melting point, high mechanical strength, and high thermal resistance. However, the maximum demand for lithium is being stimulated by its use in Lithium ion batteries (LIBs) used to power electric vehicles (EVs).

Over a decade, the demand for lithium has skyrocketed while producers are frantically exploring for new sources of supply. The global EV battery market is burgeoning across the globe at the backdrop of rising fuel prices, low operating cost, high energy efficiency, expansion of global auto-manufacturers into new emerging markets, evolution of Lithium-ion technology in EVs, improvements in public charging infrastructure and related initiatives by the governments.

Besides, climate change and alarming pollution levels are also instilling the urgency to adopt clean energy alternatives to create a low-carbon future.

Different market analysts including the Australian government forecaster and Benchmark Mineral Intelligence are all indicating to a looming deficit for lithium supply by the early to mid-2020s. Meanwhile, car manufacturers are continuing to boost their planned production of electric vehicles, as lithium offers an alternative to nickel metal batteries that are used in EVs, due to their small size and light weight.

Investors with focus on market opportunities over the near-term can expect attractive returns, specifically from those projects that can benefit from the lowest cost lithium output in the globe.

According to Benchmark Mineral Intelligence, lithium supply is required to grow at a CAGR of 19% over the next six years in order to meet the demand forecast for 2025.

The situation in the lithium market is such that both spodumene and brine resources are required to be developed to reach somewhere near the growth estimates for the next two to three years and beyond.

Various analysts have been acknowledging the oversupply myth related to lithium, with Macquarie recently changing from a bear to a bull on global automakersâ push into electric vehicles. For example, German automaker Volkswagen plans to buy more than USD 56 billion of lithium-loaded battery cells, while Toyota expects half its global sales to comprise electric vehicles by 2025.

While, it cannot be denied that prices have dipped in the short term, yet, the medium to longer-term lithium outlook looks bright.

Letâs look at the following four ASX-listed lithium stocks and their recent activities update.

| Company | Market Cap | Stock Price | 3-month Return |

| Lake Resources N.L. | AUD 26.78 mn | AUD 0.056, on 28 August 2019 (AEST 01:41 PM) | 24.44% |

| Lithium Australia NL | AUD 25.65 mn | AUD 0.048 on 28 August 2019 (AEST 01:42 PM) | -37.91% |

| Latitude Consolidated | AUD 4.4 mn | AUD 0.016 on 26 August 2019 | 14.29% |

| Core Lithium Ltd | AUD 31.53 mn | AUD 0.040 on 28 August 2019 (AEST 01:43 PM) | -6.98% |

Stock Performance; Source: ASX

Lake Resources N.L.

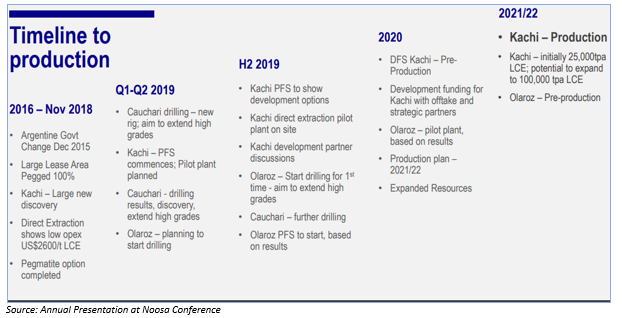

Lake Resources N.L. (ASX: LKE) is a metals and mining sector company, engaged in the exploration and development of its four wholly-owned key lithium brine and hard rock projects (Total Tenement Package: ~200,000 Ha) in Argentina, located in the world-renowned Lithium Triangle, where half of the worldâs lithium is produced. The projects include the Kachi Project, the Catamarca Project the Cauchari project and the Olaroz-Cauchari and Paso brine projects.

Recently on 23 August 2019, Lake Resources reported high-grade results, confirming a major discovery at Cauchari Project. The high-grade results averaged 493 milligram per litre of lithium over 343 metres (from 117 metres to 460 metres), up to 540 milligram per litre, with a 2.9 Li/Mg ratio. The brines were intersected over a depth of 506 metres. The results underpinned the companyâs strategy to move ahead with the drilling pending for the Olaroz Project.

Meanwhile, the Pre-Feasibility Study (PFS) is advancing at the Kachi Project and the pilot plant is nearing construction using the direct lithium extraction production process of US-based Lilac Solutions.

Lithium Australia NL

Lithium Australia NL (ASX: LIT) is an Australian metals and mining sector player working to 'close the loop' on the energy-metal cycle in a sustainable way and establish a vertically integrated lithium processing business. The company has developed a strategic project portfolio as well as established partnerships along with unique extraction technologies (LieNA®) for the conversion of lithium silicates (including mine waste) into lithium chemicals.

