The Australian economy, like many countries, is facing challenges in terms of an ageing population, rising chronic diseases, rising demand for new treatments and more hospital beds. S&P/ASX 200 Health Care Index generated an annual return of 9.92%. Here, letâs take a look at a few companies with this perspective.

Orthocell Limited (ASX:OCC)

Orthocell Limited (ASX: OCC) is a small-cap regenerative medicine company with the market capitalisation of $82.6 million as on 28 June 2019. The company, prima facie, has two products to focus on (a) CelGro®, a naturally derived collagen medical device for soft tissue repair; and (b) OrthoATI®, used for chronic, treatment resistant tendon injuries.

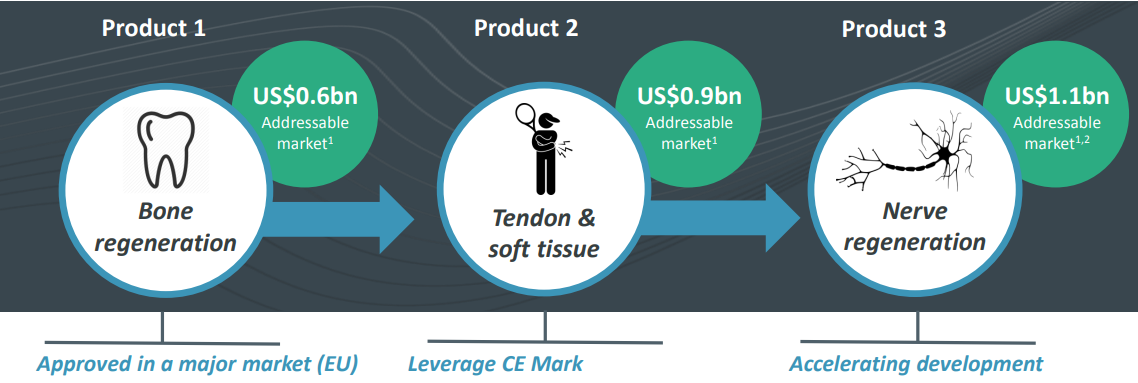

CelGro®: Strategic Focus (Source: Company Reports)

The company recently announced that all patients have successfully completed the CelGro® single-stage dental implant study (Marketing Study), which was planned to analyse efficiency and probability. This dental implant study took place after the completion of Stage-II dental implant trial as well as the market authorisation of CelGro® in the European Union (EU), which was accounted for dental bone & soft tissue application. The outcome of the marketing study authenticated CelGro® as a better medical device to overhaul the bones and soft tissues.

The company recently announced that it has issued 1,000,000 unlisted options exercisable at $0.413 on or before 13th June 2022, pursuant to Orthocell Limited Equity Incentive Plan.

The company also informed the market about issuing 26,500,000 shares (at an issue price of $ 0.40 per share) under a recent placement (Placement)), as announced in May 2019. OCC, through the Placement, raised $10.6 million before costs. This fund, combined with the cash reserves, will be deployed to speed up the commercialisation of CelGro® for dental bone, tendon and nerve repair into key markets. In addition, the funds will also be deployed to obtain the approvals from regulations in the US and other jurisdictions. Fund will also be utilised to assist the current business developments and marketing initiatives.

Quarterly Report for March 2019: A growth of about 80% was noted for total sales for nine months to March 31, 2019, over the prior corresponding period. 2019 biennial International Dental Show helped the awareness of global products and advanced strategic partner discussions. The company, during the period, progressed multiple studies required by the FDA, which were essential for CelGro® for 510(k) clearance in the US. The annual quality study unearthed a success rate of about 82%, using the Ortho-ATI® stem cell therapy to treat chronic tendon injuries to the shoulder, hip, elbow, knee and ankle tendons. The clinical trial in relation to Orthocellâs tendon regeneration therapy (Ortho-ATI®) against corticosteroids, was indicated to be on track for recruitment completion by 2QCY19.

