In this article, we would discuss three stocks from the financial services industry in Australia. Two out of three companies under discussion have reported full-year results for the period ended 30 June 2019. Meanwhile, the results of the third company are expected shortly.

Letâs now go through the updates and results of the three stocks.

Mortgage Choice Limited (ASX: MOC)

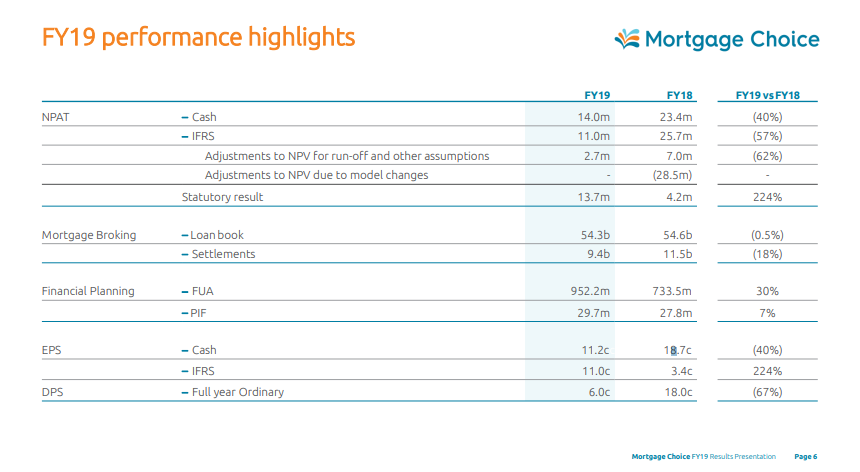

On 22 August 2019, the company reported results for the full year ended 30 June 2019. Accordingly, the company settled $9.4 billion in home loans for the year, down by 18% from $11.5 billion in FY2018. The companyâs loan book was slightly down by 0.5% to $54.3 billion as at 30 June 2019 compared with $45.6 billion in the previous year.

Reportedly, the company recorded IFRS based NPAT of $13.7 million in FY2019 compared with $4.2 million in FY2018, and the previous year had one-off non-cash adjustment related to the new mortgage broking remuneration model introduced on 1 August 2019.

Besides, the companyâs financial planning unit delivered funds under advice result of $952.2 million âup 30%, and Premiums In Force of $29.7 million were up 7% from the prior year. The net revenue of $1.9 million was impacted by the new remuneration model introduced on 1 October 2018.

FY19 Performance Highlights (Source: MOCâs FY19 Investor Presentation)

FY19 Performance Highlights (Source: MOCâs FY19 Investor Presentation)

Operating Review

Regulation: Reportedly, the year has witnessed a highest form of public enquires into the financial services industry, and a range of issues were identified across the spectrum of the industry. However, there was no evidence of systematic misconduct in the mortgage broking industry.

Besides, the company is committed to implementing the recommendation made by the Combined Industry Forum (CIF), in response to ASICâs 2017 Review of Mortgage Broker Remuneration.

New Remuneration Models: As per the release, the company undertook a country wide program in FY2019 to accommodate the implementation of a new broker remuneration model. Under the revised model, the franchisees are expected to attract new, motivated individuals with a business-owner mindset to the company over the future.

Meanwhile, the new model was implemented to Mortgage Choice Financial Planning (MCFP) network, which encourages MCFP franchisee owners to grow businesses with investment and competitive business models.

Innovative Technology: Reportedly, the company delivered high-class technology that enables brokers to operate more efficiently, while achieving better business performance outcomes. Within the platform, the product catalogue allows the brokers to show home loan products from thousands of options.

Besides, the Home Loan Doctor allows brokers to compare home loan products for customers with data analytics and payment schedule for making informed purchasing decisions.

Market Insights: Reportedly, the affordability and increasing lending complexity continue to challenge investors and home buyers. However, the mortgage brokers achieved the highest ever residential home loan market share at 59.7%.

Besides, the housing market in the country has continued its correction, and the company brokers faced challenging conditions. The national dwelling values had depicted an annual decline of 6.9% in the twelve months period until June 2019.

Meanwhile, the decline in the property market is attributed to the tightening credit policy by lenders, whose forensic scrutiny of the home loan applications had delayed the loan approvals, and reduced borrowing power of many applicants.

Further, following the federal elections, the decline in property prices has lost its momentum, rate cuts have been passed by the lenders, which has reduced the cost of borrowing. Nevertheless, the scrutiny of home loan applications continues, and broker remains the preferred source to secure financing for the home loans.

Dividend: Reportedly, the company has decided to retain cash in the business, considering the subdued property conditions and ongoing investment. Meanwhile, the company has declared a fully franked dividend of AU 3 cents per share, with a record date on 3 September 2019, and the dividend is payable by 15 October 2019.

Outlook: Reportedly, the company anticipates better market conditions in the year ahead, and it would look for efficiencies across the business. Besides, the implementation of strategic change program to build a platform for sustainable growth. Meanwhile, the key focus areas would be to grow the franchise, customer base with investments in IT infrastructure and service proposition.

On 23 August 2019, MOCâs stock was trading at A$1.105, down by 2.643% (at AEST 12:53 PM). Over the last one year, the stock gave negative return of 35.51%. However, the stock has proved positive return of 31.98% in the last six-months period.

