Investment in gold has been an age-old trusted strategy. The consensus believes that this precious metal brings balance to the world economy. Gold is considered to be either a currency proxy, an inflation hedge or a safe-haven asset for investors and buyers alike. Largely denominated in dollars, gold likes a low rate/ declining rate environment, and thrives under uncertainty.

Gold in 2019 and the 2020 Outlook

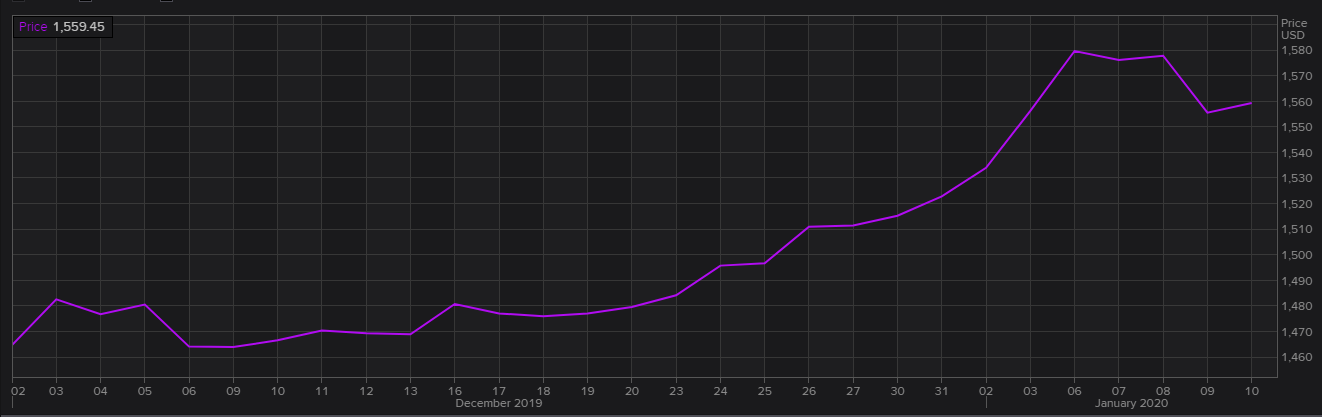

In 2019, gold offered an 18% increase in returns on investment and the demand increased by 2.4% (September quarter). This was propelled largely by the inflows into gold-backed ETFs and the purchase by the central banks. Gold ended the December holiday season healthily, with gold reaching US $1500 an ounce on Christmas.

Moreover, gold set another record in 2019, as the surge in the prices catalysed customers to sell it back to recyclers, building a record level of gold recycling.

In 2020, gold bulls have been optimistic and believe that it likely to outshine other commodities. The 2020 estimates are US$1,474 an ounce in 2020, according to the Resources and Energy Quarterly December 2019. On the production side, Global mine production is likely to surge to 3,568 tonnes in 2020.

Gold Price Trend since December 2019 (Source: Reuters)

Factors Driving Gold Prices

Currently, there is a lot of macro-economic activities affecting commodity prices across the globe. Few of these lifting the gold prices are listed below:

- The recent Iranian retaliation on the US airbases in Iraq

- The inflows into gold-backed ETFs and the purchase by the central banks

- The prolonged US-China trade dispute led to shunning of interest rates thrice by the US federal reserves, motivating investors towards gold

- The slowing global economic growth has shifted the institutional investors towards gold

- In the near-term as well, gold would benefit from the higher demand as a hedge to other commodities

To know more about gold’s momentum in the market- READ HERE.

In this backdrop, let us acquaint ourselves with significant and recent updates from two Gold miners/ producers, listed on the Australian Securities Exchange (ASX)- Resolute Mining Limited (ASX: RSG) and St Barbara Limited (ASX: SBM).

Resolute Mining’s FY19 Production and FY20 Guidance

An efficient, dividend-paying gold miner with over three decades worth of experience as an explorer, producer and operator of gold mines in Africa and Australia, RSG recently notified about its gold production and preliminary cost results for FY19 (the 12 months to 31 December 2019) and a revised production and cost guidance for FY20 (the 12 months to 31 December 2020). Let’s take a look at both-

RSG’s FY19 Production

- Gold production for FY19 totalled 384,731 ounces (oz) relative to the guidance of 400,000oz

- The Company sold 394,920oz of gold in FY19 (average price received was US$1,344/oz

- All-In Sustaining Cost (AISC) was US$1,090/oz relative to the guidance of US$1,020/oz

- RSG’s Syama Gold Mine in Mali produced 243,058oz of gold at an AISC of US$1,125/oz

- The Mako Gold Mine in Senegal produced 87,187oz of gold

- The Ravenswood Gold Mine in Queensland contributed 54,486oz of gold at an AISC of US$1,356/oz

- In the December 2019 quarter, the Company produced 105,293oz of gold at an AISC of US$1,419/oz (more details in the December 2019 Quarterly Activities Report due on 17 January 2020)

On the financial end, RSG’s cash, bullion and listed investments totalled US$127 million and the net debt position was US$267 million (as at 31 December 2019)

RSG’s FY20 Guidance

- Gold production is forecasted at 500,000oz at an AISC of US$980/oz

- Syama is expected to produce 260,000oz at an AISC of US$960/oz

- The target of Syama annual production rates is 300,000oz at an AISC of US$750/oz (via expansion of mining rates at the Syama Underground Mine and the addition of a future high-grade underground mine at Tabakoroni)

- Nonsustaining capital for Syama in FY20 is forecast to be US$15 million

- Gold production from Mako is expected to be 160,000oz at an AISC of US$800/oz

- Production target at the Ravenswood Expansion Project is 80,000oz of gold at an AISC of US$1,200/oz

On the financial end, RSG remains on track to refinance debt facilities provided by Taurus Funds Management Pty Ltd, achieved through the expansion of the Company’s existing low cost flexible revolving Syndicated Loan Facility. Moreover, RSG’s total debt is likely to reduce, driven by the refinance, reduced capital demands and cashflow generated from operations in FY20.

St Barbara Completes Expenditure Obligation for Lake Wells Gold Project Earn-in and JV Agreement

Renowned for the Leonora Operations (WA), the Simberi mine (PNG) and the Atlantic Gold operation (Canada), SBM is into gold exploration and production since 1969. It had entered into an Earn-In and JV Agreement over the Lake Wells Gold Project (Project) with Australian Potash Limited (ASX: APC) in October 2018.

As per the Agreement, SBM has the right to earn up to a 70% participating interest in the Project tenements via the expenditure of $1,750,000 in the First Earn-in Period, and $3,500,000 in the Second Earn-in Period.

Recently, the Company completed expenditure obligation of $1.75 million under the First Earn-in Period pursuant to the Project Earn-in and JV Agreement.

- The Company has agreed to reimburse $318,000 for previously incurred gold exploration expenditure to APC, which holds a 100% interest in the Lake Wells Sulphate of Potash Project

- SBM and APC agree to a Gold Drilling Amount of $318,000 (reimbursable gold drilling expenditure incurred by and payable to APC)

- The Company will proceed to the Second Earn-in Period, requiring the expenditure of an additional $3,500,000 to earn a 70% interest

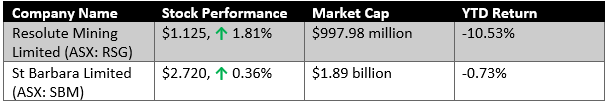

Stock Performance

Let us graze over the stock performances of the discussed stocks on the ASX after the close of market on 13 January 2020:

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.