On 22 August 2019, Lithium Australia informed the market that its proprietary LieNA® technology is designed to produce different high-purity lithium battery chemicals from spodumene feeds without the need for roasting. The potential lithium chemical suite may comprise high-purity phosphate, hydroxide sulphate or chloride. LieNA®, derived from several years of R&D undertaken in collaboration with the Australian Nuclear Science and Technology Organisation (ANSTO), has recently transitioned from a scoping study to preliminary feasibility study assessment.

Lithium Australia also added that it received various enquiries for the supply of both refined tri-lithium phosphate (LP) and lithium-ferro-phosphate (LFP) on its recent visit to China. The company has lodged for both provisional patent and Patent Cooperation Treaty applications for LieNA® as a part of its intellectual property protection strategies.

Latitude Consolidated Limited

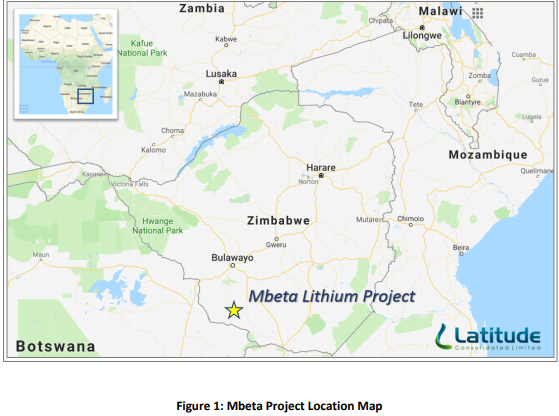

West Perth, Australia-based Latitude Consolidated Limited (ASX: LCD) is a resources development company currently focused on Lithium Projects in Zimbabwe. In addition, the company also holds a portfolio of prospective gold tenements in Western Australia. On 25 July 2019, Latitude Consolidated announced to have finalised the 70% acquisition of the Mbeta Lithium Project from Zimbabwean national Robert David Hutchings, at a value consideration of AUD 71,089.

The Mbeta Project comprises ~ 18 km² of mineral tenements, that are highly prospective for lithium and related elements. A recent field visit report obtained by the company confirmed that lepidolite?mineralised pegmatite is exposed in pit floors, and mineralised material is stockpiled in locations near the remains of a crushing facility.

Source: June 20919 Quarterly Activities Report

Latitude Consolidated continues to perform assessments of a range of compelling potential investment opportunities in regions including Zimbabwe and Zambia. The company is also undertaking due diligence on a number of prospective properties.

Core Lithium Ltd

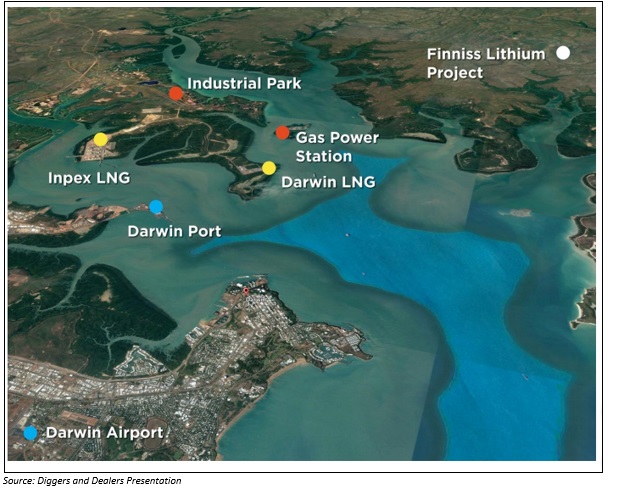

Core Lithium Ltd (ASX: CXO) is developing two of Australiaâs highest-grade lithium resources at the Grants and BP33 deposits while the company has recently published a DFS for the development of a spodumene concentrate operation at the Finniss Lithium Project, located in the Bynoe Pegmatite Field in the Northern Territory. The company is planning to further increase the mine-life and commence mining and construction in the second half of 2019 and spodumene concentrate production in 2020, subject to financing and regulatory approvals.

The Finniss Project has one of the best supporting infrastructure and logistics chain, inlcuding 25km distance from the port, a power station, gas, rail and one hour by sealed road to workforce accommodated in Darwin and importantly to Darwin Port - Australiaâs nearest port to Asia. This significantly reduces the capex and opex requirements.

The company has executed offtake and prepayment agreements with respect to the project and discussions are ongoing to negotiate agreements with some of Asiaâs largest lithium consumers and producers that would support and finance the Finniss Projectâs modest capex requirements and the company into production.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.