CelGro®: The company has formulated a marketing strategy to establish CelGro® as a supreme membrane for bone and soft tissue repair, which, in turn, will speed up the revenues. OCC is receiving excellent traction in key European markets.

Outlook: The company is setting the grounds well for marketing as well as sales strategy, for its key product CelGro® in relation to dental bone and soft tissue repair. It includes the appointment of country-based distributors in the EU and undertaking targeted education, promotion and advertising programs. OCC is intended to leverage the CE Mark to receive Australia and the United States regulatory approvals and speed up the introduction of the tendon and nerve indications, in parallel to the commercialisation of Ortho-ATI® and pipeline products.

The stock has zoomed ~300% in the last three months and is trading towards its 52-week high level. At market close, the stock was trading at a price of $0.510, with a market cap of $82.6 million on 28th June 2019.

Paradigm Biopharmaceuticals Limited (ASX:PAR)

Paradigm Biopharmaceuticals Limited (ASX: PAR) is engaged in the research and development of therapeutic products for human use. It is a drug repurposing company, seeking new uses for old drugs, thereby reducing the cost and time to bring therapeutics to the market.

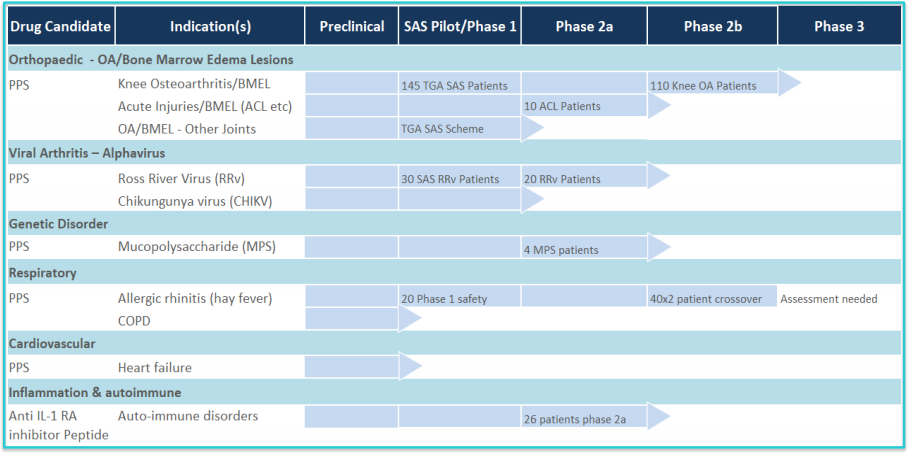

Broad Product Pipeline (Source: Company Reports)

The company recently reported about meeting its primary endpoint of safety in the pilot Phase 2a randomised, double-blinded placebo-controlled multicentre clinical trial in patients with chronic RRV (Ross River Virus) induced arthralgia treated with iPPS (injectable pentosan polysulfate sodium).

The company recently updated about >50% reduction in pain across 205 patients, suffering from OA (knee osteoarthritis). These OA patients were treated with iPPS under the Therapeutic Goods Administration Special Access Scheme.

PAR, as on 9th May 2019, notified about the successful completion of the retail component of its 1 for 8 accelerated non-renounceable Retail Entitlement Offer, which was announced on 15th April 2019. The Entitlement Offer was indicated to be underwritten by Bell Potter Securities Limited. The Retail Entitlement Offer was closed on 6th May 2019 and raised ~$16.5 million with the issue price of $1.50 per share. The total amount, including shares issued under the institutional component, will stand at ~$26.3 million.

1H FY19 Performance: In the month of November 2018, the company raised $5.55 million via a significantly oversubscribed Placement with existing and new institutional, sophisticated and professional investors. The capital raise meant that the company is well funded for CY19.

In the period, the company reported a total expenditure of $3.6 million, with the majority of costs related to the R&D and preparations for its Phase II OA and BML trial and the Phase II RRV trial. At the end of 1H FY19, cash in bank stood at $6 million. The company is well funded to meet the R&D expenses related to the trial and other R&D activities.

