Introduction

Unibail-Rodamco-Westfield (ASX:URW) is a company which belongs to the real estate sector and is the owner as well as the operator of commercial property portfolio in Europe, the United Kingdom and the United States. These commercial properties comprise of shopping centres, offices as well as convention & exhibition centres.

By the closure of the market on 12 September 2019, the S&P/ASX 200 Real Estate (Sector) was up by 0.95 per cent to 3,736 against S&P/ASX 200 which was up by 0.26 per cent to 6,654.9.

Although the real estate index performed relatively well on 12 September 2019, still one of the stocks belonging to this sector was a strong performer. It is known as Unibail-Rodamco-Westfield. By the end of the dayâs trading, the shares of URW zoomed up by 1.655 per cent to $10.440 on ASX. The shares opened at a price of A$10.420, at a gap up of A$0.15 from its last closing price. URW has a market cap of A$28.42 billion with approximately 2.77 billion outstanding shares.

Let's try to know more about URW:

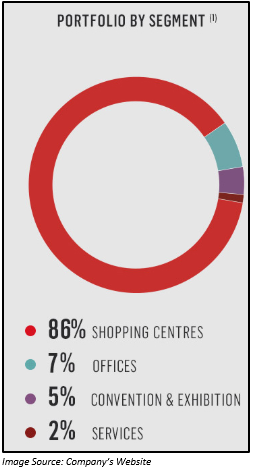

Unibail-Rodamco-Westfield is the leading global developer as well as the operator of shopping destinations and the value of its portfolio by 30 June 2019 stood at â¬65 billion. The portfolio of the company comprises of 86 per cent retail, 7 per cent offices, 5 per cent convention & exhibition venues and the remaining 2 per cent is services. At present, the company is the owner and operator of ninety-two shopping centres which includes fifty-five flagships in the most vibrant cities in Europe as well as the US. The company has presence in two continent and 12 countries. Each year, around 1.2 billion visitors visit the properties. The company is capable of positioning itself for generation of superior value and also develop superlative projects.

The ambition of the company to produce extraordinary as well as sustainable places. The company engages itself by participating in shaping up and enhancing the cities where they are present and focuses on the lifestyle of the people which includes the living style, working ways, shopping patterns and how people keep themselves entertained.

The companyâs strategy includes concentration, differentiation & innovation. By concentration, it means that the company focuses on the best assets in the liveliest cities of the world. In the US, the company operates in airport retail facilities. It is also engaged in the development of state-of-the-art office buildings with extraordinary work atmospheres. The company also owns as well as operates major convention & exhibition centres in the Paris zone. The company continues to focus on making an investment in its portfolio based on its asset rotation strategy, management of assets in a controlled manner and the build-out of the development pipeline.

The company believes in reinventing retail experience by providing outstanding services, exclusive designs, bold digital marketing, premium retailers, along with exciting events.

The company focuses on innovation by grabbing external opportunities via technology and to explore new business models, create value, make growth, and at the same time, stay ahead of the curve.

The company believes in working as a single team as they feel that togetherness helps them in achieving ambitious projects.

Business:

The company aims to offer its clients with the best services, digital marketing, unique design, differentiating premium retailers as well as arranging exciting events.

- Marketing: Through marketing, the company tries to create robust and engaging relations with end consumers.

- Events & Entertainment: Through events and entertainment, the company tries to connect with people having a common passion.

- Brand Ventures: The team of URW who are into Brand Ventures provides a unique value proposition by making experiences as well as complete packages which enable brands to occupy a complete visual landscape. Brand Ventures includes pop-up stores, kiosks and carts.

- Leasing: The shopping destinations facilitate the best retail offers for its clients belonging to players from various segments like fashion, luxury, technology, entertainment, dining etc.

- Destinations: Focuses on increasing customer reach and satisfaction.

Recent Update:

On July 31, 2019, Unibail-Rodamco-Westfield released its half yearly results for the period ended 30 June 2019. The company reported a very strong tenant sales growth in its leading destinations. In Continental Europe, there was a growth of more than 5.7 per cent, 7.1 per cent in the UK and above 4.9 per cent in the USA. The net rental income of the Group like-for-like increased by more than 3.3 per cent over the corresponding year-ago period. In continental Europe, the like-for-like growth in the Shopping Centres was more than 2.1 per cent. In the UK it declined by 3.1 per cent, and in the US, the like-for-like growth in the Shopping Centres was above 2.2 per cent of which more than 5.5 per cent was for flagship properties. There was a Continental European rental growth of more than 12.2 per cent of which more than 13.8 per cent was in the flagship properties. The average cost of debt remained low at 1.6 per cent, and the average debt maturity period got extended to eight years. The development pipeline scaled back during the period to â¬10.3 billion.

The company during the period made a net profit of â¬1,177.9 million during the period. The company in 1H FY2019 experienced a fall in the shareholdersâ equity during the period to â¬31,684.5 million as compared to â¬32,141.5 million in the year-ago period. The company reported a rise in the operating cash flow from â¬710.7 million in 1H FY2018 to â¬882.5 million in 1H FY2019. The net cash outflow from the investing activities declined during the period from â¬4,958.2 million in 1H FY2018 to â¬466.6 million in 1H FY2019. There was a net cash inflow of â¬472 million from the financing activities of the company.

Overall, there was a net cash inflow of â¬887.9 million during the 1H FY2019. By the end of 1H FY2019, Unibail-Rodamco-Westfield had net cash and cash equivalents worth â¬1,297.1 million.

Outlook and Guidance:

Despite the challenging retail environment, the companyâs performance in 1H FY2019 was strong. The company expects that in FY2019, the Continental European Like-for-like NRI would be increasing by more than 3 per cent. The financing conditions might also be more favorable.

Based on this, the Group has increased its 2019 AREPS (adjusted recurring earnings per share) guidance by more than â¬0.30 to fall in the range of â¬12.10 and â¬12.30.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.