In the present age of digitization, digital health service sector has surfaced as one of the fastest-growing industries. Introduction of technologies in the health care domain has completely transformed the sector and has emerged out as a boon for patients, clinicians, researchers and scientists.

In the article discussed below we would be zooming the lens over the details of two health care stocks AVITA Medical (ASX:AVH) and PolyNovo Limited (ASX: PNV).

In Index Rebalancing, stocks are periodically added to the ASX index on account of eligibility & future potential in a process of systematic re-assessment of the stocks listed in the Index. The entire process is based on specified methodologies and essential assessment benchmarks.

A regenerative medicine company, AVITA Medical developes a technology platform which is placed well to address significant unmet medical needs in therapeutic skin restoration focusing on burns, aesthetics indications and chronic wounds. The patented medical devices and groundbreaking application technology provides innovative treatment solutions.

The medical devices function by formulating an autologous suspension, REGENERATIVE EPIDERMAL SUSPENSION⢠(RESâ¢), consists of the cells isolated from patientâs skin essential to regenerate natural healthy skin and then the suspension is sprayed on to the areas of the patient where treatment is needed.

AVITA Medical to Secure its place in S&P/ASX 200 Index

In an announcement dated 08 November 2019, it was informed to the market that AVITA Medical would be included in to the S&P/ASX 200 index with effect from market open on 14 November 2019, 2 months after the company was added to the S&P/ASX 300 index.

AVITA Medical Reports Updates for the First Quarter of the Fiscal Year 2020 ended 30 September 2019

A$4.6 million Commercial Sales of RECELL® System in US Reported

The RECELL System received U.S. Food and Drug Administration (FDA) approval on 20 September 2018. Later in January 2019, it was launched commercially across the nation following which AVITA has been actively engaged in promoting this device for nine months in the country.

For fiscal first quarter, the company generated A$4.6 million from the sale of its RECELL® System in US representing 60% growth quarter-over-quarter.

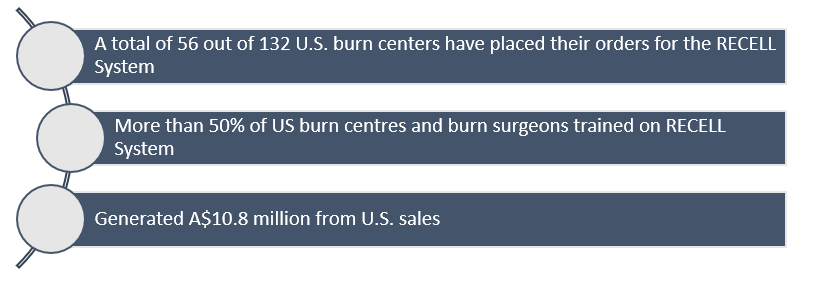

US Commercial achievements

Since approval following milestones were completed by AVITA Medical:

NASDAQ Listing

The company commenced trading on Nasdaq on 01 October 2019 under the code âRCELâ and listed American Depositary Shares on the Nasdaq Capital Market.

S&P/ASX300 index

AVITA Medical was included into the S&P/ASX300 index during the given period. S&P/ASX300 index measures the performance of the largest 300 companies on the basis of their market capitalization on ASX.

FDA Approval

U.S. FDA Investigational Device approval of pivotal study protocol was obtained by the company to investigate the RECELL System for soft tissue reconstruction, including traumatic wounds.

Publications

AVITA Medicalâs significant achievements are reflected by publications of its multiple studies focused on probing the possible usage of the RECELL System for dermatological conditions in peer-reviewed journals.

Update on Projects Under the Pipeline

In the fiscal year 2020, the company anticipates the following developments-

- Initiating the pivotal trials to determine the safety and efficacy profile of the RECELL System for timely intervention treatment scald wounds in children and for the traumatic wounds and reconstruction of the soft tissue reconstruction;

- Advancing with the pivotal clinical trials in fiscal 2021, of its pilot studies with the RECELL System for treating vitiligo;

- Acquiring the marketing approval and reimbursement for the RECELL System in Japan in partnership with an M3 Group company, COSMOTEC.

Financial Update

For the quarter ended 30 September 2019, the company reported the following financial performance-

- Total cash receipts of value A$5,237k, representing a growth of 4% (increase of A$197k) when compared to the previous quarter ended 30 June 2019.

- Cash receipts from customers amounted to A$4,079k, up 16% (increase of A$565k) relative to previous quarter, attributable to growing sales in the US.

- Total Cash collected from BARDA amounted to A$1,158k, declined by 24% (decrease of A$368) in comparison to the prior quarter.

- Collective payments valued A$27.9 million have been received under the BARDA contract, through 30 September 2019.

- Total net cash utilized in operating activities was A$7,037k, decrease by 33% decrease (or by A$3,393k) compared to the previous quarter.

- As at 30 September 2019, cash and cash equivalents held by AVITA Medical amounted to A$22,656k.

Stock Information

As on 8 November 2019, AVH shares traded at $0.69, up by 5.34% post the index rebalancing announcement. The market capitalization of the company stood at $1.23 billion with 1.87 billion outstanding shares. The 52 weeks high of the stock was noted at $0.74, with an average annual volume of 8,813,443. The company generated a whopping Year-to-date investment return of 729.11%.

PolyNovo Limited (ASX: PNV)

Melbourne based biopharmaceutical company, PolyNovo Limited (ASX: PNV), has been recently added to the S&P/ASX 200 Index as a result of periodic index rebalancing. PolyNovo develops novel, biodegradable, proprietary polymer platform to be applied in the manufacturing of medical devices.

PolyNovoâs Unique Platform Technology -NovoSorb® polymer

- The base polymer was developed by an Australian Government research organisation, the CSIRO and rolled out as PolyNovo.

- Its unique polymer technology, Carbamate, can be programmed for re-absorbsion rate and product traits.

- NovoSorb® polymer has outstanding biocompatibility, safety and toxicity profile. The polymer is biodegradable as it degrades via hydrolysis and is excreted from the body through urine, respiration and macrophage activity.

- PolyNovo continues to develop the polymer further with foaming process and novel formulations.

Appointment of Non-Executive Director

In its latest announcement, PolyNovo notified that Dr Robyn Elliott has been appointed as Non-Executive Director to the board of directors.

Dr Elliot is a skilled pharmaceutical specialist with a rich experience of more than 30 years across different organisations globally. Presently, she is serving as Senior Director for Strategic Expansion Projects at biopharmaceutical giant CSL Behring and has a proven expertise in clinical trials, product development, audits, regulatory affairs, quality management as well as operational strategy.

Stock Information

As on 8 November 2019, PNV shares traded at $2.18, down 5.21%. The market capitalization of the company stood at $1.52 billion with 661.09 million outstanding shares. The 52 weeks high of the stock was noted at $2.66, with an average annual volume of 3,696,293. The company generated a significant Year-to-date investment return of 283.33%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.