All three stocks have recently come up with significant business updates. Winchester Energy released the results for June quarter, reporting new oil discoveries and drilling plans. Coles Group released a refreshed strategy to offer long-term value for shareholders. Woolworths Group came up with an announcement regarding the merger and separation of Endeavour Drinks and ALH Group businesses, aimed at simplifying the organisational structure to offer augment long-term shareholder value.

Let us now have a detailed look at the above updates.

Winchester Energy Limited

ASX-listed Winchester Energy Limited (ASX: WEL) is primarily involved in the exploration and development of oil & gas. The shares of the company have recently been put on a trading halt upon request from the management.

In a recent announcement to the exchange, the company updated that Mr Peter Allchurch resigned from the position of Non-Executive Director due to health issues.

Quarterly Highlights: During the quarter ended 30 June 2019, the company discovered two new oil wells at its Mustang Prospect and Lightning Prospect. White Hat 20#3, the oil well discovered at the Mustang Prospect, came in with an initial production rate of 306 barrels of oil per day. The second oil well Arledge 16#2, discovered at the Lightning Prospect has 45 feet of interpreted net oil pay in Cisco sand and would begin production testing in the next few weeks. New oil discovery in the Mustang Prospect has resulted in production turnaround with working interest production of 133 barrels of oil per day in the June quarter, which is 2.4 times higher than the working interest oil production of 54 bopd in the March quarter. The period also saw an upgrade in the shale oil potential across the companyâs 17,000 acres in the Thomas119-1H well, after 29 bops vertical frack of Wolfcamp âDâ shale in the well, carried out by US Energy Corporation of America.

In addition to oil well discoveries, the company confirmed Mustang Prospect as a significant development project with planned discovery in nine new wells over the next 12 months. Drilling at White Hat 20#4 and 20#5 is expected to begin in the mid of August 2019. An exploration and development drilling program is currently in process at the companyâs EI Dorado, Lightning, Spitfire and Mustang prospects. Total Cumulative Gross Prospective Resource from the drilling program falls in the range of best estimate of 9.7 million barrels to a high estimate of 22.7 million barrels.

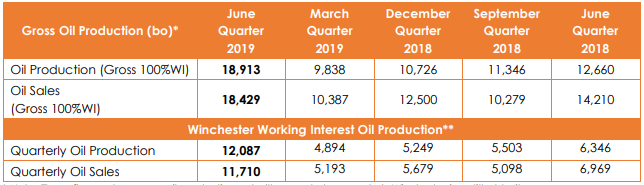

Production and Sales: During the quarter, the company reported working interest oil and gas sales amounting to A$ 697,171, as compared to WI oil and gas sales of A$ 274,566 in the March quarter. The company reported a gross oil production of 18,913 barrels in the June quarter, as compared to 9,838 barrels of oil in the previous quarter. Gross oil sales for the period were reported at 18,429 barrels against the March quarter sales of 10,387 barrels.

Production & Sales Summary (Source: Company Reports)

The stock of the company last traded on 02 August 2019, at a market price of $ 0.032 and has a market capitalisation of $ 13.8 million.

Coles Group Limited

Coles Group Limited (ASX: COL) operates as a retailer of consumer products including fresh food, liquor, household goods, groceries, etc. The company recently announced that it would be releasing its full year FY19 and Q4 FY19 retail sales results on 22 August 2019.

Refreshed Strategy: The company recently unveiled its refreshed strategy that is aimed at sustainably feeding all Australians and creating long-term value for its shareholders. The new strategy is underpinned by three key objectives including (a) Inspiring customers through best value food and drink solutions (b) Smarter selling through efficiency and pace of change and (c) Winning together with suppliers, team members and communities. The strategic differentiators as explained by the CEO involve (a) Achieving long term structural cost advantages through automation and technology partners (b) Winning market share in online food and drinks with an optimised store count and supply chain network (c) Building a valuable brand position and (d) Team engagement to achieve pace in execution.

In addition to the above, the company came up with its financial objectives for the next four years. Revenue over the period is expected to grow at least in line with market growth. The company is targeting cost savings of approximately $ 1 billion by FY2023. Apart from the above objectives, the company also expects to stick to an attractive dividend payout ratio over the period.

