Investing is defined as the process of putting capital or money into different financial schemes, stocks, assets, or in commercial endeavors with an expectation of return in the form of dividend / interest income or profit through price appreciation. Investing provides a range of asset classes that are accumulated in order to realize one's goals. In simple terms, investing is a way to set aside money with hopes of growing it over time. The gamut of assets in which investors can put in their capital and attain profit is broad. It comprises of real estate, metals, shares, bonds/debentures, REITs, managed funds, exchange-traded funds (ETFs), commodities and other alternative investments/funds. And the combination of investible assets is referred to as a portfolio.

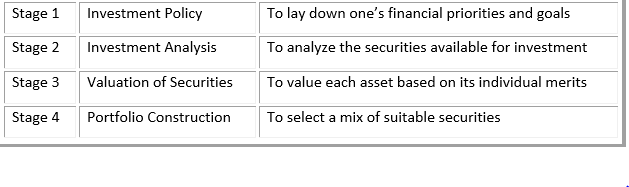

Process of Investing: The process of investing is divided into four stages-

Pros and Cons of Investing

There are many advantages of investing that attract market enthusiasts. Investors reap many benefits as investing help in building wealth, grow money in times of inflation, saving taxes, meet individual's financial goals, reap advantages of compounding, etc. However, a bunch of disadvantages are also associated with investing just as a coin has two sides to it. Investing cons include a slightly complicated concept to make sense of, unpredictable annual returns at times, market risks, macro and microeconomic factors that could adversely impact investors returns, and a time-consuming process that requires detailed research and analysis as well as expert advice.

Diversified Portfolio and Importance of Diversification

Diversified portfolio consists of stocks belonging to various sectors and market capitalizations, fixed income securities of diverse maturities, commodities and alternative assets like bullion, etc. A properly diversified portfolio helps the investor in realizing a higher return with minimum risk. When constructing a portfolio, an investor allots a percentage of his investment into several available investment products. Portfolio construction depends on the following four criteria, including the aim of the investor, the budget, the risk-bearing capacity or risk appetite and the holding period.

Diversification is the process of investing across multiple sectors, asset classes and locations that aid in managing and reducing investors' risk effectively and yielding above-average returns.

Five Pointers to Consider While Opting for Diversification

- Diversification of Stocks/Sectors: Don't keep all eggs in one basket; In simple terms, investors should keep in mind not to pour in all their money in one stock or one sector, rather consider spreading their wealth which provides the foundation to a diversified portfolio. Investors should invest in different sectors as these would react differently to any particular event. For instance, assets with a different correlation like bonds and stocks move in opposite directions so that they would react differently in case of an adverse event. Any unfavorable movement in one asset will be offset by the positive outcome in the other. Some examples of different sectors one can consider investing are health care, technology, financial services, consumer staples, energy etc. Simply put, a mix of asset classes would reduce a portfolio's sensitivity to market oscillations.

- Diversification of Location: Like stocks, diversification among different geographies is also important. An investor should aim for going global and invest outside his home location. This way, the associated risk would be minimized with a resulting possibility of higher returns.

- Diversification via investing in Index Funds/Fixed Income Funds: Besides stocks, investors should also consider allocating their investible funds into commodities, exchange-traded funds (ETFs), and real estate investment trusts (REITs), etc to diversify their portfolios. Putting money into securities listed on different indices could lead to a sustainable long-term diversification strategy. Fixed-income investments could help cushion investors from the vagaries of the market. Also, the management and operating costs of these index funds are very low, which indicates lower fees and, in turn, more money to the investor.

- Diversification by stockâs market capitalization: Even if an investors' portfolio is diversified in other ways, it is important to diversity via the company's market capitalization. Market capitalization refers to the different sizes of the company. Companies with a large market cap may be subjected to different underlying risks than those with small market capitalizations.

