2019 has been a challenging year for several construction and material companies, with headwinds associated with declining market activity and significantly higher energy costs. Particularly in Western Australia, market conditions remain extremely difficult. The demand for materials softened (driven by softer residential demand) in several key markets and external delays and disruptions heavily impacted the industry.

As per the Australian Bureau of Statistics, in the June 2019 quarter, the trend estimate for the value of total engineering construction work done declined by 2.9%, while the seasonally adjusted estimate for the value of total engineering construction work slumped by 0.9% to $20,361.2 million.

However, for the coming months, market experts have depicted a more modest downturn in residential construction relative to past cycles. In FY2019, even across borders, the US housing market contracted for the first time in eight years, with extreme rainfalls disrupting activity across the country, though the stance is expected to improve (supported by lower interest and mortgage rates).

How are ASX-listed material companies performing in these challenging times? Let us find out:

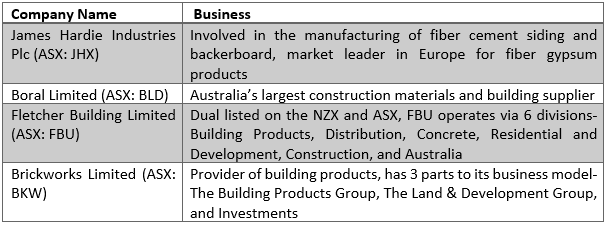

Companies in Discussion

James Hardie Lifts Profit Guidance Catalysed By Improving US Housing Market

The worldâs biggest fibre cement manufacturer, James Hardie Industries Plc (ASX:JHX) lifted its FY2020 adjusted net operating profit guidance, on the back of improving US housing market. The company is expecting the FY2020 net operating profit to range between US$340 million to US$370 million (previously US$325 million to US$365 million) after posting a 17% rise in the first half adjusted operating profit.

In Australia, the company expects a high single digit percent contraction for FY2020, while the Aussie housing market recovers from a two-year property downturn.

For the second quarter of fiscal year 2020 and half year ended 30 September 2019, JHX posted a NOPAT of US$98.6 million and US$188.8 million, respectively. The first-half dividend of US$0.10 per share was declared, payable on 20 December 2019.

The net sales for the quarter and half year increased by 2% (on pcp) to US$660.1 million and US$1,316.9 million, respectively.

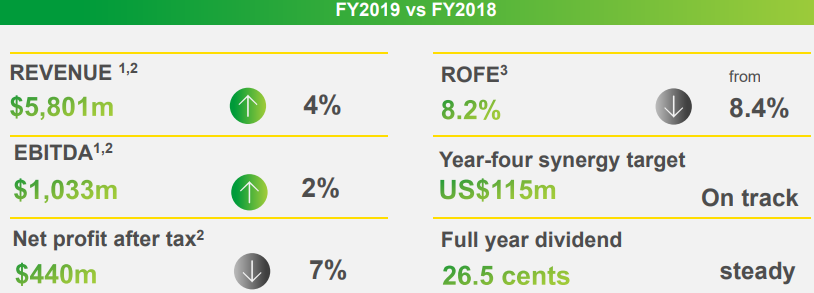

Boral Reaffirms FY2020 NPAT Outlook Guidance

In 1Q FY2020, Boral Limited (ASX:BLD) witnessed volume pressures in several businesses, reflecting softer activity. In Australia, the 1Q earnings were low, driven by delays in infrastructure projects and the overall softer housing market. In North America, 1Q earnings were slightly lower than the prior year, though the early signs of US housing market improving might benefit 2H. USG Boral faced slowdown in residential construction in Australia, and continued downturn in South Korea, driving low earnings.

The company expects NPAT to be ~5-15% lower in FY2020 relative to FY2019 (reflecting lower earnings and higher depreciation charges), while FY2020 property earnings are likely to range between $55 million and $65 million.

(Source: BLDâs Report)

On the good side, BLD posted a 14% improvement in RIFR for FY19 and 10% of its revenue was driven from lower carbon, high-recycled-content products. As per the companyâs report, since 2012, energy use and CO2-e emissions reduced by 27% and 32%, respectively.

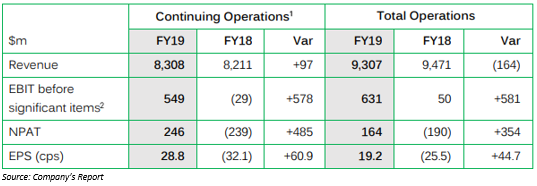

Fletcher Building Deals with NZICC Fire Hazards; Strong Results in FY2019

As per a Fletcher Building Limitedâs (ASX:FBU) report, on 22 October 2019, a significant fire started at the Fletcher Building Limited construction site of the New Zealand International Convention Centre (NZICC), though the company staff and subcontractors on the site were evacuated safely.

The company confirmed that Contract Works and Third Party Liability insurances were in place for the project. A couple of days later, SkyCity Entertainment Group Limited (ASX: SKC) confirmed that the situation was under control, and fire and emergency teams remained vigilant on the site.

On 6 November 2019, the site was handed back to the company, which is working to determine the impact of the fire on the projectâs delivery timeline and costs, the timing of insurance proceeds and cash flows.

For FY2019, the company returned to profitability despite challenges in Australia, reporting net earnings of $164 million, compared to a loss of $190 million in the year-ago period. FBU is expecting to register storing performance across all its divisions in FY2020.

Brickworks Acquires Assets of Redland Brick; FY2019 NPAT at $234 Million

The contribution from property was a highlight in 2019 for Brickworks Limited (ASX: BKW), driven by a significant increase in the value of the companyâs industrial property portfolio. Another significant highlight of the company was the acquisition of Glen-Gery, which is deemed to have taken BKW to be a true international player.

BKW reported a record underlying NPAT (continuing operations) of $234 million, representing an increase of 4% on pcp. The Underlying EBITDA from continuing operations was $346 million, up by 12% on pcp.

However, statutory NPAT was down by 12% to $155 million. The company declared a fully franked final dividend of 38 cents per share, up by 6% on pcp, bringing the total dividends to 57 cents per share, up by 3 cents (6%) for the year.

The Property division produced a record result in 2019, delivering EBIT of $158 million and recording a seventh consecutive year of earnings growth.

Within Building Products Australia, though orders and sales are currently steady in most divisions, BKW expects a soft first half in FY2020, wherein product development and innovation would remain a key focus. The Southern Cross Cement facility project is much anticipated and is predicted to deliver solid returns on invested capital.

The company recently entered into a binding agreement to acquire assets of Redland Brick Inc. for up to US$48 million, which supports BKWâs growth strategy in North America and is a quicker and more cost-effective route to achieving a modern network of highly utilised manufacturing plants, compared to building new plant. With the transaction expected to complete in February 2020, the acquisition is expected to deliver 3% EPS accretion within three years.

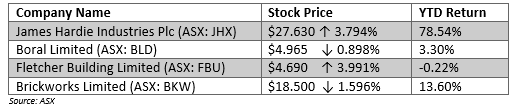

Stock Performance

Let us now browse through the stock performance of the discussed companies, post market close on 8 November 2019:

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.