Financial Stocks

Financial stocks include companies engaged in a range of services, including of investment banking & brokerage, retail banking, corporate banking, mortgage financing, consumer financing, specialised financing, asset/investment management, real estate investment trusts, custodian services, insurance & financial advisory.

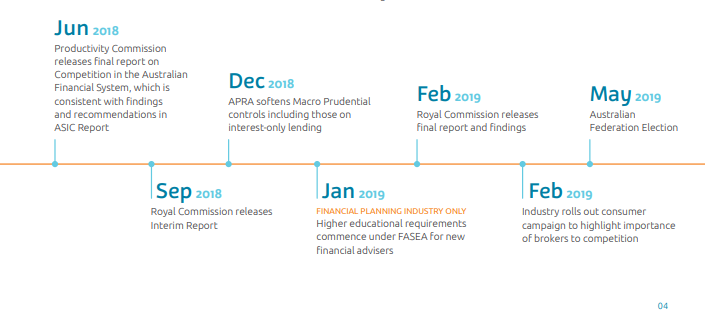

Industry Developments (Source: Mortgage Choice 2019 Annual Report)

In Australia, the financial services industry has gone through significant structural changes that have forced many firms to go out of business or sell their segmental businesses, particularly, the financial advisory/planning business. Meanwhile, this has been a growth opportunity for many companies, as they look to acquire these businesses and improve the revenue streams.

The above time in the image presents very useful information to these structural changes as initiated by the reports of Productivity Commission, ASIC and Royal Commission. Currently, the companies are adhering to these structural changes, which is in the best interest of the customers.

Investing in Financials sector:

As an economically sensitive sector, there are a lot of considerations to be taken before any investment decision in financial companies are made. While the sector is dominated by banks, we would discuss them, considering that we are talking predominantly about asset management companies in this article, which provide other services, and not just saving deposits and lending.

Investment Management companies predominantly perform better when markets are resilient, as the revenue sources of these companies are the fees derived from managing the funds. Generally, Investment Management companies charge a management fee and a performance fee. It is unlikely that material fluctuations in management fee would occur unless there is a substantial fall in the funds under management. Conversely, the performance fees are tied to the performance of the funds, which is unlikely to be high when the market is depicting subdued sentiments.

A diversified revenue stream is always a cover to potential shocks, and companies with such competitive advantage could deliver resilient earnings growth over the period. An example of such a company is Fiducian Group Limited (ASX: FID), which is engaged in providing a range of services. Meanwhile, Evans Dixon Limited (ASX: ED1) is on the way to be recognised as a full-service investment powerhouse, which has a presence in M&As as well after an acquisition.

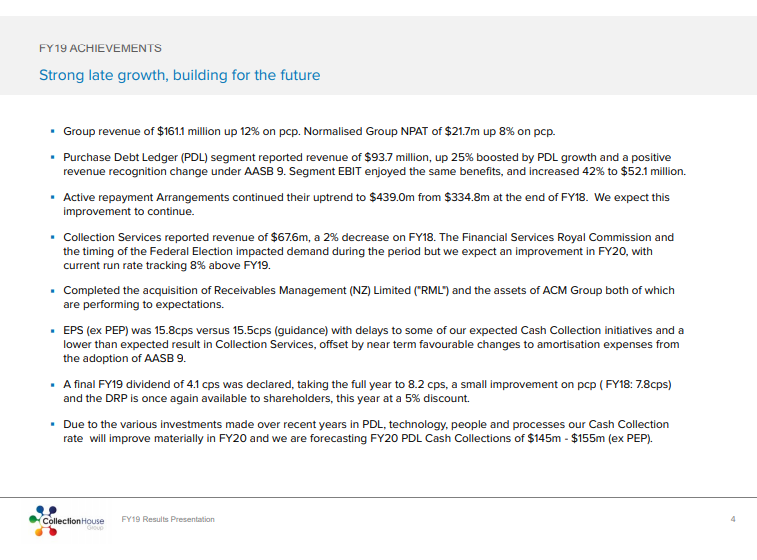

Fiducian Group Five Year Metrics (Source: FIDâs Annual Report)

There are other important considerations as well, such as the fundamentals of the business, profitability ratios & margins, revenue growth, return on capital employed, return on equity, cashflow strengths, factors impacting cashflows, price-to-book ratio, price-to-earnings ratio, macro-economic fundamentals, competitive advantages, customer engagement.

On the back of the above background, letâs discuss five such financials sector companies on ASX. Mainly, these companies are investment management companies, and a few are providing other services as well.

