According to a âHealth expenditure Australiaâ report for 2016 â 2017 by Australian Institute of Health and Welfare (AIHW), Australia spent nearly $181 billion on health which accounts to an astonishing 10% of the entire economy. The real growth, after adjusting for inflation, stood at 4.7% in the year.

With the development in the healthcare sector, it's becoming increasingly affordable for masses and could be one of the reasons to look at some healthcare stocks as an investment opportunity. Lets look at two health care stocks that are currently trading near their 52-week high levels.

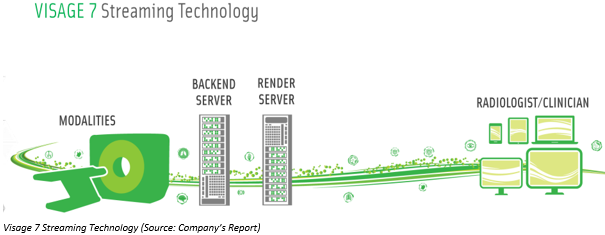

- Pro Medicus Limited (ASX: PME) is a medical imaging company that provides a full range of IT software and services based on radiology to hospitals on a global scale. In January 2009, the company acquired Visage Imaging, which delivers amazingly fast, multi-dimensional images through Visa 7.0.

In the latest investor presentation released on 2nd May 2019, the company updated about its performance and highlighted that Visage 7.0 continuous to be the no. 1 platform in speed, functionality and scalability. Its electronic health record which helps hospitals to consolidate their clinical and financial data was mandated in the US hospitals by the end of 2018. Through operational (transaction) model, which is used in RIS contracts in Australia a SaaS model based on guaranteed transactions minimums provides the company an annuity-style revenue stream. The projected 5 years revenue is upwards of A$160 million.

In 1HFY19 results, the company posted total revenue of $25.44 million with gross profit of $24.18 million. The profit for the year stood at $9.08 million, with basic earnings per share increased from 3.1 cents per share (cps) to 8.77 cps. The company reported total assets and liabilities at $69.27 million and $28.14 million respectively.

The company has a market capitalisation of A$2.23 billion, and the stock had touched a 52-week high and low of A$21.96 and A$6.999 respectively. The stock made an intraday low of A$20.84 and closed at A$21.25 as on 24th May 2019. The last one-year return of the stock is 177.4%, and the YTD return stands at 84.4%. The stock is currently trading near its 52 Week high level.

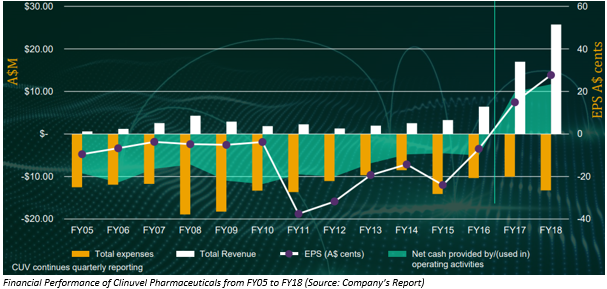

- Clinuvel Pharmaceuticals Ltd (ASX: CUV) is an ASX listed healthcare company, operating worldwide and which is developing innovative treatments against a range of severe genetic and skin disorders. CUVâs European Commission approved, lead compound SCENESSE® is used for the prevention of phototoxicity in adult patients having erythropoietic protoporphyria (EPP), which arises from deficiency in the enzyme ferrochelatase.

In 1HFY19 results, released on 26th February 2019, the company posted total revenue of $8.98 million with total expenses of $5.68 million. The profit for the year stood at $4.07 million, which led to an increase in the basic earnings per share from 3 cps to 8.5 cps. The company reported total assets and liabilities at $45.7 million and $2.58 million respectively

On 15th May 2019, the company released a notice regarding the change of directorâs interest. The companyâs Non-Executive Director, Karen Agersborg bought 1200 United States Level 1 American Depositary Receipts (ADRs) Over the Counter (OTC:CLVLY) at the price of 16.7804 per CLVLY ADR.

The company has a market capitalisation of A$1.57 billion, and the stock had touched a 52-week high and low of A$33.04 and A$9.43 respectively. The stock made an intraday high of A$33.04 and closed at A$32.61 as on 24nd May 2019. The last one-year return of the stock is 152.5%, and the YTD return also stands at 73.2%. The stock is currently trading near its 52 Week high level.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.