In this article, we are discussing three financial stocks listed on the ASX. These three stocks include a bank business, an insurance business and a diversified financial business. All of these companies have recently released significant announcements to the exchange.

On 27 December 2019 (AEDT 12:35 PM), the S&P/ASX 200 Financials (Sector) index was trading at 6,050.2 points, up by 0.31% or 18.8 points from the previous close.

Bank of Queensland Limited (ASX: BOQ)

Share Purchase Plan Update

Bank of Queensland has provided an update in relation to the Share Purchase Plan, which was well supported by shareholders and closed on 20 December 2019. For the plan, the bank received applications for approximately ninety million dollars, which are subject to a final reconciliation and payment clearance. The plan was announced along with a fully underwritten institutional placement of $250 million.

The issue price of new shares under the plan would be $7.27 per share, reflecting a two percent discount to Volume Weighted Average Price (VWAP) of BOQ shares between 16 December 2019 and 20 December 2019. It is expected that the shares would be issued on 2 January 2020 with trading commencing on 3 January 2020.

2019 Annual General Meeting Address

Recently, the bank convened its 2019 Annual General Meeting. In its Chairman Address, Mr Patrick Allaway stated that BOQ is now operating in a low growth part of the cycle with growing disruption and competition in the industry, as well as declining margins, elevated community expectations, and increased regulatory and compliance costs.

Accordingly, the bank’s previous year performance was subdued. As a result of the disappointing performance, short term incentive compensation was not paid to KMP and to the senior leadership team in 2019.

The bank is emphasising on delivering shareholder value through performance improvement and adoption of a sustainable business model for a low growth environment. Moreover, the bank has taken following steps;

· The appointment of new CEO, COO and CFO.

· A productivity review to optimise cost to income ratio that would deliver a simplified business model.

· A strategic review to emphasise on target customers across retail and business segments.

· Investment to improve customer experience.

· Improvement in technological infrastructure to close the digital and data gap.

· Continue to strengthen the bank through capital raising, strong governance, risk management and compliance.

Further, the bank is targeting a dividend pay-out ratio of 70% to 80% of cash earnings per share.

George Frazis, BOQ Managing Director & CEO, stated that he believes the bank is a fundamentally sound business, providing opportunities to grow amid a wider disruption in the industry. And, three months into the role of CEO, he is excited about the potential of the bank.

The bank would be releasing its strategy update in February 2020. Also, FY 20 would be a challenging year, and the bank expects lower y-o-y cash earnings, and revenue and impairment consistent with FY19, depending on market conditions.

On 27 December 2019 (AEDT 12:36 PM), BOQ was trading at $7.340, up by 0.273% from the previous close. In the last one year, the stock has delivered a return of -21.54%, while in the last three months, the stock has delivered a return of -25.38%.

nib Holdings Limited (ASX: NHF)

Board Updates

On 23 December 2019, the group announced changes to the senior executive team. Accordingly, it was notified that Mrs Michelle McPherson has reigned to take another role. Mrs McPherson was the Chief Financial Officer and Deputy Chief Executive Officer of the group and has been working with the group since 2003. She would continue her role for the coming months along with the presentation of the interim results in February 2020. The group has commenced the search process to fill the position.

The group has announced to appoint Mr Matt Paterson as Group Executive Business Services, and he would be responsible for operational contact centres and claims functions across the group. He is set to join the group in February 2020.

Increase in Premiums

In December, the group also reported that it would be increasing its health insurance premiums by an average of 2.90% starting from 1 April 2020. The move comes after the approval from Federal Minister for Health, and it’s the sixth year running that the group has increased premium which is lower than the preceding year.

It was reported that the group is aware of increasing concerns from consumers regarding the affordability of private health insurance, and as a result, the group has delivered the lowest change in premiums in the last 17 years.

Mark Fitzgibbon, nib Managing Director, also presented his concerns related to the rising costs and frequency of the medical treatment in the health care industry. This is placing additional pressure in the claims costs. In the previous financial year, the group paid a record $1.7 billion in claims with a record-pay-out of over 310k in the largest single claim.

Joint Venture with Cigna

Earlier in December, the group announced the incorporation of a specialist health care data science and services company to deliver better health outcomes for members and communities. The initiative is a joint venture with Cigna Corporation that would see the contribution of $10 million from both parties as a start-up funding.

Purpose of the joint venture (JV)

· Analyse and interpret underlying individual disease risk;

· Providing guidance to mitigate risks arising out of disease;

· Deliver health care programs, services and interventions according to the disease risk.

The JV would commence business within the group companies during the starting stage. And, the group intends to improve the outcome of members and communities in ANZ. Therefore, it is also anticipated that the services would be extended to other health care providers, health care insurers and payers.

On 27 December 2019 (AEDT 12:38 PM), NHF was trading at $6.600, up by 1.382% from the previous close. In the last one year, the stock has delivered a return of +32.32%, while the last three-month return of the stock is -13.43%.

LawFinance Limited (ASX: LAW)

Strategic Capital Raising

On 24 December 2019, the company announced a series of transactions, targeted towards reducing costs, enhancing balance sheet and funding the growth in National Health Finance (NHF), its US medical receivables business.

An equity placement valued at $ 5.0 million was completed with existing and new sophisticated investors, involving the issue of 78,125,000 new fully paid ordinary shares. Moreover, the company would offer shareholders the opportunity to participate in a further capital raising to be undertaken through a 1:1 Pro-Rata Non-Renounceable Entitlement Offer.

Third Quarter Highlights

In 3Q 2019, the company recorded USD 5.4 million in Net Operating Cashflow, taking the total to USD 14.9 million for the nine months ended 30 September 2019. Cash collections for the period were USD 9.4 million, originations for the period were USD 8.2 million with the net receivables of USD 126.1 million.

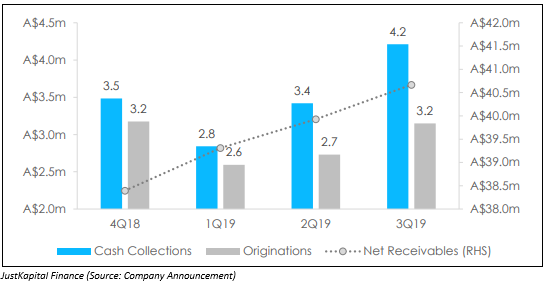

In Australia, the disbursement funding business (JustKapital Finance) delivered sequential growth with improvements in originations, cash collections and net receivables over the prior quarter, on a constant currency basis.

In the US, the company noted that it was a solid quarter for the US business – National Health Finance. The originations improved during the quarter, and origination contributions are returning to a level that was noticed in the earlier quarters post acquisition of NHF.

Further, the management is focusing on cash collections, and the use of NetSuite had a favourable impact on the cash collection process. The use of NetSuite resulted in the strongest cash collection quarter for NHF.

In Litigation Funding, the company had notified to wound down the operations, and it would not be funding any cases. However, the company expects to collect USD 20 million as its share of proceeds from the cases that were funded earlier.

In addition, the company notified that the legal charges pressed by former chairman of the company had been settled. LAW has entered a Forbearance Agreement with its US financier to refocus on key business drivers.

The company was working with its lenders after a breach of a financial covenant under the $42 million Syndicated Acquisition Facility, and it has requested Forbearance while discussions with lenders are ongoing.

On 27 December 2019 (AEDT 12:40 PM), LAW was trading at $0.072. Over the last one year, the stock has delivered a return of -10%, while the last three-month return is +2.86%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

.jpg)