Resource stocks are highly sought after by the investors to take an indirect exposure in the commodity market, i.e. to diversify their portfolio and for the return enhancement. The direct correlation of commodities with inflation makes resource stocks a value addition to oneâs portfolio to reduce the inflation risk.

How to Value a Stock?

It is important to understand the foundation stone of value investing, without which an investor would stand in the middle of a busy road in oblivion. There are plenty of ways to value a stock and various models designed for the task.

A stock can be valued by using multiple approaches such as relative price model, discounted cash flow method, multiples-based approach, etc.

Comparing key metric ratios such as price-to-earnings, debt-to-income, etc., over a period of time is also an effective way to value a stock. The scope of this writing circulates around using price-to-earnings ratio in the resource sector and take further note that the price-to-earnings ratio, when applied on other sectors, might not offer as much as trouble as it does in the resource sector.

However, to understand the complexity of price-to-earnings ratio, we must first get acquainted with few correlations of resource sector with other sectors within an economy.

To Know More About Price-to-Earnings ratio, Do Read: Importance Of P/E Ratio And 5 Consumer Staples Stocks- CGC, BAL, ING BGA and ELD

Resource stock and Underlying Commodity

Resource stocks generally follow the price pattern of the underlying commodity they produce with slight divergence at times amid various factors; thus, resource sector and commodity show a positive correlation, i.e., a rise in commodity price leads to an increase in the resource stock and vice versa.

Commodity and Inflation

Commodity and inflation show a partially positive correlation; however, typically, a stock shows a negative correlation with inflation. Thus, the property or the structure of a resource stock (i.e. dual nature of commodity and stock) makes the interpretation of the price-to-earnings ratio more complex in resource stocks than the stock of any other sector.