At market close, the stock was trading at a price of $1.400, with a market capitalisation of $256.6 million. The stock has rallied ~113% in the last one year and 39.49% in the last six months, whereas for the last one month, the stock has dipped ~9.80%. The 52-week high and low range for the stock stands at $2.149 and $0.591.

Sonic Healthcare Limited (ASX:SHL)

Sonic Healthcare Limited (ASX: SHL) is engaged in the provision of medical diagnostic services and the provision of administrative services and facilities to the medical practitioners.

Sold-off Stake in GLP Systems: The company very recently announced that it has sold its 85% shareholding in GLP Systems GmbH to Abbott, acquiring the remaining 15% stake as well in GLP. With the transaction, the company will generate profit after tax of ~â¬30 million or ~$48 million. The cash amount of ~â¬80 million or ~$130 million (comprising sale transaction amount and shareholder loan repayments) will be returned to SHL. With this amount, the company will pay its current debt and create extra balance sheet capacity for additional laboratory acquisitions. Revenues for GLP in FY19 is approximately â¬14 million or ~$23 million. As per the sales deed, Sonic and Abbott will be in a long-term collaboration agreement and Sonic will continue to be an important customer of GLP.

The company also updated that it has issued 68,000 fully paid ordinary shares, including (a) 33,000 shares issued at $27.34 per share on the exercise of options with an exercise price of $19.78 per option, and (b) 35,000 shares issued on the exercise of options with an exercise price of $12.57 per option.

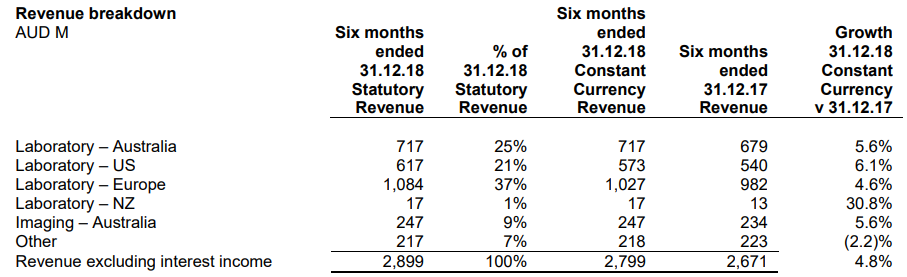

1H FY19 Results Performance: The company posted revenue growth of 9% in 1H FY19. The group organic revenue growth came in at 4.5% at constant currency (CC). The Laboratory division witnessed a 10% revenue growth in the period, and this included about 5% of organic revenue growth on CC. About 6% of organic revenue growth for Australian Laboratory was noted and this included sales from groupâs National Bowel Screening contract. Organic revenue growth for the US came in at ~8% on CC. The total US sales witnessed a decline by about $13 million, in view of the merger of SHLâs US Mid-west division into its JV with ProMedica Health System. Sales from the US was impacted by Medicare fee cuts, which came into effect from 1st January 2018. Further, a rate cut from 1st January 2019, presented comparatively less headwind for CY2019. The UK operations reported for an organic growth of about 9% on CC, in view of the Barnet /Chase Farm NHS hospital laboratory outsource contract (in October 2017). The company reported almost flat results in relation to organic growth for German and Belgian segments, which was affected by the European heatwave during the summer season. The sales from Germany was also hit by changes in regulations to referrer âbonusâ calculations relating to the EBM fee system, which was partially offset by selective fee quota rise. Growth in Germany, however, found some support coming-in through the acquisition of Pathology Trier, done in July 2018. The organic growth for Swiss segment stood at 5% on CC.

Revenue Breakdown (Source: Company Reports)

At market close, the stock was trading at a price of $27.100, with a market capitalisation of $12.91 billion and an annual dividend yield of 3.01%. Currently, the stock is trading towards its 52-week high of $28.030. The stock has gained ~25% on a YTD basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.