The Australian LIC market may have underperformed in the last few years, however, on the positive side Australia has witnessed a surge in the number of LICs listed on the ASX in the recent years, with over 110 ASX-listed LICs currently.

The LIC space is retaining its attractiveness and traction. Below are some of the key reasons for which the investors are still eyeing this space:

- To achieve a meaningful diversification of the portfolio and utilizing the skills of a well-performing portfolio manager.

- To obtain financial exposure with low minimum investments which can be transacted daily on the ASX for as little as $500.

- To get exposure to a curated investment strategy.

- To get the benefits of a managed fund with ease of trading and liquidity.

What is LIC?

A LIC or a Listed Investment Company is a type of investing fund that specialises in pooling together stockholdersâ money and investing it based on certain strategy. They are structured as companies and are listed on the Australian Stock Exchange and other security exchanges around the world.

Most LICs declare dividends with associated franking credits and are generally paid from the profits generated over time. Investors can also get compensated by the share price movements of the LIC.

Structure of LICs

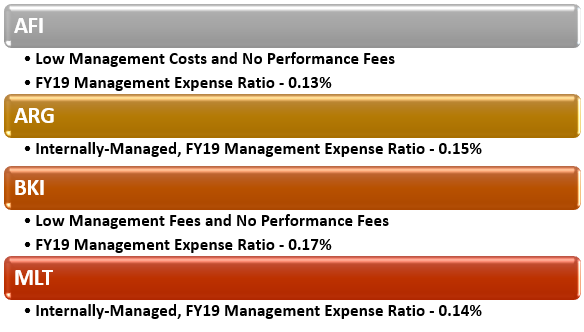

Most LICs are managed by an external investment manager under a formal contract. The investment manager charges a fund management fee to the LIC which is a percentage of the assets under management (generally 1%-1.5% of net assets). He also charges a performance fee which is 15%-20% of any returns over a specified benchmark. The management fees are payable irrespective of how well the fund performs while some funds might not charge a performance fee.

An alternative structure is an internally managed LIC. In this case, investment staff is employed by the LIC, which pays the employment and associated costs. The fund management charges levied by an LIC is normally higher than that of ETFs but lower than that of unlisted managed funds.

In this article, we will discuss the four most popular Australia-managed LICs : Australian Foundation Investment Company Limited (ASX: AFI), Argo Investments Limited (ASX: ARG), BKI Investment Limited (ASX:BKI) and Milton Corporation Limited (ASX: MLT).

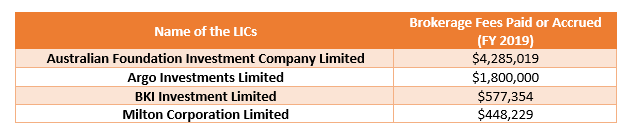

Brokerage Fees

The LICs are bought and sold on the ASX, through an online trading account or a broker. A broker is a person who receives a fee or a commission for arranging a contract, which is termed as brokerage fees. Let us take a look at the brokerage fees paid by the four well-known Australia-managed LICs in the financial year 2019:

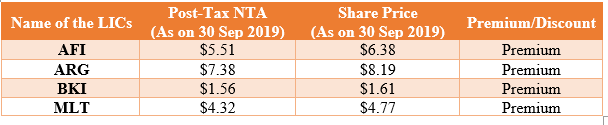

LICs: Premiums and Discounts

Generally, some LICs trade at a premium for longer period while others trade at a discount, as LICâs share price can vary significantly from its underlying NTA (Net Tangible Assets). This means that the price of a share may trade either at a higher value (at a premium) or lower value (at a discount) than the value of the underlying assets per share.

Investors pay a close attention to LIC premiums and discounts to make their buying and selling decisions. A rational investor is likely to sell the LICs trading at an unusually high premium while buy those trading at a large discount to their NTA. He may not buy LICs at a premium as there is no guarantee that the current performance will continue at the similar extent in the future.

Let us understand the reasons for LICs trading at a premium or a discount:

Trading at a Premium

- Strong performance for a decent time period.

- Experienced management.

- Offering higher than average fully franked dividend.

- Solid investment portfolio performance.

- Greater shareholder demand and a high level of popularity.

Trading at a Discount

- Lesser shareholder demand.

- Poor investment portfolio performance.

- Offering unreliable dividends.

- Disappointing performance in the recent years.

- Less trustworthy management.

Besides the above-mentioned factors, sometimes the LICs do not follow the market precisely and thereby trade at a discount or premium. In this case, it takes time for the share price of the LICs to reflect the market movements.

Let us ascertain whether the four LICs discussed above traded at a premium or discount (as on 30th September 2019) in accordance with their recently reported Post-Tax NTA:

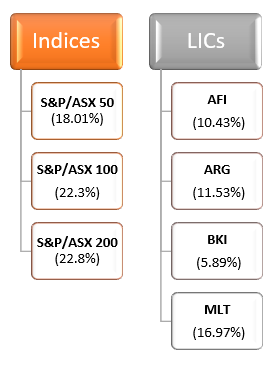

Performance of LICs Relative to Stock Market Indices

While analysing the returns generated by the four LICs over the past 5 years and comparing them with the returns generated by the broad market indices, it can be inferred that the LICs have underperformed the indices during the last five years.

The below figure shows the 5-year returns delivered by Australian stock indices and LICs (as on 15 October 2019):

LICs have also underperformed in the March 2019 quarter, as indicated by Bell Potter report. As per the report, the total share price return for domestic equity focused LICs was 3.4% in the quarter on a weighted average basis, while the S&P/ASX 200 index delivered 11.2% return.

The data reflects that most of the LICs have been trading at a premium to the NTA of their underlying portfolios. This reflects that the operators of LICs listed on the Australian Stock Exchange are not facing much difficulty in getting the value of their share prices to reflect the value of the underlying portfolios of their funds..

ALSO READ: LICs and The Returns for Investors â Related Players Under Spotlight

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_01_09_2025_07_01_12_631371.jpg)