- Monitoring of the Portfolio: There is a possibility that a diversified portfolio may become unbalanced due to market volatility or changes in companiesâ business and/or corporate strategies such as mergers/ acquisitions. These events may drastically change a company's focus areas, execution strategy and even its industry concentration. Thus, investors should keep a check on their stock/bond portfolio on a regular basis and undertake rebalancing or fine-tuning after certain specific time periods, such as half-year or a year.

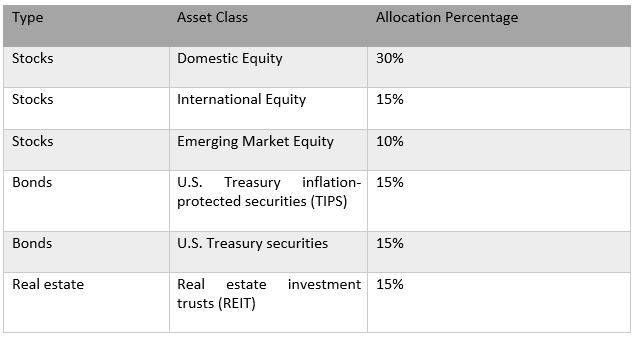

An example of a diversified portfolio is "The Swensen Model". David Swensen is a well-known investment manager. He runs Yale Universityâs endowment plan and generated an outstanding 16.3% annualized return for more than 20 years, reflecting doubling of money every four years from 1985 till today by means of asset allocation and rebalancing.

Swensenâs Model Portfolio

Now let's have a look at the stock performance of some of the ASX listed companies belonging to diversified sectors as traded on 4 November 2019 (02:54 PM AEST).

Flight Centre Travel Group Limited (ASX: FLT)

Involved in travel retailing business, Flight Centre Travel Group Limited (ASX: FLT) caters to the leisure and corporate travel sectors. It also operates businesses including tour operators, destination management firms, hotel management and wholesaling. FLT shares last traded at $42.07, up 0.179%. The company has a market capitalization of 4.25 billion and ~101.12 million outstanding shares. The stock has generated a return of 3.73% on year-to-date basis.

CSL Limited (ASX:CSL)

A pharmaceutical giant, CSL Limited (ASX: CSL) has one of the largest & fastest-growing protein-based businesses, focusing on research and development, manufacturing, commercialization and delivery of innovative treatments and influenza vaccines. CSL shares last traded at $260.19, up 0.59%. The company has a market capitalization of 117.39 billion and ~ 453.87 million outstanding shares. CSL has generated a return of 39.52% on year-to-date basis.

Macquarie Group Ltd (ASX: MQG)

A diversified financial group, Macquarie Group Ltd (ASX: MQG) primarily serves as an investment intermediary for different institutions, government, retail and corporate clients and offers a diversified range of products and services to its client. MQG shares are trading at $134.22, down 0.19%. The company has a market capitalization of 47.62 billion and ~ 354.38 million outstanding shares. MQG has generated a return of 25.77% on year-to-date basis.

Wesfarmers Limited (ASX: WES)

With prime focus on retailing of home improvement & outdoor living products, Wesfarmers Ltd (ASX: WES) is a company involved in different industrial sectors including coal and mining, supermarkets, chemicals & fertilizers, fuel & liquor etc. WES stock is trading at a current market price of $40.21, up 0.62%. The market capitalization of the company is $45.31 billion, with 1.13 billion outstanding shares. WES has generated a return of 30.36% on year-to-date basis.

Linius Technologies Limited (ASX: LNU)

Headquartered in Australia, Linius Technologies Limited (ASX: LNU) is an information technology firm, which has invented a patented Video Virtualization Engine⢠(VVE), currently accessible on IBM Cloud, Microsoft Azure, and Amazon Web Services. LNU shares are trading flat at $0.037. The market capitalization of the company stands at $43.25 million, with 1.17 billion outstanding shares. LNU has generated a negative return of 28.85% on year-to-date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.