The Big Four Banks of Australia- Commonwealth Bank of Australia (ASX: CBA), National Australia Bank Limited (ASX: NAB), Westpac Banking Corporation (ASX: WBC) and Australia and New Zealand Banking Group Limited (ASX: ANZ) experienced earnings headwinds due to customer remediation costs, slow economic growth and low interest rates.

Despite these headwinds, CBA shares are still trading at a premium to its Big Four brothers. If compared by the most basis measure of valuation- price to earnings ratio, CBA has P/E multiple of 16.610x at current market price (as on 20 November 2019). This premium is obvious if we compare it with other four banks like NAB is sitting at a P/E multiple of 15.890x, WBC at 13.510x and ANZ at 12.100x (as on 20 November 2019).

Why is it trading at a Premium?

Well itâs not because of the dividend the bank offers. CBAâs annual dividend yield is almost similar to the other four banks. CBA has a current annual dividend yield of 6.29% which is at par with the other banksâ annual dividend yield - WBC (6.55%), NAB (6.09%) and ANZ (6.29%) (as on 20 November 2019).

CBA has a larger market share in practically every product it sells than it did ten years ago. The bank has a market share of 24.4 percent in home loan, which is up from 21 percent in 2009, market share in credit card is 27 percent as compared to 19 percent in 2009 and in household deposits, its market share is 28 percent as compared to 28.8 percent in 2009.

Also, in business lending, CBA has lifted its market share from 13.6 percent to 16.6 percent as per APRA data.

This shows that CBA is leveraging its dominance and branding in a very effective way as the banking sector of Australia is a very competitive landscape and CBAâs increasing ascendancy is a sign of a âwide economic moatâ.

CBA Issues CommBank PERLS XII Capital Notes

Commonwealth Bank of Australia has confirmed that the bank has issued and allotted 16,500,000 CommBank PERLS XII Capital Notes to successful Applicants at the application price of $100 each, raising $1.65 billion.

Allocation Policy

- Securityholder Offer â Valid applications under the Securityholder Offer have been accepted in full;

- Broker Firm Offer â Brokers are responsible for determining allocations made to Broker Firm Applicants;

Trading on ASX

PERLS XII are expected to commence trading on ASX under the trading code âCBAPIâ as follows:

- Deferred settlement trading â 15 November 2019

- Normal settlement trading â 19 November 2019

First Distribution

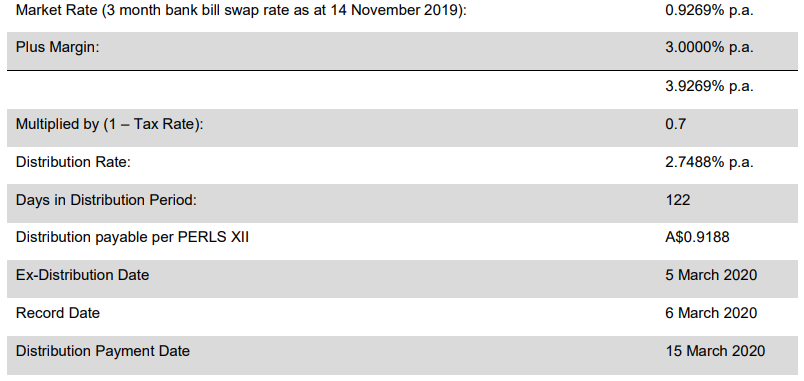

The first distribution will be $0.9188 per PERLS XII and the distribution rate of 2.7488% was calculated as follows:

The distribution is expected to be fully franked.

Change in Team Leadership

The CEO of Commonwealth Bank, Mr Matt Comyn announced on 13 November 2019 that there were some changes made to the Groupâs Executive Leadership Team. Adam Bennett has decided to leave the Group by the end of January 2020.

- In the early February next year, Mike Vacy-Lyle would be joining the Bank as the Group Executive Business and Private Banking (dependant on meeting regulatory requirements);

- Currently he is the CEO of FNB Commercial Banking.

Highlights of Q1FY20 Results

In this challenging environment, highlighted by global macro-economic uncertainty and historical low interest rates, the Bank remains well placed. The Companyâs strong balance sheet and capital position were well placed to meet the need of the customers demonstrated by good volume growth in its core markets of home lending, business lending and household deposits.

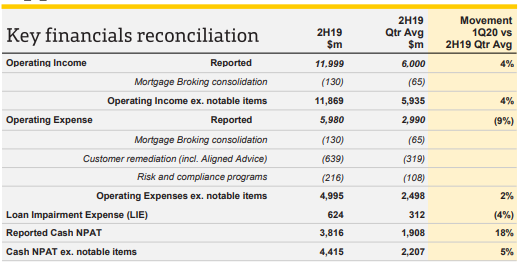

An overview of 1Q20:

- The bank reported unaudited statutory net profit of approximately $3.8bn2,3 in the quarter, including a $1.5bn gain on sale of CFSGAM4;

- Unaudited cash net profit from continuing operations stood at approximately $2.3bn2,5 up 5% ex notable items;

- Operating income up 3% on a day-weighted basis due to lower basis risk, one-off items and volume growth;

- Strong CET1 ratio of 10.6% after 2019 final dividend payments (-90bpts) and organic generation of 35bpts ex one-offs;

- Operating expenses (ex-notable items) increased 2% due to higher staff costs and IT amortisation, partly offset by business simplification savings;

- Strong funding position maintained, with deposit funding at 69% and the Net Stable Funding ratio at 112%;

- The Net Stable Funding Ratio (NSFR) stood at 112%, the Liquidity Coverage Ratio (LCR) at 130% and the Groupâs Leverage Ratio at 5.5% on an APRA basis (6.4% internationally comparable);

- Funding and liquidity positions remained strong, with customer deposit funding at 69% and the average tenor of the long-term wholesale funding portfolio at 5.4 years.

Financial Highlights (Source: Companyâs Report)

Divestment of Australian life insurance business

On 1 November 2019, the bank announced that the joint co-operation agreement with AIA Australia Limited (AIA) in relation to CBAâs Australian life insurance business (CommInsure Life) has been executed.

Commonwealth Bank has received an upfront payment of $500 million from AIA and the full economic interests associated with CommInsure Life have been transferred to AIA, with AIA attaining an appropriate level of direct management and oversight of the business.

The Australian distribution agreement between CBA and AIA of 25 years, has also initiated.

Outlook

Commonwealth Bank of Australia expects its operating context to remain challenging as it adapts to heightened regulatory change, increasing competition, evolving customer preferences, and the need to invest in risk and compliance, and technology and innovation. It is focused on continuing to serve its customersâ needs and making the necessary changes to become a simpler and better bank.

Stock Performance

The stock of CBA closed the dayâs trading session at $79.600 per share on 20th November 2019, down by 1.326% from its previous closing price. The company has a market capitalisation of $142.81 billion with an annual dividend yield of 5.34%. The total outstanding shares of the company stood at 1.77 billion, and its 52-week low and high is $67.550 and $83.990, respectively. The stock has given a total return of 5.74% and 4.22% in the time period of 3 months and 6 months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.