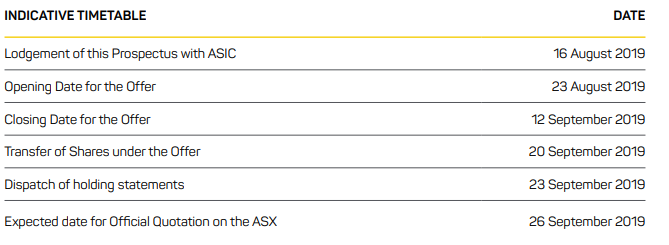

What is Initial Public Offering?

Initial Public Offering (IPO) is one of the financing decisions taken by the companies to fund growth opportunities, development, service debts, project funding, or any activity that requires capital.

Firms assess the viability of the possible sources of financing which can include a range of sources, including trade credit, bank financing, debt financing, equity financing, venture capital, private equity, issue of preference shares etc.

Initial Public Offering is a part of the equity financing sources, which companies, have had potently used for raising capital from the market. Also known as floats, IPO allow a company to sell its stakes in the market to a range of market participants, which includes retail investors, institutional investors, and underwriters.

Each jurisdiction has its own procedure for the IPO process, which is predominantly supervised by a market regulator. In Australia, the Australian Securities & Investments Commission (ASIC) is the prime body responsible for the IPOs & other market supervision activities in the country.

IPOs allow companies to list their securities in a publicly traded stock exchange, and the market participants trade these securities. Market participants buy these securities in anticipation to earn dividend income and profit from the capital gains on these securities. Firms have numerous advantages of listing its stock in the market, such as liquidity to its investors, cheaper access to capital, and significant brand value.

IPOs can be a significant source of wealth creation. Commonwealth Bank of Australia (ASX: CBA) was listed on ASX in 1991 at an issue price of $5.4. On 2 September 2019, the stock last traded at A$78.94, which shows potential capital gain over the time. Moreover, there have been numerous dividends paid to the shareholders over the time as well.

How do IPOs work?

Companies follow detailed procedure before the listing of its stock, and it requires substantial time as well. The process starts with the appointment of advisors, which are generally investment banks or brokers providing necessary consulting work.

Advisors and company prepare the prospectus for the IPO. The prospectus is a brief document about the company, which provides significant information regarding the business, management, capital structure, existing investors, financials, details of the offer, risk factors, investigation accountantâs report, intellectual property report, industry overview, board and corporate governance.

The next step requires the company to file the prospectus with the market regulator - ASIC to review the prospectus of the company. Simultaneously, the company and lead managers of the transaction are engaged in the marketing of the companyâs prospectus to attract maximum investor capital.

At times, the offers are underwritten by the lead managers, which translates to an obligation by the underwriter to subscribe for certain or whole of the offer. Company pay fee related to advisory services, pre-IPO raising services and offer fee to the parties, including advisors, lead managers and underwriters.

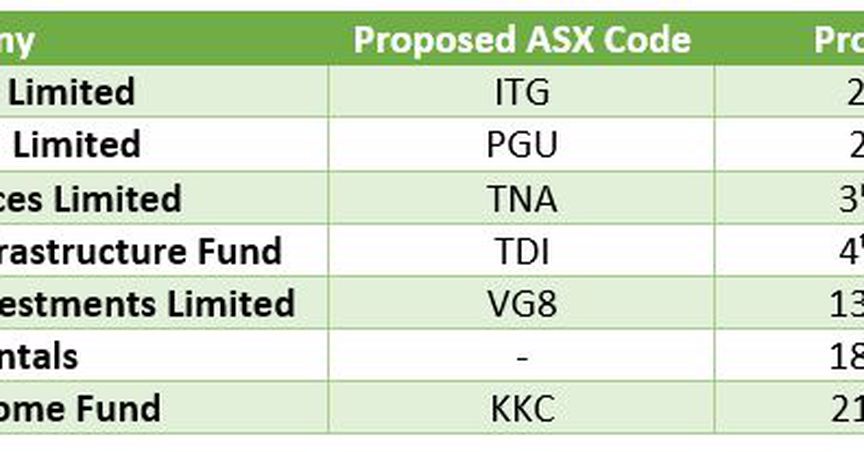

Timetable (Source: Mader Group Prospectus)

Further, investors are provided with the stipulated time period to subscribe for the offer, which is enlisted in the prospectus. Information relating to the opening of the offer and closing of the offer is provided in the prospectus document. Besides, it also provides other information related to the allotment date of the securities, expected date of quotation on the stock exchange.

Investing in IPOs

Investors who are considering investing in IPOs should go through the prospectus issued by the company. The prospectus provides in-depth information, regarding the business of the company, risks and much more. More importantly, it provides the offer price of the securities to be listed on the exchange, and it is the price of the securities that will be paid by the shareholders.

Investors will have to contact their brokers or the platform operator where they have the brokerage account to buy & sell the securities. Brokers would provide the necessary information regarding the offer and apply for the required number of securities as desired by the investor.

Certain offers are fully underwritten, some are partially underwritten, and some are not underwritten at all. Minimum subscription criteria necessitate the offer to be subscribed to raise a certain minimum amount of capital after the subscription period of the IPO is closed, and in case, if the minimum subscription is not met, it might result in further extension of the subscription period or refund of the application money.

An Upcoming IPO â Mader Group

Mader Group

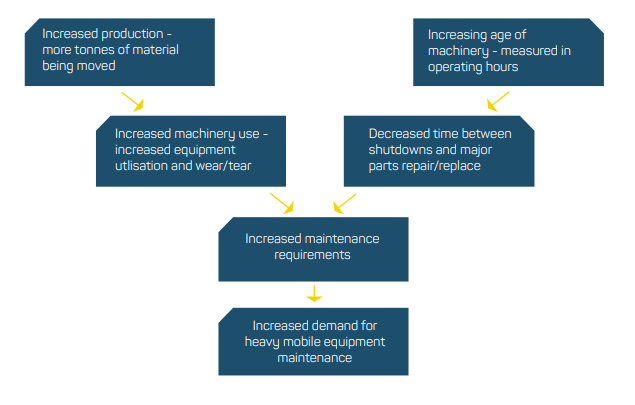

Maintenance Service Company, Mader Group provides skilled labour to the resources industry. Mader Group was founded in 2005 and has grown to over 1,100 employees. Its services include maintenance labour, field support, shutdown maintenance, maintenance workshops and other ancillary services.

The revenue stream of the company consists of the contract labour services at an hourly rate per persons provided. Payments under the services are made consistent with the services agreement, agreed hourly rates, and sometimes on an ad-hoc basis.

Mader Group has a presence in Australia, the USA, Mongolia, Zambia, Mauritania, Senegal, Democratic Republic of Congo and Chile. Meanwhile, the domestic revenue accounted for 88% in FY2019, and the rest was sourced from overseas operations.

Demand Drivers (Source: Mader Group Prospectus)

According to Prospectus, the forecast on pro forma financial performance for FY2019 includes the actual pro forma financial performance for the 10 months ended 30 April 2019 and forecast financial information for the two months ending 30 June 2019.

As per forecast pro forma financial performance for FY2019, the revenue of the company is noted at $226.22 million compared to $156.2 million in FY2018. Net profit after tax is noted to be at $14.77 million in FY2019 compared to $11.353 million in FY2018.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.