It’s autumn in Australia, when you usually plan to indulge in a lot of fun activities outdoor amidst the beautiful weather. As it marks the transition from summer to winter, you generally think of updating your wardrobe for the approaching cold climate. But, this time it’s different, isn’t it?

Possibly, you must not be thinking of visiting a shopping mall for upgrading your dress collection. It’s very much likely that you have also not planned any outdoor activity this time. Perhaps your autumn plans are same as of others, staying at home and practicing social distancing.

COVID-19 pandemic has certainly changed our lives, the way we travel, the way we shop and the way we work. Though people are getting accustomed to it as soon as possible, the businesses may not get back to their normal business practices so easily. Several companies have already withdrawn their profit guidance in the wake of coronavirus crisis.

In this backdrop, let us discuss three Australian retail property groups that own and manage a large portfolio of shopping centres and have withdrawn their FY20 earnings guidance:

Vicinity’s Balance Sheet Remains Solid, Says CEO

One of Australia’s leading retail property groups, Vicinity Centres (ASX:VCX) has recently withdrawn its earnings and distribution guidance for FY20 owing to the escalation of coronavirus pandemic and heightened uncertainty surrounding the effect to operating and retail trading environment.

The Company’s CEO and Managing Director, Mr Grant Kelley mentioned that the Company’s balance sheet remains solid, with $1.3 billion of undrawn facilities. He added that the earnings and distribution guidance has been withdrawn after observing as a deterioration in the retail trading and operating environment since the time Company announced its interim results in mid-February.

In its financial report for the half year ended 31st December 2019, Vicinity Centres Trust Group reported the statutory net profit after tax of $219.5 million, which marked a rise of $2.7 million on the prior corresponding period (pcp).

Moreover, the Trust Group declared the following statutory result highlights:

- Positive operating cash flows of $350.8 million;

- Total revenue and income of $602.9 million;

- Property revaluation decrements of $53.2 million;

- Basic earnings per unit of 5.83 cents; and

- Distributions per unit of 7.70 cents.

The Trust Group notified in its half-year report that it maintains a strong and conservative capital structure with appropriate liquidity, low gearing and a diversified debt profile (by source and tenor).

As per Mr Kelley, the Company is flexible enough to postpone capital expenditure on major projects until coronavirus-related uncertainties are resolved. Recognizing the impact of a pandemic on Australia, he has assured to work with the Company’s retailers during this phase of adjustment.

Stockland Has Strong Investment Grade Credit Ratings

Australian property development company, Stockland (ASX:SGP) recently withdrew its FY20 funds from operations (FFO) and distribution guidance following intensified uncertainty around the coronavirus outbreak. However, the Company has strong investment grade credit ratings of A-/A3 with a stable outlook from S&P and Moody’s respectively.

The Company also has a robust balance sheet, with gearing of 26.1 per cent as at 31 December 2019. Moreover, it has a total available liquidity of $850 million, including cash and committed undrawn bank debt facilities available at 29th February 2020.

The Company reported that it has a well-diversified debt book and long dated maturity profile with considerable headroom in its financial covenants.

In this backdrop, let’s take a quick look at the key highlights of the Company’s financial results in the half year ended 31st December 2019:

- Statutory profit improved 66.1 per cent to $504 million.

- FFO declined by 5.6 per cent to $384 million.

- FFO per security fell 4.2 per cent to 16.1 cents.

- Adjusted funds from operations (AFFO) dropped 4.2 per cent to $338 million.

- AFFO per security plummeted 2.7 per cent to 14.2 cents.

- Net tangible assets per security rose to $4.12 from $4.04 at 30 June 2019.

- Distribution per security at 13.5 cents.

In the half-year results, the Company reported its FY20 projections as FFO per security of 37.4 cents and distribution per security of 27.6 cents, which are now being withdrawn.

SCP’s Centres Stay Resilient in the Current Crisis

Shopping Centres Australasia Property Group (ASX:SCP) reported about the withdrawal of its FY20 earnings and distribution guidance on 25th March 2020. However, the Company believes its supermarket-anchored centres remain resilient in the current crisis.

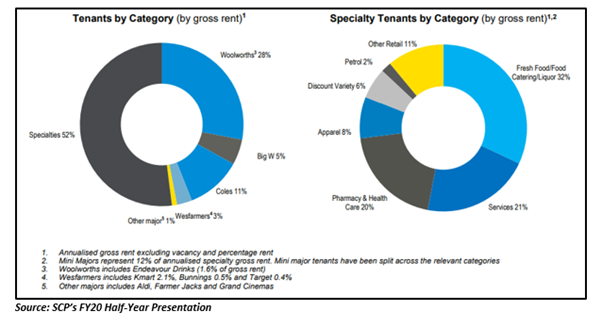

The Company emphasized that all of its eighty-five shopping centres are either anchored by Coles Group Limited’s (ASX:COL) or Woolworths Group Limited’s (ASX:WOW) supermarket and are benefitting from the elevated foot-traffic over recent weeks. The Company’s anchor tenants represent 48 per cent of its gross rental income, while its specialty tenants account for remaining 52 per cent.

Below chart demonstrates the classification of the Company’s tenants by category:

The Company also mentioned that its several tenants had to close their businesses over the last few days for an indefinite period, particularly those operating cinemas, beauty, massage, tanning salons, gyms and nail bars. These tenants account for around $1.0 million per month of the Company’s gross rental income.

As the Company’s total annual gross property income is about $300 million at present, the gross rental income from all its tenants in the impacted categories is about 0.6 per cent of its annual gross property income per month. The Company added that any effect on its FY20 earnings from rental loss is likely to be partly offset by interest expense savings, rises in percentage rent from its anchor tenants and cost savings.

With $176 million in cash and undrawn facilities, the Company considers its balance sheet and debt position as robust. It expects to have positive cash flows over the next thirteen months.

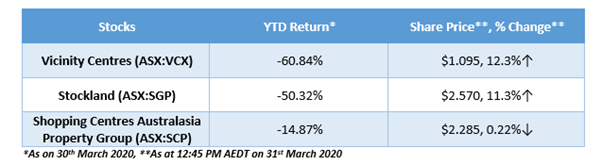

Stock Performances

Before concluding, let’s take a quick peek into these companies’ stock performances in the below table:

_09_03_2024_01_03_36_873870.jpg)