Iron Ore Futures (62% Fe CFR (TIOC1)) at the time of writing traded at US$92.88 (August 26, 2019 16:00 UTC+10). It recently reached its 5 years high price at US$123.19 on July 1, 2019, on account of reduction in global ore supplies resulting from dam accident in Brazil at a mine run by Vale and cyclone hitting Western Australia, affecting global shipments.

Later, with the improvement in the situation, the iron ore supplies were improved meeting the global demand. With the slump in the infrastructure spending and iron ore consumption in China, the demand for Iron ore reduced which resulted in increase of iron ore inventories worldwide. Since then, the iron ore price has corrected by ~25.00% and is expected to show further weakness in the coming times. Amid escalating trade-tensions, Brexit concerns, economic growthâs slowdown in China, World Bank has now reduced its global growth forecast to 2.6% in 2019, which is expected to continue till 2020. However, from 2021, with modest recovery in the emerging economies, the iron-ore growth would gradually rise to 2.8%.

In 2019 and 2020, Iron Ore prices are expected to decline further on account of huge supply and demand misbalances.

Letâs acquaint ourselves with the three important Australian companies, specifically into Iron & Steel space - Fortescue Metals Group Ltd (ASX:FMG), BlueScope Steel Limited (ASX:BSL) and Mount Gibson Iron Limited (ASX:MGX).

Fortescue Metals Group Ltd

Perth based, Fortescue Metals Group Ltd (ASX:FMG) owns and operates integrated operations in the three mine sites in the Pilbara and the five berth Herb Elliot Port in Port Hedland.

The company, recently on 23 August 2019, provided statement related to Mineral Resources on its Greater Western Hub Development properties, as on 30 June this year. The Greater Western Hub Inferred Mineral Resource has increased by 405 million tonnes (mt) to 2,047 million tonnes, which comprise of updates to the Flying Fish, Cobra and Elevation deposits. The Pilbara Other Inferred Mineral Resources comprise of 384 million tonnes with the addition of the Fig Tree and Wonmunna deposits. The additional tonnes include high grade bedded iron deposits (BID) in the Brockman and Marra Mamba Iron Formations, along with channel iron deposits (CID). The Queens Extension deposit earlier included within the Greater Solomon Hub has been transferred to operating properties.

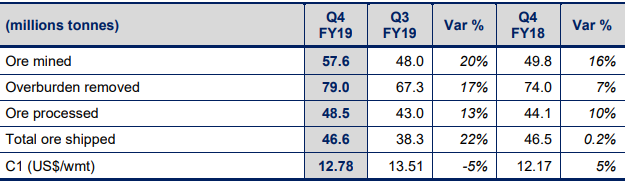

Juneâ19 Quarter Key Highlights: On 25 July 2019, the Group reported record quarterly shipments of 46.6 million tonnes (mt) and cash production costs (C1) of US$12.78 per wet metric tonne (wmt) for the period. Its Total Recordable Injury Frequency Rate for the period was reported at 2.8, which is an improvement of 22% on the previous quarter. Its quarterly shipments were reported at 46.6 million tonnes (including 4.7 million tonnes of West Pilbara Fines). Its FY19 shipments was 1% lower than the previous year at 167.7 million tonnes, as an influence of Cyclone Veronica.

The groupâs average revenue received in the June quarter increased by 30% to US$92 per dry metric tonne (dmt) as compared to the previous quarter at US$71/dmt. The C1 costs for the period decreased by 5% to US$12.78/wmt, as compared to US$13.51/wmt in the previous quarter.

Juneâ19 Quarter Production Summary (Source: Companyâs Report)

Stock information: On 26 August 2019, FMGâs stock settled the dayâs trade at A$7.17 down by 5.284%, with the market cap of ~A$23.31 Bn. Its current PE multiple is at 19.150x and its last EPS was noted at A$0.395. Its annual dividend yield has been reported at 4.1%. Its 52 weeks high and 52 weeks low stands at A$9.550 and A$3.224, respectively, with an annual average volume of 17,012,615. It has generated an absolute return of 103.77% for the last one year, 27.95% for the last six months, and -9.34% for the last three months.

