Why Diversification in stocks is required?

Diversification helps to lessen the risk by allocating investments between several financial instruments in diverse zones that may react differently in the same circumstance. Investors may find difficulty in balancing the diverse portfolio and the diversification expensive as well.

Let us discuss a few diversified stocks to invest in.

PINCHme.com Inc. (ASX: PIN)

New York based, PINCHme.com Inc. runs product sampling and digital promotions platform. The companyâs platform intelligently matches the requirement of large FMCG brands by providing them with a comprehensive data of consumer habits. PIN has more than 4 million profiled members, and in the first half of FY 2018 it had progressed at a pace for ~ 100,000 members per month. The company was admitted on Australian Stock exchange on 24th October 2018.

On 30 August 2019, PIN released its six-month report closed 30 June this year. Some of the highlights of the interim period is mentioned below:

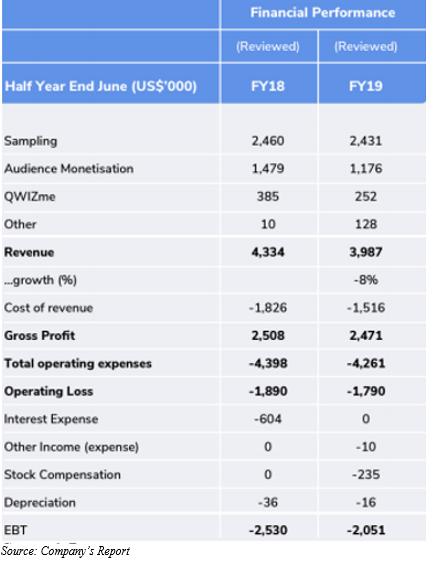

Financial Performance of the company in H1 2019

- The companyâs revenue was down by 10 percent standing at US$4.0 million compared to the revenue of USD 4.3 million in the previous corresponding year.

- EBIT loss was recorded at US$2.1 million against USD 2.5 million in the pcp.

- The gross profit margin increased by 4% to 62% due to higher margin from sampling campaigns.

- Sampling revenue dipped by 1% due to rise of smaller scale programs along with higher profit margins.

- Total operating expenses declined by ~ 3% with a constant focus to efficiently manage expenses.

- Cash position as on 30th June 2019 stood at ~US$ 1.1 million.

Business update & Outlook

The QWIZme survey platform collaborated with London based survey business- Qmee. Also, QWIZmeâs revenue went down during the integration stage. Further, a Q3 launch is anticipated and would boost QWIZmeâs survey conclusion rate along with optimisation of its user experience. The companyâs biggest two clients are continuing to grow their partnership with PIN, individually spending more than $1 million with PIN in YTD.

Stock Performance

PINâs stock last traded on ASX at A$0.100 on 30th August 2019. The company has ~139.78 million shares outstanding, and the market cap of the stock stands at AUD 13.98 million. The 52-week high value of the stock was noted at AUD 0.480.

BetMakers Technology Group Limited (ASX: BET)

BetMakers Technology Group Limited is a leading supplier of Racing data, Analytics and Trading Solutions. The company offers full white - label platforms as well as widget platforms which integrates seamlessly via JavaScript code.

On 30th August 2019, the company notified that its 100 percent owned subsidiary BetMakers DNA had established a fresh commercial collaboration with a leading principal authority, RVL or Racing Victoria Limited for the development and commercialisation of a racing integrity platform to aid in overseeing RVLâs integrity requisites.

Within a software development deal, BET has developed a technology for Racing Victoria, named RVIP or Racing Victoria Integrity Platform which utilised throughout their racing program.

Few highlights of the update:

- The new RVIP utilises BETâs technology and provides greater transparency for the racing authorities.

- BET signed deal for international distribution to expand the platform.

- RVIP identifies, manages an array of data points and maintains data in easy to use format.

- RVIP feature comprises of real-time tracking of data like price movements and related betting patterns.

Further, BET and Racing Victoria have signed a licence agreement, which would enable it BET to disperse and commercialise integrity platform technology in a customisable solution to racing authorities both in Australian region and global arena.