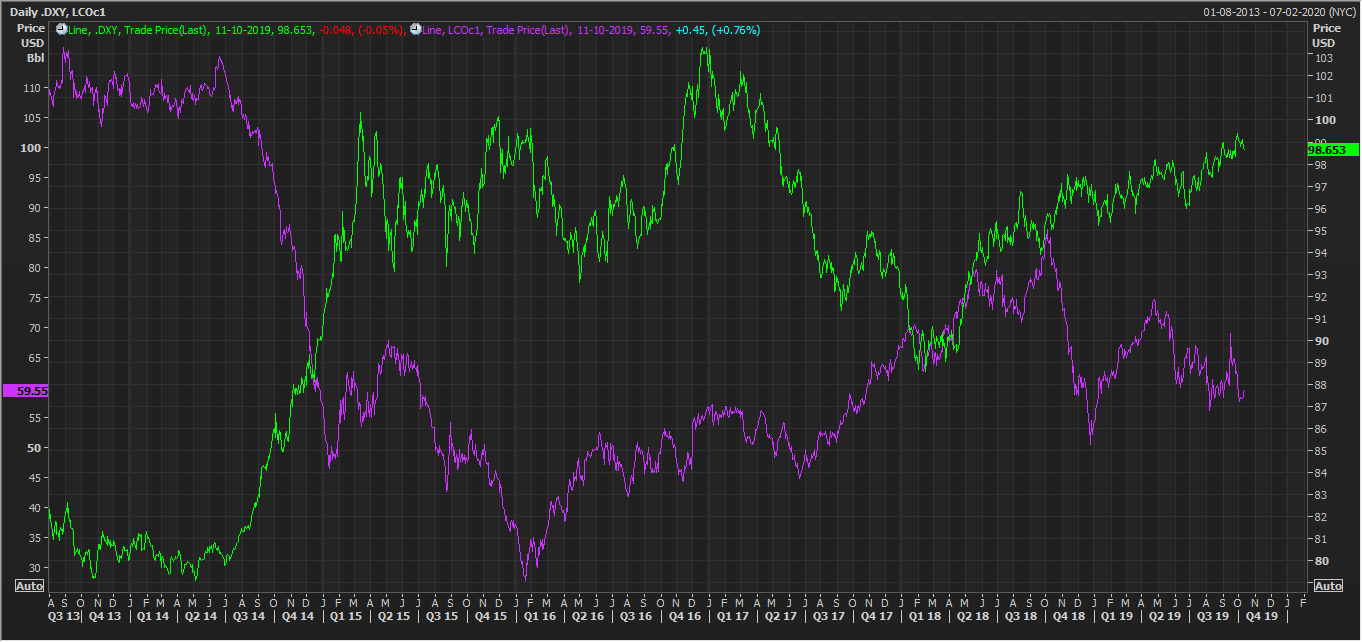

Dollar and Oil Negative Correlation (Source: Thomson Reuters)

Higher inflation or depreciation of the currency makes a commodity expensive; however, the extent would always depend upon the economic scenario, and at times the relation might not hold true.

Dollar and Gold Positive Correlation (Source: Thomson Reuters) (inflation and commodity relation not holding true)

Risk and Difficulty with P/E Ratio in the Resource Sector

Investing in resource stocks brings an additional Beta (systematic risk) of the commodity market for the investors apart from the Beta (systematic risk) of the equity market.

A major problem with the approach of investing in the resource stock is that most firms would be generating revenue from a variety of commodities such as copper, nickel, gold, etc., or could have operations beyond the ownership and extraction of commodities, which brings the correlation of a resource stock down against a single commodity.

Another key problem with the resource stock is that the earning per share (or EPS) of a resource firm may be highly correlated to the price of the underlying commodity, the price-to-earnings ratio (or P/E ratio) is not.

If the stock market declines quickly, P/E ratio falls, and when the commodity prices and inflation increases, the decline in the overall market P/E ratios could arguably lead to a decline in the P/E ratio of the mining stock, however, because of the cyclical nature of their earnings, which makes the consideration of the P/E ratio alone doubtful to value the resource stock.

Let us try to understand the aforementioned reason in brief:

To calculate a P/E ratio, we divide the current market price of a stock with its earning per share calculated by net income â preferred dividend/ Weighted average shares outstanding.

When the inflation is high commodity prices surge (positive correlation) which improves the revenue earned by these resource firms by selling the produced commodities at a high price.

The increase in revenue increases the earnings per share of a resource stock, and as the earnings per share improve the denominator of the equation carries more weight, which in turn, decreases the P/E ratio.

In general, a low P/E ratio is desired by the value investors to take advantage of the anticipated growth; however, in the case of a resource stock the lower P/E ratio could be misleading, and the stock could be overvalued, as the earnings are at the peak of the cycle.

Apart from the denominator, in the case of high inflation, the global stock market declines amid increased raw material costs for their business, which further exists pressure on the market price of the resource stock as well.

The decline in price against the rise in the commodity price could make the resource stock underperform the commodity, which in turn, makes some resource stock a hunt of cherry-picking.

On the other hand, when the inflation declines, it appreciates the currency, which in turn, drags the commodity prices down. When the commodity prices fall, the revenue of a resource firm takes hit, which in turn, reduces their EPS and increase the P/E ratio; however, again the stock could be undervalued, as the earnings might be at their trough of the cycle and the P/E could be misleading again.

Ratios to Consider Before Diving-in

Apart from various other things an investor should look upon before diving into the resource sector, calculating and interpreting the key ratios are considered a prerequisite.

To Know More, Do Read: Smart Ways To Invest In A Commodity Stock

Price-to-Book Value ratio is not as sensitive as the P/E ratio and could provide a clearer picture of the intrinsic value of a resource stock

Book value of a stock can be easily calculated by subtracting liabilities from the assets to use further in the calculation of the P/B ratio.

Price-to-cash-flow is another ratio, which could provide a clear picture; however, the price-to-cash flow could be misleading in the case of a developing resource firm.

A developing resource firm could have large gestation period for cash due to the ongoing development of the operational assets, which in turn, could reduce the movement of cash in and out of the project. An investor should consider key metric ratios along with other variables to value a resource stock.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.