Healthcare changes significantly on the back of continuous technological advancements, from antibiotics and anaesthetics to radiotherapies and magnetic resonance imaging scanners. The future of technological improvements like new drugs and treatments and new devices are going to keep changing healthcare. However, human consideration will remain one of the stable constraints of breakthroughs.

One of the most important things that aren’t going to change the health care sector is its continuous implementation of technology. The health care world has been going through its digital revolution. Latest technologies such as telemedicine, wearables, and Internet of Things (IoT) connectivity are getting their way into clinics, hospitals, and care homes. These technologies are designed at enhancing care pathways to decrease average hospital stays and improve patient well-being.

Giving patients an improved hospital experience, connecting healthcare professionals to safeguard the continuity of care and access to patient data, and connecting healthcare services to utilize the power of the IoT are some of the benefits of adopting latest technologies.

Healthcare & Technology Interconnected

Mounting administrative costs and the requirement for prompt and comprehensive access to a patient’s medical records to evade errors have augmented the need for big data (the cloud-based electronic health records [“EHR”] model being the most preferred), 3D printing, blockchain and Artificial Intelligence (AI). Notably, these trends are presently influencing the MedTech space.

The impact of artificial learning (AI) and machine learning (ML) in the health care industry is life-changing. Artificial Intelligence applications are changing hospital care to clinical research, drug development and insurance and the working of the health sector in a bid to enhance patient results and reduce expenditure.

Another new craze is the blockchain technology, a modern method of collecting the same amount of digital information in a way that takes up a reduced amount of space. Remarkably, blockchain technology permits particular investigators to gain access to parts of patient’s data for a fixed time period. With this technology, patients can link to different hospitals and instinctively gather their medical data. This, in turn, keeps patient records more secure, while at the same time making it easier for suppliers to share information on patient care.

As healthcare becomes more connected and organized, cybersecurity becomes a main worry for hospitals. Notably, healthcare services have been the focus of many high-profile incidents by hackers that have cost millions and caused a major disturbance in patient care systems. In fact, security faults are often found in electronic medical device operating systems or other devices like imaging scanners, ECG machines, telemetry systems and infusion pumps.

Future Projections

It is expected that the health care sector will have many prospects in upcoming years and spending in this sector is likely to increase at a compound annual growth rate (CAGR) of 5% in the time span of 2019-2023. The drivers accountable for the growth of the health care sector in upcoming years are growing incidence of chronic diseases, aging demographics, and advancements in the technology.

Stocks to Watch Out For

In this article, we have highlighted three promising health care stocks in the coming years:

PolyNovo Limited (ASX:PNV)

PolyNovo Limited is involved in building NovoSorb BTM, a dermal regeneration solution. The company produces this solution by utilizing its patented technology which is based on polymer and identified as NovoSorb biodegradable polymer technology. NovoSorb BTM is listed for use in Australia, Malaysia, United States, Saudi Arabia, New Zealand, India, South Africa and Israel.

Financial Highlights for 2019 (year ended on 30 June 2019)

The company reported FY 2019 revenue of $13.683 million, an increase of 128% year over year. Revenue from Sales of NovoSorb BTM amounted to roughly $9.3 million. The company ended the period with a cash balance of $13.9 million.

Source: Company’s Annual Report

Outlook

The company expects that the manufacturing process for hernia is likely to bring some productivity advantages to NovoSorb BTM making a positive effect towards its gross margins.

Further, the company also stated that the latest production machines have been ordered and would be supplied around February 2020. The company anticipate filing for US FDA 510(k) towards the end of the fiscal year 2020.

Stock Information

On 14 January 2020, PNV’s stock closed at $2.165, up by 4.589% compared to its last closing price, with a market cap of approximately $1.37 billion.

Cochlear Limited (ASX:COH)

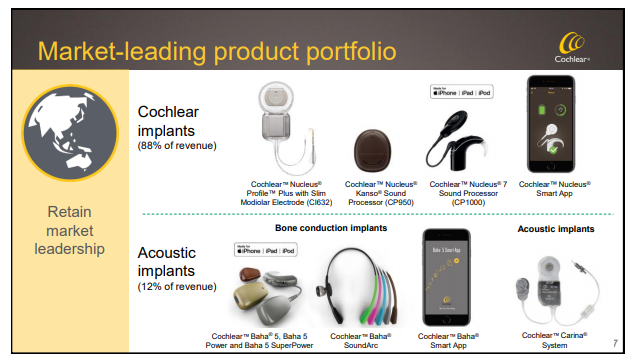

Cochlear Limited is engaged in the advancement and supply of implantable hearing solutions for providing a lifetime of hearing outcomes. The company’s implantable hearing solutions have two main parts: first is the external sound processor and the second part is the implant surgeons. Cochlear offers its implants along with acoustics. Notably, 12% of the total revenue comes from acoustics that consists of bone conduction implants and acoustic implants.

Source: Cochlear Capital Markets Day

FY2020 financial View

In FY2019 (period ended 30 June 2019), the company provided its guidance for FY2020. The company predicts net profit in the range of $290-300 million, an increase of 9-13% on underlying net profit for FY2019. The company also expects solid growth in cochlear implant units, attributed by various latest products launched late in the FY2019.

Stock Information

On 14 January 2020, COH’s stock closed at $231.639, slipping by 0.224% compared to its last close, with a market cap of approximately $13.43 billion.

Nanosonics Limited (ASX:NAN)

Nanosonics Limited is a leading health care player involved in the advancement of unique automated high-level disinfection device and is a pioneer in delivering high-level disinfection for ultrasound investigations. Nanosonics unique, automated trophon® EPR high-level disinfection device is a complete solution for reducing the spread of health care-acquired diseases by lowering the infection among the patients.

The company is operating with the aim of enhancing the safety of patients, clinics along with their staff by changing the way of illness impediment and creating new technologies for providing improved standards of care.

FY2020 Guidance

For the FY2020, the company has proposed to concentrate majorly on the below three zones:

Firstly, the company is planning to establish trophon as a standard of care for the high-level disinfection of all semi-critical ultrasound surveys.

Secondly, Nanosonics Limited is intending to invest and grow into new markets and drive understanding for the impact of high-level disinfection of ultrasound probes.

Last but not the least, the company is proposing to develop its product portfolio and focus on the expansion and commercialisation of new products to meet the ever-increasing demand for infection prevention.

Stock Information

On 14 January 2020, NAN’s stock closed at $7.010, up by 2.187% from its last close, with a market cap of approximately $2.06 billion.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.