Companyâs Dynamic Odds provides Official Price to Australiaâs racing authorities, Source: Companyâs Website

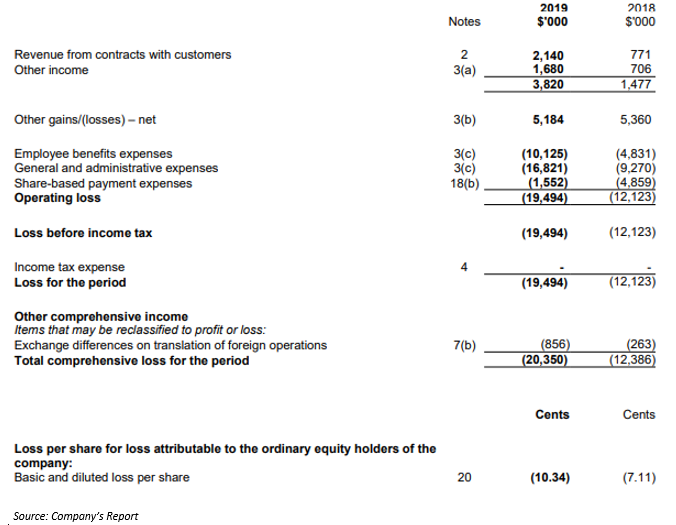

Financial Performance for the year FY 2019

On 29 August this year, BET released full-year report closed 30 June this year, highlights of which are mentioned below.

- The companyâs revenue decreased to $6.15 million from $12.7 million compared to the previous year.

- Loss before income tax stood at $4.61 million

- Total comprehensive income for the year stood at ~$3.60 million.

- Cash and cash equivalents decreased to $0.45 million from $1.45 million last year.

- Revenue from ordinary activities was down by 53.8% to $6.16 million.

Stock Performance

By the end of the trading session, BETâs stock was at AUD 0.077, slipping down by 6.098 percent from the last close. With ~413.49 million outstanding shares, the market cap of the stock stands at AUD 33.91 million. The 52-week high and low value of the stock was at AUD 0.087 and AUD 0.0.25, respectively.

Enevis Limited (ASX: ENE)

Enevis is a leading provider of audio - visual and lighting solutions. Headquartered in Melbourne, it has offices across Australia and Asia Pacific region. The company has three division namely, SKS technologies, Urban Lighting Group & Enegrow that deliver solutions to the end users.

Financial Performance for FY 2019

On 30 August this year, ENE declared annual results ended 30 June this year, financial highlights for the same are as follows:

- The companyâs non - Lumex sales revenue of $36.54 million up from $27.15 million in FY 2018.

- Total sales increased by 51.7% to $41.19 million.

- Gross Margin was consistent in comparison with last year.

- EBIT was at $0.60 million with a negative of $2.22 million.

- EBITDA dipped to $1.03 million with a loss of $0.52 million in FY 2018.

- NPAT was $0.02 million compared with a loss of $3.01 million.

On 1st May 2019, the company has released Smart Led Grow light Presentation.

Outlook

The company has recognised and would look for new opportunities that was delivered by the LumiGrow supply agreement inked in April 2019.

Stock Performance

ENEâs stock settled on ASX at AUD 0.185 on 2 September 2019 with a surge of 12.121%. in comparison to the last closed price. With ~66.61 million outstanding shares of the company the market cap of the stock stands at AUD 10.99 million. The 52-week high and low value of the stock was at AUD 0.310 and AUD 0.140, respectively.

GetSwift Limited (ASX:GSW)

New York based GetSwift Limited leads the delivery management automation around the globe.

On 30th August 2019, the company announced the addition of master IT service licence agreement (MSA) with Heineken International B.V with current deployments in Malaysia & Egypt. The agreement value cannot be determined, when the update was releases because it is subject to utilisation take up and additional deployments.

On 28th August 2019, the company declared the Financial result for FY 2019, closing 30 June this year. The highlights are mentioned below:

Financial Performance for FY 2019

- Total Revenue and other income increased by 159% to $3.82 million from the previous corresponding year.

- Cash and Cash equivalent reported $68.8 million with no outstanding debt.

- Net loss after tax reported was $19.49 million.

- Year on year growth rate in revenue & other income reaching at a pace of 249% in three months through June.

- The Groupâs franking account had nil balance on 30th June 2019.

Business Report during FY 2019

- During the period, the group grew its investment in enterprise integration, product development and deepened into expansion into a new market.

- The penetration to its software platform with new and old clients has been noticed during the FY 2019 period.

- The group had made two acquisitions in North America during the year namely, Delivery Biz pro and Scheduling+.

Stock Performance

ENEâs stock settled on ASX at AUD 0.325 on 2 September 2019 with a surge of 4.839%. in comparison to the last closed price. With ~188.52 million outstanding shares, the market cap of the company stands at AUD 58.44 million. The 52-week high and low value of the stock was at AUD 0.710 and AUD 0.155, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.