Collection House Limited (ASX: CLH)

Listed in 2000, Collection House is a receivables management company, and it operates under numerous brands providing a range of services, including debt collection and receivables management, debt purchasing and recovery, legal services and insolvency administration, and finance broking for credit.

In its full-year results for the year ended 30 June 2019, the company recorded decent growth of 12% over FY2018 in revenue, which reached $161.1 million from $143.9 million. The net profit after tax for the period was $30.7 million, up 18% on profit of $26.1 million in FY2018.

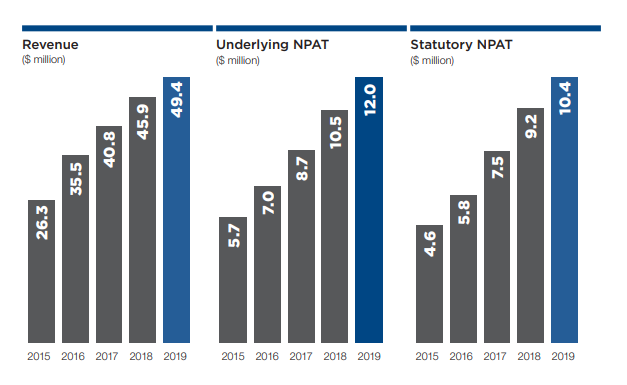

FY2019 Achievements (Source: CLHâs FY19 Results Presentation)

Reportedly, Collection House has announced 100 percent franked dividend of 4.1 cps, to be paid by 25 October 2019 to the shareholders, on record on 3 October this year.

Despite challenging situations, due to changing regulatory environment and, federal election, the company is well positioned to deliver on FY20 commitments backed by the resilient performance of Purchased Debt Ledger (PDL) segment.

Meanwhile, Collection Services segment had faced hardships attributing to the timing of federal election, and Financial Services Royal Commission. In the initial two months of FY20, the collection services segment has returned to FY18 levels of revenue & profitability.

More importantly, the company has provided guidance, in the range of $145 million to $155 million for PDL cash collections, which represent an increase of 16% on FY2019.

On 30 August 2019, CLHâs stock last traded at A$1.215, up by 10.455% relative to the previous close.

Fiducian Group Limited (ASX: FID)

Premium Wealth Services Provider, Fiducian Group offer services like financial planning, investment funds management, superannuation, information technology solutions and so forth.

In its full-year results for the period ended June 2019, declared on 15 August this year, the company witnessed revenue of $48.92 million, up 7.68% from $45.43 million in FY2018. Net profit for the year was up 13% to $10.35 million in FY2019, up by 12.52% from $9.19 million in FY2018.

Meanwhile, Fiducian Group declared a fully franked dividend of 11.3 cents per share payable on 11 September 2019 to the shareholders, in record on 28 August 2019.

At the year-end, the company had combined Funds under Management, Administration and Advice (FUMAA) of $7.4 billion, up 10% over FY2018 of $6.7 billion.

FY2019 Highlights (Source: FIDâs Investor Presentation - FY 19 Results)

Reportedly, the company has been placing focus on compliance in its financial planning network following the Royal Commission, which has substantially raised the expectations on compliance of regulatory requirements. Besides, the recommendation of the Royal Commission to remove grandfathered commissions by 1 January 2021 attributes to ~4% of the net revenue of the company.

In June this year, the company had announced to acquire MyState Limited (ASX: MYS) retail financial planning business for a consideration of $3.5 million. The client book included funds under advice of more than $340 million.

On 30 August 2019, FIDâs stock last traded at A$5.15, down by 1.341% from the previous close.

Evans Dixon Limited (ASX: ED1)

Evans Dixon is engaged in investment & financial advisory, stockbroking, property design and construction management, self-managed superannuation fund administration, the management of investment companies and managed investment schemes.

In its full-year results for the year closed 30 June 2019, released on 26 August this year, the company had posted total revenue of $239.04 million for the period compared to revenue of $306.3 million in FY2018. Statutory NPAT was down 13% to $16.8 million against $19.27 million in FY2019.

