For any economy, the financial sector is generally considered a lifeblood. Just like blood plays an essential role in the human body and is central to its survival; likewise, the financial sector is critical to an economy’s performance. Without growth in the financial sector, it is not possible for an economy to grow.

The financial sector generally comprises of companies, that are engaged in the business of banking, financial and other related services. Also, diversified financial services come under the purview of the sector. In this article, we will look at two diversified financial companies – MyState Limited and Australian Finance Group Ltd - and their latest financial performance:

MyState Limited (ASX:MYS)

MyState Limited is a diversified financial services company, which includes banking and financial services. The company is also in the business of fund management.

MyState reports a decent growth in NPAT in 1H FY20

The company recently notified the market with the operational and financial performance for the half-year ended 31 December 2019 and outlined the following:

- MYS reported robust results along with decent improvements throughout the business. The company has developed a highly competitive position with its strategy of digitisation. Also, the company is delivering superior service, which is supporting robust customer growth.

- The company reported net profit after tax amounting to $15.1 million, reflecting a growth of 5.4% as compared to the previous year. It posted earnings per share of 16.6 cents for 1H FY20 with an increase of 4.4%.

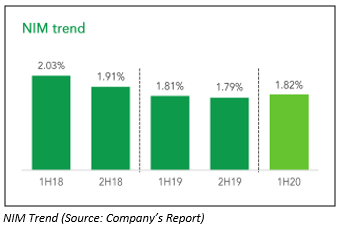

- MyState experienced a rise of 9.1% in net interest income, which stood at $48.2 million. The growth was driven from balance sheet growth, disciplined deposits and lending margin management, as well as reduced wholesale funding costs over 1H FY20.

- The company managed to drive the transformation via the implementation of digital systems as well as structuring its business in order to serve customers more effectively.

- The period witnessed the company continuing growth to broaden its digital, internet and mobile banking services, and online customer growth, which further surged by 62%

- The Board of the company declared a fully franked interim dividend amounting to 14.25 cents per share. The company will be paying the said dividend on 15 April 2020 with the record date of 02 March 2020.

On the operational front, rebranding MyState’s wealth management operations as TPT Wealth has proved to be a significant step, which is underpinning its plans for national growth. This was enabled by the launch of its new investor portal, which allows investors to manage their investments online. TPT Wealth revenue from continuing operations witnessed a rise of 5.1% and reached $8.2 million. As of 31 December 2019, the funds under management stood at $1.19 billion on 30 June 2019, up 1.3% and the highest in a decade.

As per the key personnel of the company, MYS continues to build its strategic position with the help of excellent asset quality, modern digital platforms as well as broader management capabilities, while the company is operating in a challenging and competitive market. The company continue to re-engineer the business, building a scalable business with digital competencies throughout the organisation.

Also Read: Change in top Management of MyState

Stock Performance

The stock of MYS was trading at $5.810 per share on 24 February 2020 (at 02:36 PM AEDT), indicating a decline of 0.171% against its previous closing price. The company has a market capitalisation of $534.22 million, and the total outstanding shares stood at 91.48 million. The 52-week low and high is $4.020 and $6.000, respectively. The company has generated positive returns of 21.92% and 26.96% in the last three months and last six months, respectively.

Australian Finance Group Ltd (ASX:AFG)

Australian Finance Group Ltd is primarily engaged in the mortgage origination and management of home loans and commercial loans.

AFG reports impressive 1H FY20 results led by a 20% growth in NPAT

Australian Finance Group recently announced its results for the first half of the financial year 2020. The company reported excellent performance during the period, which was supported by growth in AFG Securities as well as rising trail books throughout the diversified earnings streams. Below are the key highlights:

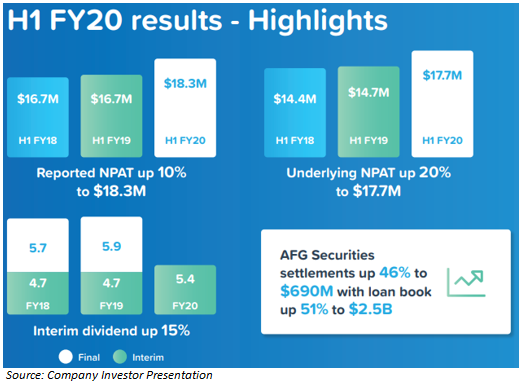

- For 1H FY20, the company reported underlying net profit after tax amounting to $17.7 million with a growth of 20% as compared to the previous corresponding period.

- The company reported residential settlements of $16.9 billion and combined residential and commercial loan book amounting to $160 billion.

- AFG continues to generate strong cash flows, buoyed by an improving lending environment. AFG remains positioned for continuing organic earnings growth.

- For the half-year, the company declared a fully franked interim dividend amounting to 5.4 cents per share, reflecting a rise of 15%.

- Mainly during the span of the last three months, the company has experienced an acceleration in market activities. It added that the competitive market is generating growth in market share for non-major lenders.

- According to the top management, the half-year results are proof of growing strength, resilience as well as diversified nature of its business. AFG Home Loans, AFG Commercial, and AFG Business have been helping report growth and build on the momentum, which was generated by the implementation of its diversification strategy.

- AFG remains a capital-light business at the end of the period, which helped the company to drive sturdy cash flows. The company possesses a debt-free balance sheet, which provides flexibility to consider future investment opportunities as and when they arise.

- The net cash flow from operating activities stood at $16.9 million, with a rise of 35%. This has been driven by historical trail book growth flowing through as increased cash flow.

- The company continues to generate strong cash flows as well as to maintain a capital-light business model, which is allowing current investments to create future growth.

- The investment of the company in Thinktank has continued substantial contribution to earnings in the first half of the financial year 2020. Strong relationships with an array of aggregators has aided the growth of the company.

On the outlook front, the company is well placed for future growth opportunities with the help of an established distribution network and strong cash flow generation. The company is continuing to make investments in technology in order to grow scale efficiently.

Stock Performance

The stock of AFG was trading at $3.010 per share on 24 February 2020 (at 02:36 PM AEDT), indicating a decline of 0.987% against its previous closing price. The company has a market capitalisation of $655.33 million, and the total outstanding shares stood at 215.57 million. The 52-week low and high is $0.950 and $3.185, respectively. The company has generated positive returns of 16.03% and 33.92% in the last three months and last six months, respectively.