Types of Precious Metals

There are mainly four types of naturally occurring precious metals present in the earthâs crust, namely, gold, silver, palladium, and platinum.

There are mainly four types of naturally occurring precious metals present in the earthâs crust, namely, gold, silver, palladium, and platinum.

Which Precious Metal is More Feasible for Investing?

Gold is regarded as a safe haven in the investing community due to its ability to provide a hedge against systematic and non-systematic (diversifiable) risk. Gold absorbs the inflationary pressure and appreciates in value at the times of global chaos.

Gold not only perform well when an economy is faltering, it also performs well when an economy thrives, as a thriving economy pushes up gold demand in the form of Jewelleries, Coins, etc.

Gold is regarded as a safe haven in the investing community due to its ability to provide a hedge against systematic and non-systematic (diversifiable) risk. Gold absorbs the inflationary pressure and appreciates in value at the times of global chaos.

Gold not only perform well when an economy is faltering, it also performs well when an economy thrives, as a thriving economy pushes up gold demand in the form of Jewelleries, Coins, etc.

The Financial Crisis of 2007-2008

The Global Financial Crisis, which started in early 2007 at a smaller subprime mortgage market in the United States, developed into a full-blown international banking crisis post the collapse of Lehman Brothers in September 2008. The financial crisis dragged down risky assets such as equities; however, in the event of the 2007-2008 financial crisis, gold prices kept its patina and appreciated. Gold from the beginning of 2007 to early 2009 appreciated from the level of USD 601.70 to the level of USD 1,006.40, which marked a gain of more than 67 per cent. While, the global equity indices such as the S&P 500 plunged in the same period from the level of US$1,441.61 to the level of US$734.52, which marked a loss of more than 49 per cent. The global market started showing recovery signs in early 2009 to May 2011, post which the S&P 500 corrected, and gold made a multi-year high of US$1,920.80 in November 2011. After the fall in 2011, the global equity market started showing promising recovery, which marked a slowdown in gold.The Status Quo

In the current scenario, risky assets are witnessing a see-saw movement amid looming global uncertainties. As per the International Monetary Fund, the re-escalation in the U.S-China trade war is again pressurizing the global economic growth. Apart from that, the rising war tension between the United States and Iran is further fanning the global uncertainties, which in turn is pushing the gold prices up as investors are seeking a hedge against the risky assets. Also Read: Risky Commodities Lumber As Trade War Intensifies; What To Expect From Crude Oil and Gold Ahead? Over the last four months, gold prices have witnessed a sharp upside from USD 1,266.35 to USD 1,555.23, which marks an increase of more than 22.80 per cent, and the gold prices are still shining high. To Know More, Do Read: Global Gold-Backed ETFs Pushes Gold; ASX-listed Gold Stocks Under Pressure Over Bearish SignsWays of Investing

The route to gold marks a different way of parking the capital such as jewellery, direct investment, Gold Stocks, etc. However, which way is to be considered the most effective? The investment in gold in the form of jewellery gives an investor direct possession of gold; however, for the investment purpose, the jewellery making charges along with relative taxes substantially absorb any potential gain from the price appreciation. The indirect investment in gold could via taking a position in the future contracts, which allows investors to take advantage of the gold appreciation; however, future contracts carry leverage, which could magnify the extent of profit and loss, and give investors a bumpy ride. Investing in gold stocks offer some advantage as it allows an investor to take benefits of the movement in the gold price, and apart from that, it enables an investor to hold the equity rights (ownership right) in a gold mining company. To Know More, Do Read: Smart Ways Of Investing And Storing Gold Amidst Gold RushResource Sector Vs Gold Sector

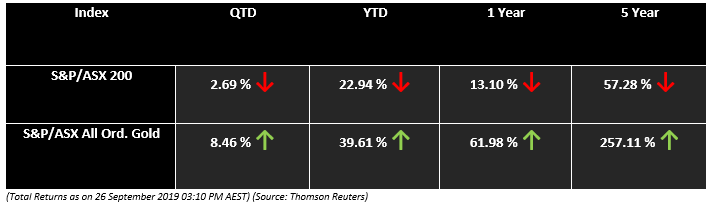

In Australia, the S&P/ASX 200 Resource Index surged from the level of 5,552.00 (low in January 2019) to the present level of 6,675.40 (as on 26 September 2019 02:56 PM AEST) which marks a surge in the resource sector of more than 20 per cent. However, a percentage change is not enough to gauge a performance if not compared against a benchmark. The S&P/ASX All Ordinaries Gold Index serves as a benchmark for the comparison rose from the level of 5,436.00 (low in January 2019) to the present level of 7,625.90 (as on 26 September 2019 03:01 PM AEST); the index marks a surge of more than 40 per cent. The gold stocks outperformed the upsurge in the overall resource sector with a substantial margin. Not just over a short-term, the gold stocks have also outperformed the resource sector over a longer-term as well, which makes gold stocks an attractive investment.

Not just over a short-term, the gold stocks have also outperformed the resource sector over a longer-term as well, which makes gold stocks an attractive investment.

