Reliance Worldwide Corporation

Reliance Worldwide Corporation Limited (ASX: RWC) was established in 1949 with headquarters in Atlanta. It is into the business of water delivery, control and optimization systems. Its brands aim to transform the performance of plumbing and heating in industries and smart homes across the globe. Along with it, it also works towards efficiency.

Brand overview of RWC (Source: Company website)

Brand overview of RWC (Source: Company website)

The company has a market cap of A$3.03bn with almost 790.09m outstanding shares. The stock closed at A$3.670, down 4.427% (As on 24 May 2019). It has delivered a 6 month return of -18.12% while the YTD stands at -13.51%.

Post delivering solid first half of the year, in the second half of FY19, the operating segments are being adversely affected by market-specific factors. These are the winters storms in America, exit of certain product lines in the EMEA segment and decline of new home construction in Australia in the APAC region. EBITDA guidance expected is now in the range of $260 million to $270 million. This was previously advised in the range of $280 million to $290 million. Despite the challenges, the company continues to be the global leader in brass and plastic push to connect fittings technology.

Incitec Pivot Limited

Incitec Pivot Limited (ASX:IPL) is a manufacturer and distributor of fertilizers, industrial explosives and chemicals. It has operational manufacturing facilities in Australia, US, Canada, Mexico, Turkey and Indonesia.

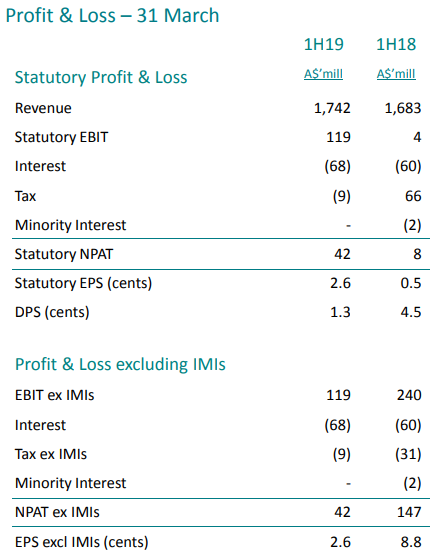

As per the companyâs half yearly results, the Statutory EBIT was $119m, exceeding more than $100m ($4m in pcp). Although, NPAT ex IMIs of $42m decreased by $105m compared to $147m recorded in 1H18, but statutory NPAT increased to $42 million in 1H19 as compared to 1H18.

Profit and Loss statement (Source: Companyâs report)

The balance sheet showed a strong overview. The Net debt increased to $1.92bn (pcp: $1.75bn) with Net Debt/EBITDA ex IMIs was 2.6x. Interest cover was 5.8x while the company completed $300m share buy-back. The company expects sustained capital expenditure for FY19 of ~$250mn and lease buyouts of ~$48m.

On the technical front, the stock traded at A$3.290, down 2.37% on 24th May 2019. Its 6 months return has been -11.55%, though the YTD stands better at 4.33%.

Clinuvel Pharmaceuticals Limited

Clinuvel Pharmaceuticals Limited (ASX: CUV) is a bio-pharmaceutical company. CUV develops drugs to treat severe skin disorders. Its lead compound is SCENESSE® .

The company recently released its Quarterly Cashflow Report for the quarter ending 31st March 2019. As per the report, the cash receipts for the quarter amounted to $5,898,000. This was 126% more from the December quarter 2018 when it was $2,608,000 and 70% more compared to the March quarter 2018 ($3,480,000). Financial year-to-date cash receipts till March 2019 amounted to $19,211,000 which was 44% higher on PCP basis. All cash receipts have been earned from SCENESSE® treatment provided in Switzerland and the EU.

The Net cash inflow from operating activities was A$2.56 million with A$27k Net cash used in investing activities. The cash and cash equivalents at the end of the quarter were A$44.98 million.

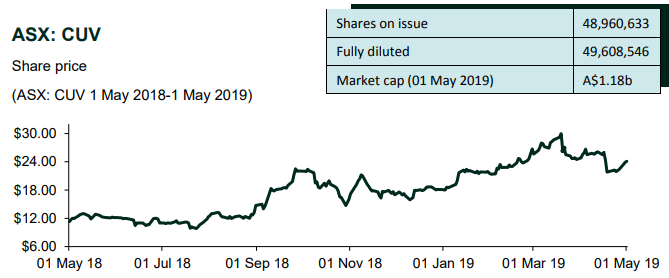

Stock trend as per ASX (Source: Companyâs report)

Stock trend as per ASX (Source: Companyâs report)

As on 20th May 2019, the stock traded at A$29.900, down 4.959% (As on 24 May 2019). With a market cap of A$1.54bn, it has delivered a YTD return of 74.78%, while the 6-month return stands better at 78.75%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.