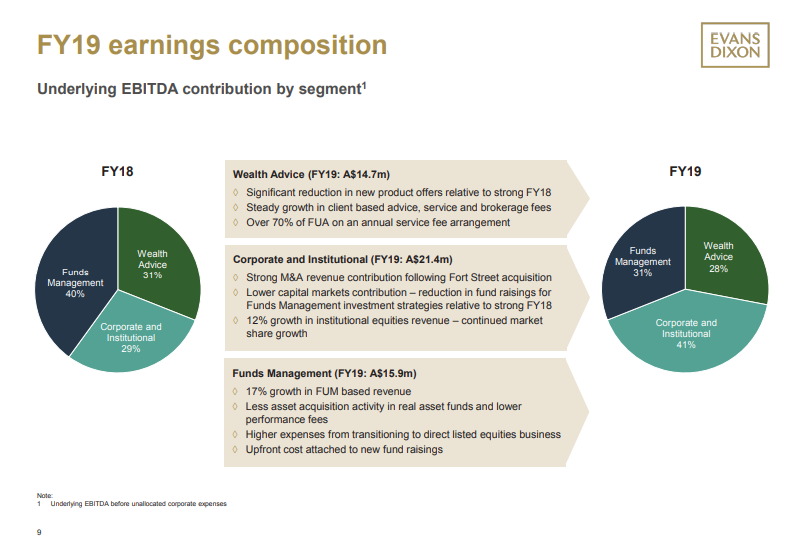

Earnings Composition (Source: ED1âs FY19 Results Presentation)

Reportedly, the companyâs Wealth Advice and Funds Management segments recorded lower transactional revenue attributing to reduced new product issuance, and lower acquisition activity in the real asset funds. Meanwhile, the Corporate & Institutional segment performed better backed by the acquisition of Fort Street Advisers, and capital revenue was down as well.

Outlook

As per the release, the company had focused on the initiatives to deliver cost efficiencies in the first months of FY20. Besides, FY20 has started on a positive note backed by good momentum across the business.

Considering the cost optimisation initiatives, the company expects the performance would improve relative to the second half of FY2019. It is expected that FY20 results would be broadly in line with FY19 results.

On 30 August 2019, ED1âs stock last traded at A$0.725, up by 3.571% from the previous close.

Pengana Capital Group Limited (ASX: PCG)

Founded in 2003, Pengana Capital is a diversified investment manager. It serves to high net worth individuals & retail clients in Australia & New Zealand. Pengana offers a range of strategy-based funds, including Australian equities, international equities, listed investment companies, listed investment trusts, and sustainable (ethical) funds.

