Class Limited (ASX:CL1), established in 2005, designs, develops and sells industry strength cloud-based software solutions for the Australian self-managed superannuation industry. The company offers two products:

- Class Super is a cloud-based administration software for SMSFs. It is primarily used by advisors, accountants, and administrators.

- Class Portfolio is a powerful portfolio administration and reporting cloud software solution for companies, trusts and individuals.

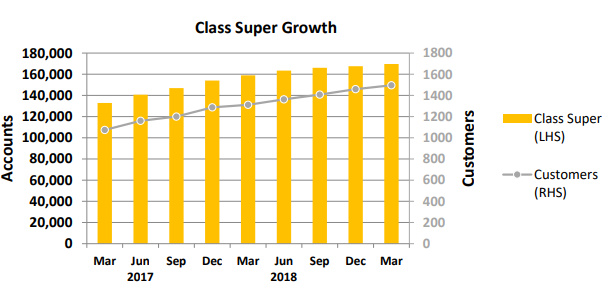

The company recently disclosed the quarterly results for the three months to 31st March 2019. As per the information provided, Class recorded 2,409 new accounts taking the total accounts to 176,621 and the total class customers were also up by 36 to 1,506.

As for the product wise performance, Class Super added 2,029 new accounts (net of ~ 700 AMP suspensions) to the total number of 169,660. The growth levels continued to reflect the prevailing regulatory and political uncertainty. However, the March quarter started to witness some recovery signs amongst both customers and prospects.

Source: Companyâs Quarterly Update

Although it was one of the slowest three months for the company in terms of account growth, the March quarter produced a net fund growth larger than the December 2018 quarter.

A couple of significant new product features were also introduced during the concerned period. These new features resonated extremely well with customers, helped drive prospect engagement and are listed below:

- Tax statement automation - a solution for processing tax statements to save significant time for accountants and administrators.

- Adviser Dashboard â an easy to use dashboard which provides the advisers with a complete visibility of all the portfolios they are managing, thereby helping them to guide their clientsâ investment strategies and performance.

- Managed accounts support â a new integration between Class and Macquarie which allows the managed account data to be directly entered into Class, thus significantly saving time.

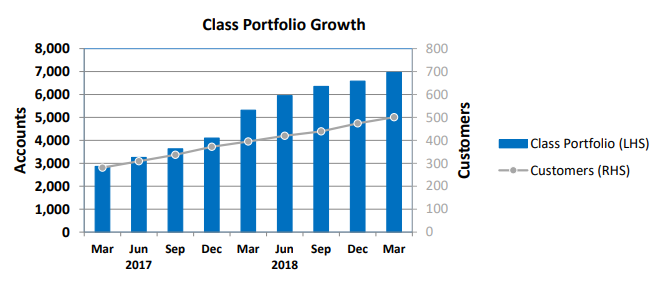

Talking of the second product, Class Portfolioâs accounts grew to 6,961 and around 33% of Class Super customers are now using Class Portfolio. Besides, Classâ integration with financial planning tools has boosted customer engagement.

Source: Companyâs Quarterly Update

Source: Companyâs Quarterly Update

The company has also informed in the report that the pilot Class to XPLAN feed, now used by more than 50 advisers, would move to general availability in the next quarter. Class Portfolio Engine is gradually gaining recognition in the growing fintech space. In addition, the company recently signed OpenInvest and InvestSMART as Portfolio Engine partners adding to the established relationship with Stockspot.

In 2019, the company also received two awards in the Fintech Business Awards. These include âSoftware Services Innovator of the Year (50 employees or more)â, and the âAccounting Innovator of the Yearâ.

The IT playerâs market capitalisation stands at around AUD 183.55 million with ~ 117.66 million outstanding shares.

Recently, Spheria Asset Management increased its shareholding in the company to 19.22% (from 17.46%) upon purchase of additional ordinary fully paid shares, which now total 22,611,526. In addition, companyâ Director Nicolette Liesbeth Rubinsztein acquired 107,864 fully paid ordinary shares (Indirect Interest) of the company at a value consideration of $ 174,698.69. In addition, Andrew Russell recently joined the companyâs Board.

On 24th May 2019, the CL1 stock ended the market trading at the last close price of AUD 1.415, down 5.67%. Around 196,371 shares exchanged the hands of shareholders.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.