Gold a Hedge Against Depreciating Currencies

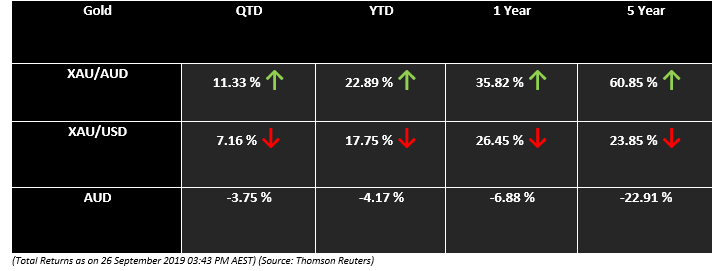

Gold prices are denominated in various currencies, depending upon the geographical area. The depreciation of the domestic currency of any country increases the value of gold-denominated in the local currency. Thus, gold provides a perfect hedge against the depreciation in the domestic currency of any sovereign country. The Australian dollar-denominated gold clearly outperformed the total returns delivered by the gold denominated in the U.S. dollar amid depreciation in the Australian dollar.

The Australian dollar-denominated gold clearly outperformed the total returns delivered by the gold denominated in the U.S. dollar amid depreciation in the Australian dollar.

Australian dollar-denominated gold provided total returns which compensated for the decline in the Australian dollar. Thus, gold acts as a perfect hedge against the depreciating currencies.

Silver prices generally witness high volatility as compared to gold amid its wide industrial applications in solar cell and other sectors. Silver is regarded as a safe asset; however, the dependency of silver on the overall economic conditions to perform extremely well makes silver less preferable against gold when it comes to safeguarding the investment.

Moreover, silver prices are derived by the same factors, which influence the gold prices; however, silver also takes a leap when the economy thrives and industrial output surges.

The precious metal speculators prefer to buy silver post confirming the indication from the popular gold-to-silver ratio.

Australian dollar-denominated gold provided total returns which compensated for the decline in the Australian dollar. Thus, gold acts as a perfect hedge against the depreciating currencies.

Silver prices generally witness high volatility as compared to gold amid its wide industrial applications in solar cell and other sectors. Silver is regarded as a safe asset; however, the dependency of silver on the overall economic conditions to perform extremely well makes silver less preferable against gold when it comes to safeguarding the investment.

Moreover, silver prices are derived by the same factors, which influence the gold prices; however, silver also takes a leap when the economy thrives and industrial output surges.

The precious metal speculators prefer to buy silver post confirming the indication from the popular gold-to-silver ratio.

Gold-to-Silver Ratio

XAU/XAG or Gold-to-Silver ratio is the popular ration monitored by the bullion investors to gauge the magnitude of price appreciation/depreciation of silver in relation to gold. A falling Gold-to-Silver ratio indicates that silver would outperform gold and vice versa. Thus, the XAU/XAG ratio exhibit a negative correlation with silver prices. An increase in silver price leads to a fall in the Gold-to-Silver ratio and vice versa. Gold-to-Silver Ratio and XAG Daily Chart (Inverse Correlation) (Source: Thomson Reuters)

Gold-to-Silver Ratio and XAG Daily Chart (Inverse Correlation) (Source: Thomson Reuters)

Platinum and Palladium

Platinum and palladium, both are precious metals with industrial applications, and apart from the demand and supply dynamics, the overall economic growth and performance of the automobile sector influence the prices of both the metals.

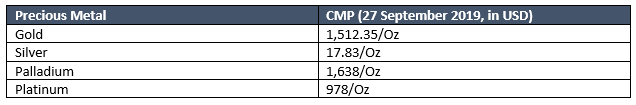

Out of all precious metals, palladium is the costliest amid its restricted supply. Palladium is produced as a by-product of nickel mining; thus, the supply of palladium remains highly choked.

Both platinum and palladium are used as an auto catalyst in the automobile industry to control the carbon emission, thus, witness strong demand, when the overall economy improves. Apart from that, both platinum and palladium witness decent demand from the jewellery sector.

The bottom line is that all precious metals rise during the time of global uncertainties; however, gold is still considered as the most feasible option in precious metals to invest amid its ability to perform extremely well during the time of global uncertainties along with the additional ability to perform decently in a thriving economy.

Also Read: Is the Time Right To Look At Platinum And Palladium Stocks On ASX?

Platinum and palladium, both are precious metals with industrial applications, and apart from the demand and supply dynamics, the overall economic growth and performance of the automobile sector influence the prices of both the metals.

Out of all precious metals, palladium is the costliest amid its restricted supply. Palladium is produced as a by-product of nickel mining; thus, the supply of palladium remains highly choked.

Both platinum and palladium are used as an auto catalyst in the automobile industry to control the carbon emission, thus, witness strong demand, when the overall economy improves. Apart from that, both platinum and palladium witness decent demand from the jewellery sector.

The bottom line is that all precious metals rise during the time of global uncertainties; however, gold is still considered as the most feasible option in precious metals to invest amid its ability to perform extremely well during the time of global uncertainties along with the additional ability to perform decently in a thriving economy.

Also Read: Is the Time Right To Look At Platinum And Palladium Stocks On ASX?

Risk Associated with Precious Metals Investing

No investment is free from risk, and the same goes for precious metals. The investment in precious metals contains various potential risks, which are as below:- Precious metals contain a long gestation period and can consolidate for years without any significant move.

- The high prices of gold provide the gold miners to dig faster to take advantage of the market price, which could influence the demand and supply dynamics of gold, and in turn, could influence the prices.

Procedure to Invest in the Precious Metal Markets

- Select the precious metal in which you want to take the exposure.

- Know your mediums to park the investment in the selected precious metal.

- Get familiar with the associated risk.

- Plan your exit.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.