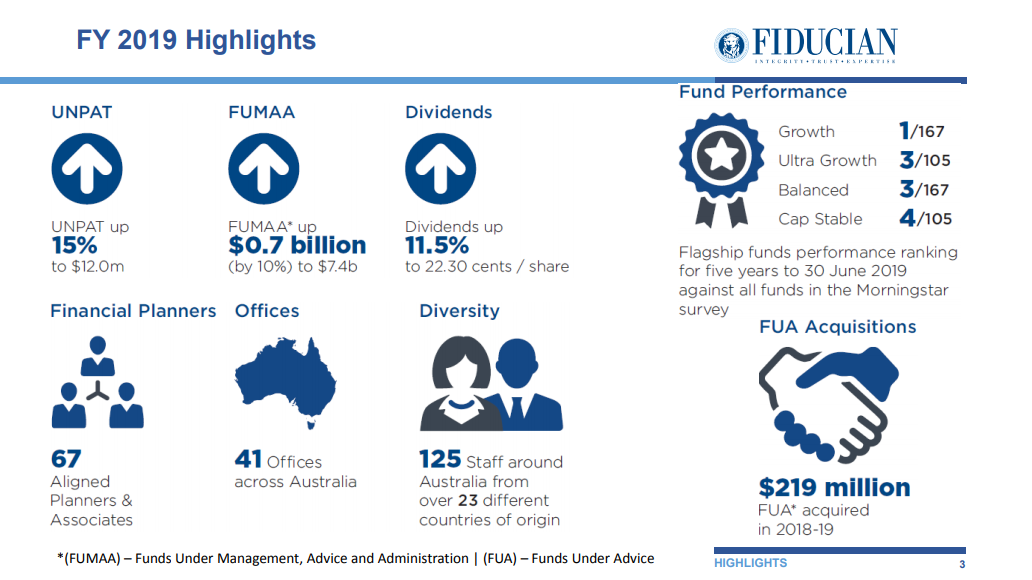

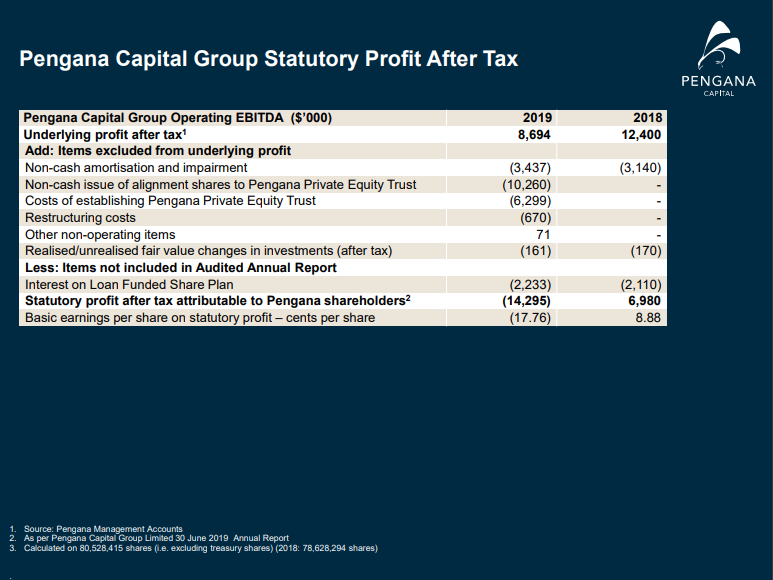

Profit (Source: PCGâs Shareholder Presentation)

Recently, on 26 August this year, the company reported full-year results for the period ended 30 June 2019. Accordingly, the total revenue was down 18% to $44.3 million from $54.2 million in FY2018, which is justified by the substantial fall in performance fee revenue, among other factors.

Meanwhile, the net loss after tax was $14.28 million in FY2019 compared to a profit of $7.09 million in the previous year. The cost associated with the launch of Pengana Private Equity Trust (ASX: PE1) was a major contributor to the loss.

Reportedly, the company is well placed to capture future growth with the launch of its private equity trust, additional development of international equity strategy, and restructuring for cost optimisation.

Besides, the Royal Commission had significantly impacted the company, while the effect was not direct, the pressure on the financial advice industry was a catalyst, as the financial advice industry is one of the main sources of fund inflows to the funds of the company.

On 30 August 2019, PCGâs stock last traded at $1.49, up by 1.706% from the previous close.

Mortgage Choice Limited (ASX: MOC)

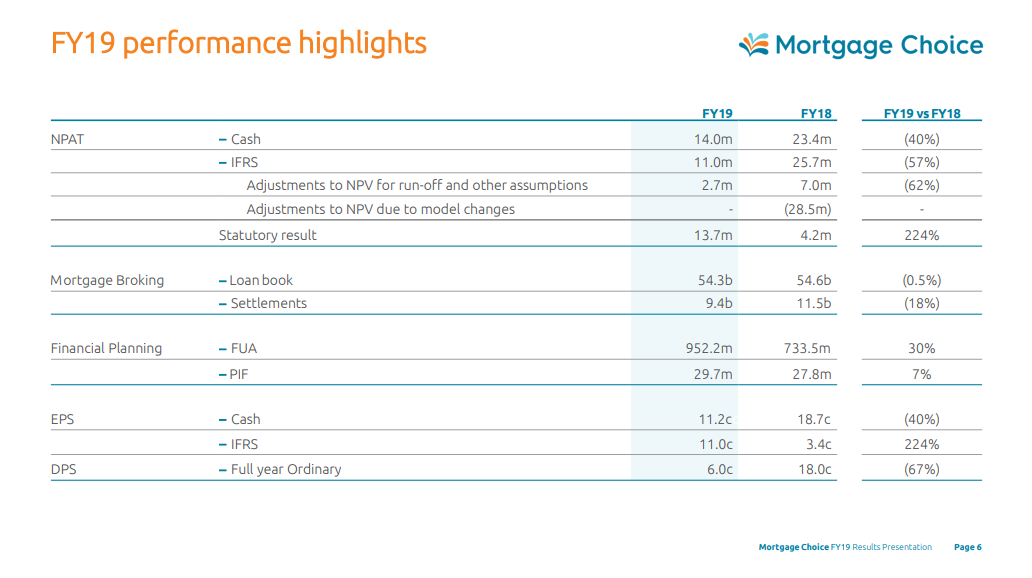

Recently, on 22 August 2019, Mortgage Choice had announced annual results to 30 June this year. Revenues were down 18% to $177.3 million for the period. Meanwhile, the net profit for the period attributable to members was up 223.9% to $13.72 million from $4.23 million in FY2018.

Reportedly, $9.4 billion worth of home loans were settled during the period compared to $11.5 billion in the previous year. The loan book of the company was $54.3 billion at the year end, slightly down by 0.5% from $54.6 billion in the previous year.

FY2019 Highlights (Source: MOCâs FY19 Investor Presentation)

Meanwhile, the company would implement its strategic change program as market conditions improve to capitalise on the opportunities that deliver efficiency in the business. Priority would be given to improve the customer footprint as well as franchise along with investments in information technologies.

On 30 August 2019, MOCâs stock last traded at A$1.17, up by 0.862% from the previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.