BlueScope Steel Limited (ASX: BSL) is among the largest players engaged in the production of painted and coated steel products in the global market. The company has presence in New Zealand, Australia, North America and Asia.

Seven-Year Power Purchase Agreement:

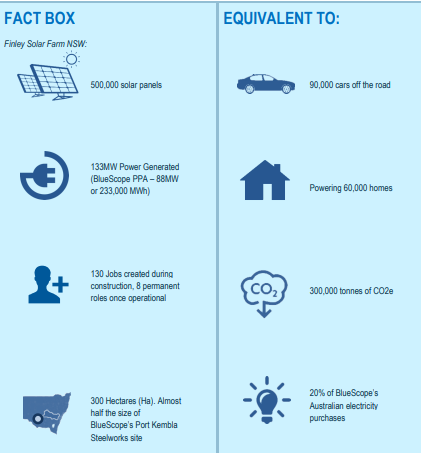

BlueScope and its partners ESCO Pacific and Schneider Electric signed a landmark Power Purchase Agreement (PPA) on 20 July 2019, meant to purchase the electricity output for a guaranteed seven years. According to this agreement, BSL will offtake 66% of the 133MW of energy that will be generated from ESCO Pacificâs solar farm in Finley. The farm, with 500,000 solar panels, is anticipated to start operations by the mid of 2019. The farm is situated 100km West of Albury in the Riverina of New South Wales.

Finley Solar Fam Snapshot (Source: Companyâs Website)

The solar farm project is expected to entail an investment of more than $ 250 million. However, as per the Power Purchase Agreement, BlueScope does not need to make an upfront investment of capital. This PPA represents one of the largest corporate offtake agreements in Australia. It is also the largest agreement signed with a solar farm to date. Through PPA, a downward pressure would be built to keep the energy costs low, as well as underpin the gradual transition to renewable energy. The volume specified under the offtake agreement represents 20% of BSLâs total electricity purchases in the country.

Lower Than Expected Earnings for 2019:

BlueScope Steel has updated its guidance for FY19 earnings, expecting the underlying EBIT for the period to grow approximately 6% year-on-year to about $ 1350 million. Earlier, the company was anticipating FY19 underlying Earnings Before Interest & Tax (EBIT) to grow by approximately 10% year-on-year from $ 1269 million in FY18. BSL expects the second half of FY2019 to report underlying EBIT of approximately $ 500 million.

Meanwhile, during the second half of FY2019, for North Star, the sales volume and operating performance continued to remain strong, however the benchmark steel spreads during the second half are now projected to be about USD 150 each tonne lower than the first half of FY19. The decline is more than the companyâs previous expectation of a decline of USD 130 each tonne. Meanwhile, for Building Products Asia and North America, the company has made good progress on the cost reduction program and the improvement of manufacturing program. However, the company is experiencing softer market conditions than expected, particularly in ASEAN and North America. During the second half of FY2019, for Buildings North America, the general market conditions and order intake continues to be positive, however, the companyâs despatch volumes and margins are affected on the back of longer customer lead times relative to prior expectations.

Extension of Buy Back:

BSLâs business continues to generate good cash flow. The company is about to complete the $ 250 million on-market buy-back program, which was announced in December 2018. Meanwhile, in June 2019, the company unveiled an addition to its ongoing on-market buy-back program by a maximum of $ 250 million. The buy-back program extension is part of the companyâs capital management program for the first half of fiscal 2020. The company anticipates continuing its share buy-back activity, at its discretion, during the month of July 2019. Moreover, the activity is expected to continue even after the announcement of the companyâs financial results for FY19 scheduled on 19 August 2019.

North Star Mill Expansion:

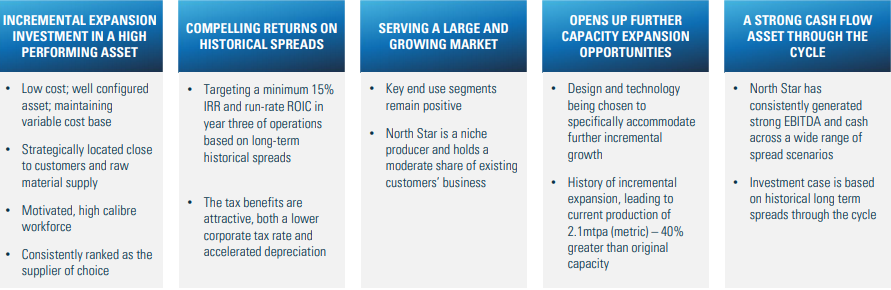

BlueScope is progressing well with the capacity expansion to its North Star mini-mill in Ohio, US. The company is assessing the addition of an annual production capacity of 800,000 to 900,000 to the facility. For this, the company has started detailed design and engineering and critical path items, which is expected to cost the company approximately USD 50 million.

The incremental installed melt capacity is projected to be of 1.4 million equivalent metric coiled tonnes, which will allow the company for further potential upside. This will however be subject to further plant debottlenecking. The company has the opportunity to expand the mill through possible 3rd electric arc furnace and 2nd caster. It has refined the range for investment case volume to be of 800 to 900 ktpa (metric). The projected investment cost for the capacity addition is in the range of USD 600 million to USD 700 million. BSL is targeting a minimum 15% Internal Rate of Return and run rate ROIC over three years of operations, based on long term historical spreads. The company will get good tax benefits, which are both a lower corporate tax rate and accelerated depreciation.

North Star Expansion Opportunity (Source: Companyâs Report)

Moreover, the North Star mill has geographic advantage, as the mill is strategically located within one of the largest scrap steel surplus regions in the United States. The company has approximately 90% of customers within an approximate 250-mile radius. This means short lead times and higher supplier responsiveness for the customers. Further update about the facility capacity expansion will be provided by the company when it releases its FY19 results on 19 August 2019.

Investing in Growth At ASP:

For the new TRU-SPEC® coil plate line, the company is investing in a new stretch levelling coil plate line of capacity 160kt at Port Kembla. This is being done in addition to the 113kt line installed in 2014. Through this, the company will get the opportunity to further grow sales of TRU-SPEC⢠steel, as well as reduce the complexity and cost in the supply chain, leading to service offer improvement and improved delivery performance. Concerning light gauge steel framing growth, the companyâs sales of TRUECORE® steel have continued to increase, driven by significant increase in demand and intermaterial growth. The companyâs distributor and fabricator numbers are also increasing.

Stock Information:

BSL stock has given a negative return of 5.39% in the last three months, while six-month return stands at 4.84%. The stock closed trading at $ 13.040 on 29 July 2019, up 0.385% from its previous closing price. It has a market cap of $ 6.71 billion and approximately 516.48 million outstanding shares. Its annual dividend yield is 1.08%, while PE ratio and EPS stands at 4.08x and $ 3.185, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.