Information Technology Outline

In the contemporary era, innovation has proved to be an essential element for any organisation, regardless of the industry. Information technology or IT is basically the utilisation of computers and software to manage information.

The term information technology was created in the late 1970s period. Since then the IT sector has changed the face of managing information on a broader scale. ICTs or Information and communication technologies facilitate capturing and protection of data and experiences that follows disaster and mass emergency circumstances.

As per a global technology sector leader, companies need to take great advantage of cloud platforms and the new emerging IT trends, to utilise their tools and services more effectively. IT platforms seems to be an important element, which aids in completing the work in a more effective and efficient manner.

Why invest in Information Technology?

Saves Time

In this modern era, everyone is busy with the daily routine and looking for a solution to save their precious minutes in whatever task they undertake. Also, one thing that the information technology is best at is saving a personâs time by providing a technology edge on the equipment that a person is using.

Security

The success of any business usually depends on the security of its data. If one invests in information technology security, it ensures that all the information is kept safe and secure from unauthorised access. The process of digitalisation also gives rise to a various security breaches which can be a threat for business, so it is of utmost importance to take care of the security part of the business.

Innovation

New and exciting digital innovations keep on taking place in the market all the time, which makes the sector competitive and important. Innovation helps a company to simplify its task further, manage time and resources effectively and efficiently. Automation is the best example of innovation.

The index S&P/ASX 200 Information Technology (Sector) was trading at 1,408.2, up by 0.43 percent on 15 October 2019. The Australian Benchmark S&P/ASX 200 was trading at 6,649.7, up by 7.1 points or 0.1 (at AEST 2:04 PM).

In this article, we will discuss the Isignthis Limited (ASX: ISX) stock from the IT sector.

iSignthis Ltd (ASX:ISX)

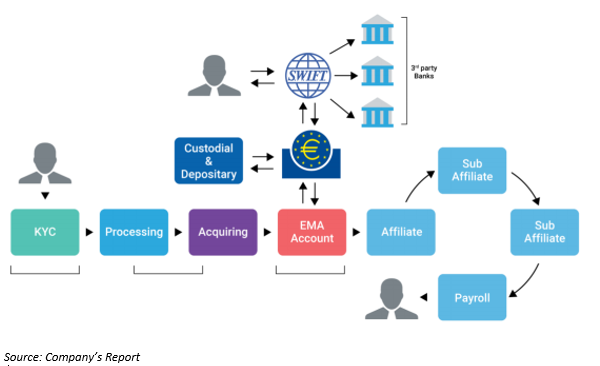

Melbourne based iSignthis Ltd (ASX:ISX) is involved in the provision of distant identity authentication and payment related services along with e-money deposit taking, banking and payment processing for merchants through its service solutions. The company is publicly listed on both Frankfurt Stock Exchange and Australian Securities Exchange.

Payment processing solutions

Paydentity⢠is a trustworthy back office solution service allowing merchants to supervise their focus on the progress of the business. It comprises of a sophisticated transaction monitoring system with an advanced KYC (Know your customer) platform.

ISXPay® is capable of processing MasterCard, Visa Inc., Diners, etc. It facilitates the merchants to gain access to payments by alternative ways like Sofort, Poli Payments, AliPay and such.

Recently on 11 October 2019, the company notified the market on a response to ASXâs query letter sent to it on 2 October this year. ASX has been addressing a number of concerns that the company is going through. The shares of ISX would be under suspension until further notice is made on it.

The company stated the reason for suspension of securities from trading on 2 October 2019, was in consultation with ASIC and related to the share price volatility in the recent times.

Annualised Paydentity GPTV surpassed $1.9 billion mark

On 1 October 2019, the company has announced the following operational update:

- The Real processing transaction volumes in AU and EU Paydentity Ecosystem remains to progress, in accordance with anticipations, since new business consumers are brought in.

- The Paydentity ecosystem persists to grow, with an emphasis on development by obtaining more consumers and various revenue lines, consisting of card acquiring and eMoney accounts increase.

- The actual annualised (AU and EU) Paydentity Ecosystem GPTV was recorded at $1.9 billion until 30 September this year.

Restated funds on behalf of merchants

On 24 September 2019, the company has declared the two Australian Financial Services licensed merchants being moved from âOn Balance Sheetâ item to âOff-Balance sheetâ item. The treatment of these two merchants is consistent between the position agreed between the ASIC and the company. The situation arose due to unusual circumstances of ASIC being successful in Federal Court freezing the funds of the two merchant banks that are held by the company.

The company remains to hold these client funds and wait for further instruction from ASIC or until the orders from the court are lifted.

These merchants are no longer active consumers of the company. The existing figures of GPTV and EBIT projection do not include these merchants.

Operating Revenue soared by 49 per cent

On 28 August 2019, the company has announced the half-yearly financial report of the period ending 30 June 2019, below are the highlights of the result:

- The total operating revenue of the company for the 1HFY19 was increased by 49 per cent to $7.5 million.

- Total revenue of the company surged by 48 per cent to $8.2 million.

- The companyâs 1H19 statutory loss was 75 per cent lower, year-on-year at $0.7 million compared to the same period of FY 2018.

- Cash in hand of ISX stood at $9.9 million, and client funds at the close of 1HFY19 period was noted of around $34.0 million.

Operational Update

- The company maintained its EBIT guidance for FY 2019 of $10.7 million.

- MSF or Merchant Services Fee from tier one network in the EU persists to grow as per anticipation.

- Group approvals of 14 per cent to 240 overalls, is made up of 95 acquiring approvals.

- On 31 July 2019, ISX hired the Elizabeth Warrell as the groupâs CFO or Chief Financial Officer.

- On 8 August 2019, the company notified on a licensing agreement with APAC or Asia Pacific Singapore established (regional subsidiary entity) Visa Inc.

Stock Performance

The stock of ISX last traded at $01.070 on ASX on 1 October 2019. The company has approx. 1.09 billion outstanding shares. The 52-week high value of the stock is at $1.765. The stock has generated a positive return of 262.71 per cent in the last six months and a positive return of 613.33 per cent on a year-to-date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.