BlueScope Steel Limited

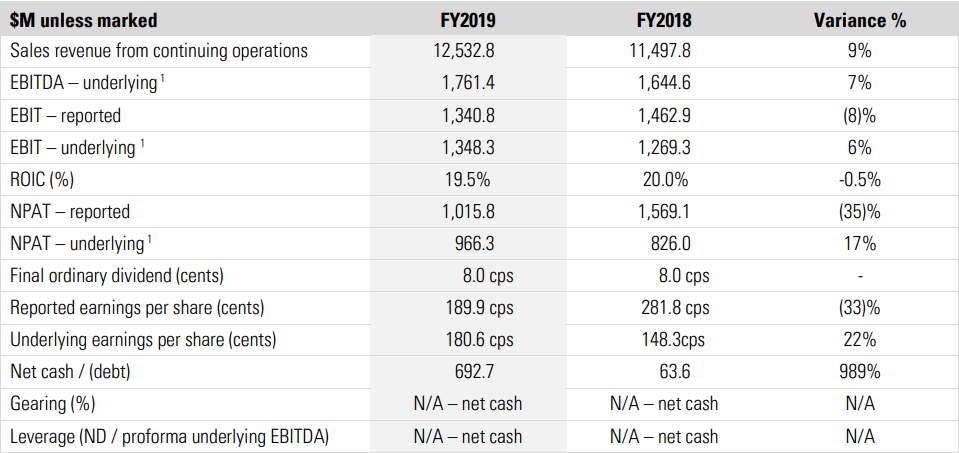

Steel building product company, BlueScope Steel Limited (ASX:BSL) recently published its FY19 report for the full year for the period closed on 30 June 2019, wherein it highlighted that its sales revenue from continuing operations increased by 9% from $11,497.8 Mn in FY18 to $12,532.8 Mn in FY19, majorly due to higher steel prices across all segments combined with favourable translation impacts from a weaker Australian dollar exchange rate. The underlying EBIT increased by 6% to $1,348.3 Mn, due to higher spreads between steel prices and the raw material input costs.

Its reported NPAT decreased by 35% from $1,569.1 Mn in FY18 to $1,015.8 Mn in FY19, whereas its underlying NPAT increased by 17% from $826.0 Mn in FY18 to $966.3 Mn in FY19. The Reported NPAT decreased due to the favourable one-off impacts of tax asset, recognition of unbooked tax losses and impairment reversals. Moreover, the USA tax reform in FY18 along higher restructuring costs in FY19, partly offset by higher underlying NPAT and higher asset sales.

Its interim dividend and final dividend for the period were reported at 6 cps and 8 cps, respectively. The final dividend is payable by 16 October this year, its ex date is 11 September 2019 and its record date has been mentioned as 12 September 2019.

Its reported earnings per share decreased by 33% from 281.8 cps in FY18 to 189.9 cps in FY19, whereas the underlying earnings per share increased by 22% from 148.3 cps to 180.6 cps in FY19. Its net tangible assets per share increased by 18% from $7.90 in FY18 to $9.29 in FY19.

FY19 Key Financial Metrics (Source: Companyâs Report)

Stock information: On 26 August 2019, BSLâs stock settled the dayâs trade at A$12.33, down by 1.753%, with the market cap of ~A$6.45 Bn. Its current PE multiple is at 6.610x and its last EPS was noted at A$1.899. Its annual dividend yield has been reported at 1.12%. Its 52 weeks high and 52 weeks low stands at A$18.200 and A$10.305, respectively, with an annual average volume of 3,868,549. It has generated an absolute return of -29.49% for the last one year, -4.42% for the last six months, and 6.09% for the last three months.

Mount Gibson Iron Limited

Mount Gibson Iron Limited (ASX:MGX) is involved in the mining of hematite iron ore in the Iron Hill deposit at the Extension Hill mine site in the Mid-West region of Western Australia, and haulage of the ore via road and rail for export from the Geraldton Port.

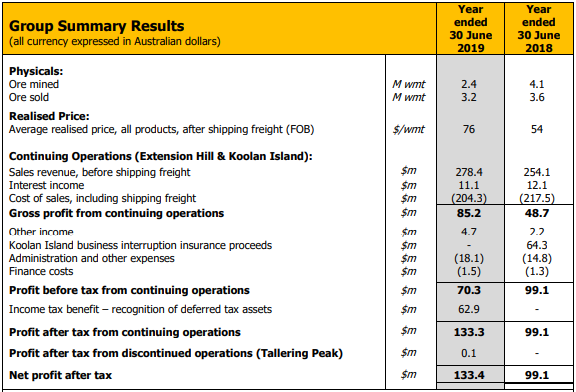

The company recently published its FY19 full year report, for the period closed on 30 June 2019, where it highlighted that its net profit after tax for the period was recorded at $133.4 million, on total iron ore sales of 3.2 million wet metric tonnes (Mwmt). The reported profit before tax (including discontinued operations at Tallering Peak) was at $70.5 million was well in excess of the result of $34.8 million reported in 2017/18 excluding the Koolan Island business interruption insurance settlement. This significant improvement reflected a 41% increase in average realised prices and the commencement of high-grade sales from Koolan Island in late April 2019.

The Groupâs average cost of sales increased from $44/wmt FOB in 2017/18 to $50/wmt FOB in 2018/19. This reflected increased royalties of around $2/wmt arising from higher realised prices, the transitional impacts of reduced production and wind-down costs in the Mid-West operation prior to the commencement of the low grade sales program later in the year, and operating costs associated with the commencement of high grade sales at Koolan Island. Unit costs at Koolan Island are expected to decrease with the ramp-up of production volumes.

FY19 Income Statement (Source: Companyâs Report)

Stock information: On 26 August 2019, MGX stock settled the dayâs trade at A$0.72, down by 4.636%, with the market cap of ~A$853.21 Mn. Its current PE multiple is at 6.300x and its last EPS was noted at A$0.120. Its 52 weeks high and 52 weeks low stands at A$1.305 and A$0.435, respectively, with an annual average volume of 3,577,783. It has generated an absolute return of 49.50% for the one-year period, 5.59% for the last six months, and -39.84% for the last three months period.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.