Iluka Resources Limited (ASX: ILU) announces a formal review for its mineral sands operations and the Mining Area C royalty- which the zircon miner reaps from the ASX iron ore giant BHP Group Limited (ASX:BHP).

The decision to undertake a formal review for the Mining Area C (or MCA) royalty tailed a substantial contribution, which the current and future materiality of MAC provides to the companyâs overall valuation.

The formal review, which Iluka commenced in September 2019 would consider a range of options related to its corporate and capital structure including a structural separation of MAC by way of demerger, estimated by few fund managers including L1 Capital to generate over $2 billion for the shareholders of the company.

However, while the market is gung-ho about the demerger, Iluka mentioned that the review might not lead to any structural change and the company would notify the stakeholders about the results of the review along with the full-year results in February 2020.

BHP- the operator of the low-cost, high-grade MAC area is progressing through the development of the South Flank (completed 50 per cent as on 30 September), and the miner stated that with the development of the South Flank, the expanded capacity of the MAC hub would reach 145 million wet metric tonnes per annum with production near to the capacity anticipated from 2023 onwards.

The expanded capacity at the MAC royalty area is anticipated by BHP to more than double the current production level of about 55 million dry metric tonnes per annum of iron ore to 135 million dry metric tonnes per annum from 2023 onwards.

The development work at the South Flank holds immense potential as post the completion it could materially increase the cash flows for Iluka from MAC, subject to various factors including the iron ore prices in the global market and USD: AUD exchange rate.

Also Read: Staggering Leap of Renewable Energy; Latest with Energy and Resource Sector Players in Australia

Operational and Financial Metrics for September 2019 Quarter

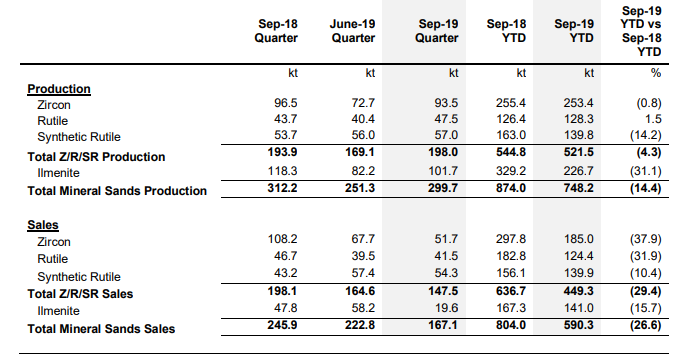

The zircon production during the quarter stood at 93.5kt, up by almost 29 per cent from the previous June 2019 quarter, but down by 3.10 per cent against the previous corresponding quarter in 2018.

The company produced 253.4kt of zircon on a YTD basis (as on 30 September 2019), which marked a drop of 0.8 per cent as compared to the previous corresponding period in 2018.

The production of total mineral sands surged by over 19.25 per cent against the June 2019 quarter to stand at 299.7kt; however, against the previous corresponding quarter in 2018 there was a drop of 4 per cent.

On a YTD basis (as on 30 September 2019), the total mineral sands production stood at 748.2kt, down by 14.4 per cent against the total mineral sands production of 874.0kt in the previous corresponding period.

The total mineral sands sales dropped by 25 per cent during the September 2019 quarter to stand at 167.1kt against the previous quarter sales of 222.8kt in June 2019 quarter.

On a YTD basis (as on 30 September 2019), the total mineral sands sales stood at 590.3kt, which in turn, witnessed a fall of 26.6 per cent against the previous corresponding period in 2018.

The production and sales of zircon, rutile and synthetic rutile remained as below:

(Source: Companyâs Report)

The mineral sands revenue stood at $252.9 million during the quarter, down by over 14.30 per cent from the revenue of $295.2 million in the June 2019 quarter.

On a YTD basis (as on 30 September 2019), the mineral sands revenue stood at $798.4 million, which marked a downfall of 13.8 per cent against the previous corresponding period.

(Source: Companyâs Report)

(Source: Companyâs Report)

On a YTD basis (as on 30 September 2019), the company witnessed an increase in production cash costs, and the total cash costs of the production during the September 2019 quarter stood at $390.1 million, up by over 16.50 against the total cash costs of $334.7 million.

Zircon Market During September 2019 Quarter

The global economic uncertainties kept a lid on the zircon market as business sentiment remains subdued, which in turn, prompted many businesses to reduce the zircon inventories throughout the supply chain.

In China and Southern Europe, the ceramics applications remained affected and exerted pressure on the sales volume and prices. The tension over the U.S-China trade war impacted the foundry and refractory industries.

However, Iluka introduced various measures to support the customer base in a challenging environment. The company enhanced the loyalty rewards and adjusted the product offering, which in turn, delivered satisfactory outcomes to the company during the September 2019 quarter.

Weighted Average Price

The company recognised a weighted average price for Zircon Standard and Premium products of USD 1,505 a tonne on a YTD basis and a weighted average price of USD 1,458 a tonne (Zircon Standard and Premium) for the September 2019 quarter.

The weighted average price for Zircon Standard and Premium products stood at USD 1,351 a tonne in the year 2018, while the weighted average price during the first half of the year 2019 stood at USD 1,522 a tonne (Zircon Standard and Premium).

Titanium Dioxide Feedstock Market

The high-grade titanium feedstock market remained steady during the September 2019 quarter, and customers took all available spot and contracted volumes.

North America continued to be the steadiest regional market, while other markets such as China, Europe, etc., remained turbulent during the quarter amid geopolitical issues such as U.S-China trade war and Brexit.

Australia Operations

The company moved the Jacinth North deposit to the Ambrosia deposit during the quarter ahead of schedule and budget. The mining and concentrating of HMC (or heavy mineral concentrate) at the Ambrosia deposit is running as per the expected operational levels of the company.

ILU produced 407kt of heavy mineral concentrate from the Jacinth-Ambrosia for the three quarters to 30 September 2019, while the production of zircon attributable to Jacinth-Ambrosia for the same period stood at 212kt.

The production of heavy mineral concentrate from the Cataby mine stood at 153kt on a YTD basis. Iluka carries the magnetic material from the Cataby operation for further processing and upgrading it from ilmenite to synthetic rutile at the SR2 kiln in Capel.

During the first three quarters of the year, kiln produced 140kt of synthetic rutile from a combination of stockpiled and Cataby sourced ilmenite. The Synthetic rutile production of 57kt during the September 2019 quarter remains above the companyâs expectations, and Iluka expects similar performance in the December 2019 quarter.

Sierra Leone Operations

The rutile production at the Sierra Leone Operations remained 3kt above the June 2019 quarter production of 30kt. The company started the Gangama expansion in June 2019, while the Lanti expansion is in a ramp-up phase and anticipated by the company to get complete in the December 2019 quarter.

MSP, which currently holds an annual capacity of around 175 thousand tonnes per annum of rutile produced 13kt of rutile in September 2019. Iluka anticipates the MSP to operate at the full capacity during the remaining 2019.

The production during the September 2019 quarter was affected by lower than expected ore throughputs and runtimes, which in turn, further unfolded materials handling issues at Lanti. The wet season conditions, which interrupted the mining activities coupled with power and maintenance outages, exerted pressure on the production.

On 31 October 2019, ILU closed the dayâs trade at $9.40 up by 6.6% as compared to its previous closing price. Its market cap stands at $3.72 billion. On a year-to-date basis, the shares have appreciated by 22.02%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.