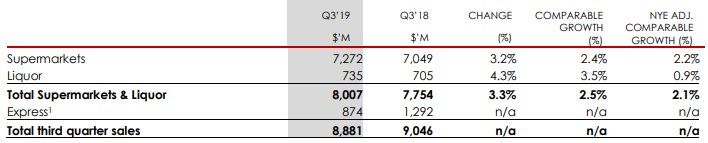

Q3 FY19 Highlights: During the quarter, the company reported total sales amounting to $ 8,881 million as compared to $9,046 million in the corresponding period of the prior year. Supermarket sales during the quarter were reported at $ 7,272 million, up 3.2% over the corresponding prior -year sales of $ 7,049 million. Liquor sales for the period were reported at $ 735 million, up 4.3% in comparison to $ 705 million reported during the same period a year ago.

Q3 FY19 Sales Results (Source: Company Reports)

Key Milestones during the quarter: To restore growth in the Express business, the company entered into a New Alliance Agreement with Expressâ fuel partner Viva Energy. The period also saw signing of a joint venture agreement with Australian Venue Co in relation to the companyâs hotel and retail liquor business in Queensland. In addition, the company entered into a strategic partnership with Optus for delivering high-speed broadband to all stores.

Outlook: The company expects to report the fourth quarter comparable supermarket sales growth in the upper half of the range between comparable growth in the second and third quarters. FY2019 net capex is expected to be in the range of $ 700 million - $ 800 million.

The stock of the company traded at a market price of $ 13.830 on 05 August 2019, down 1.355% from its previous closing price with a market capitalisation of $ 18.7 billion.

Woolworths Group Limited

Woolworths Group Limited (ASX:WOW) is engaged in retail operations, primarily across Australia and New Zealand.

Endeavour Group Update: The company recently made an announcement regarding an agreement to merger its Endeavour Drinks business with ALH Group. The merger entity is likely to be named as Endeavour Group Limited. In addition, the company is planning for the separation of the combined business entity in the calendar year 2020. The separation would either involve a demerger or any other alternative that adds value to the business. Through the above arrangement, the company seeks to benefit the customers and team members of both the groups, while focusing on maximising long-term shareholder value. The separation will provide the company with a simplified organisational structure and help shift its focus to its core food and everyday needs business and opportunities. After completion of the merger, the business is expected to have approximate sales of $ 10 billion and EBITDA of $ 1 billion, creating Australiaâs largest integrated drinks and hospitality enterprise.

Management Changes: Under the separation process, the company would have David Marr, currently Group CFO at Woolworths, taking over the role of Chief Operating Officer at Woolworths Group. David will be primarily responsible for overseeing the merger and separation arrangement of Endeavour Group. Stephen Harrison, presently Finance Director of Australian Food business, would step in as the new CFO.

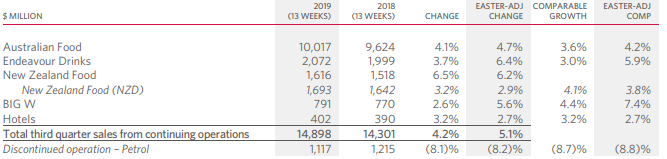

Third Quarter Sales Update: During 13 weeks to 31 March 2019, Australian Food business reported sales amounting to $ 10,017 million, up 4.1% from sales of $ 9,624 million reported during the same period a year ago. New Zealand Food reported sales of $ 1,616 million, up 6.5% in comparison to the same period a year ago sales of $ 1,518 million. Endeavour Drinks business reported sales amounting to $ 2,072 million, up 3.7% over the corresponding prior-year with positive comparable growth from BWS and Dan Murphyâs supported by the New Yearâs Eve and the weather. Total sales for the period were reported at $ 14,898 million, up 4.2% from the year-ago period. Group online sales reported a growth of 35.1%.

Third Quarter Sales (Source: Company Reports)

During the period, the company also completed sale of its petrol business to EG Group, returning $ 1.7 billion in proceeds to shareholders.

The stock of the company traded at a market price of $ 35.590 on 05 August 2019, down 0.503% from its previous closing price. It has a market cap of $ 45.02 billion and 1.26 billion outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.