FSA Group Limited (ASX:FSA)

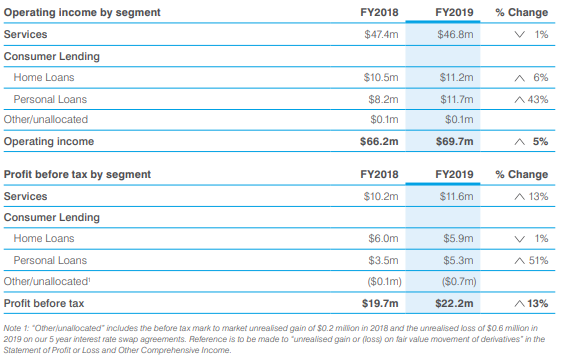

On 22 August 2019, the company reported full-year results for the period ended 30 June 2019. Accordingly, the operating income of the company was up by 5% to $69.7 million in FY2019 compared to $66.2 million in FY2018. The company recorded profit after tax of $14.4 million in FY2019, up by 14% over the FY2018 of $12.6 million.

Reportedly, the companyâs basic EPS increased by 14% to 10.08 cents in FY2019 compared with 11.52 cents in FY2018. The company has entered into the fifth year of its five-year strategic plan, and the FY2019 has been a challenging year.

Meanwhile, the company has declared a fully franked dividend of AU 3 cents per share, which is payable on 13 September 2019, and the record date for the dividend is 29 August 2019.

Segment Results (Source: FSAâS Appendix 4E and Annual Report)

Services: As per the release, the companyâs division provides a range of services, including payment arrangement with creditors, informal arrangements, debt agreements, personal insolvency agreements and bankruptcy. The company is the largest provider of these services in the country.

Besides, the Royal Commission had influenced the financial services industry in adopting a softer approach to debt collection. Australian Financial Security Authority had reported that bankruptcies for the 2019 financial year were at their lowest level in 24 years, which depict the Royal Commissionâs recommendations. As a result, the demand for the companyâs services had taken a toll in the second half of the year.

Meanwhile, the company has been focusing on the amendments to the Bankruptcy Act 1966, which came to effect on 27 June 2019. Ultimately, this had impacted the growth in the Consumer Lending segment.

More importantly, new client numbers for informal arrangements and debt agreements decreased by 21%, and personal insolvency agreements and bankruptcy increased to 1,290, up 3%.

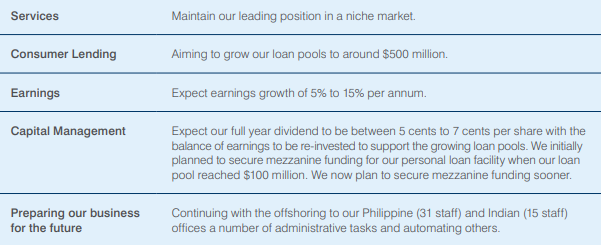

Consumer Lending: Reportedly, this segment of the company offers home loans and personal loans. The companyâs home loan & personal loan pools grew from $408 million in FY2018 to $441 million in FY2019, and the companyâs target remains $500 million, under the five-year strategic plan.

Besides, Westpac Banking Corporation (ASX: WBC) renewed the companyâs $375 million non-recourse senior home loan facility. In personal loan, Westpac approved a limited recourse senior personal loan facility of $75 million to enable future growth prospects.

FY2020 Strategy (Source: FSAâS Appendix 4E and Annual Report)

On 23 August 2019, FSAâs stock was trading at A$1.1, up by 3.774% (at AEST 1:07 PM). Over the last one year, the stock has given a negative return of 27.89%. Besides, the stock has provided the negative return of 2.75% in the last three-months period as well.

Pengana Capital Group (ASX: PCG)

An Investment Manager, Pengana Capital Group, manages over a dozen funds, and two of its funds are listed on ASX as well. Also, the group had reported its previous full year results on 28 August 2018, and the results for FY2019 period are expected shortly.

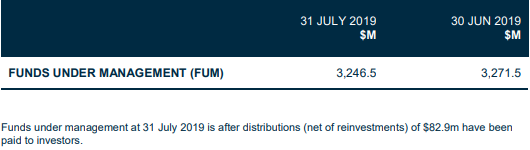

Recently, the group notified about the funds under management (FUM) for the month of July 2019, which stood at $3.24 billion (as on 31 July 2019) compared with $3.27 billion (as on 30 June 2019).

Funds Under Management (Source: PCGâs Monthly Funds Under Management - 31 July 2019)

In February this year, the group reported the half-year results for the period ended 31 December 2018. Accordingly, the FUM was down by 14% in the six months to 31 December 2018, from $3.51 billion to $3.01 billion at the half-year close.

Meanwhile, the groupâs FUM for the period ended 30 June 2019 was $3.27 billion, which is the FUM figure for FY2019 year-end close. Therefore, it represents a substantial increase from the half-year close figure of $3.01 billion.

Besides, during the half year results, it was noted that the investment performance eroded $299 million of FUM from the previous half-year, and $221 million was distributed while net inflows were recorded at $13 million.

Reportedly, the total revenue for the half-year, ended December 2018 stood at $23.04 million compared with $29.20 million at the half-year December 2017. The profit after income tax was $939k in H12018 compared with $5.05 million in H12017.

PCGâs stock last traded at A$1.355 on 21 August 2019. Over the last one year, the stock has generated negative return of 59.67%. Also, the stock has given a negative return of 32.08% in the last three-months period.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.