Several investors opt for options trading frequently to optimize their risk-adjusted returns. Options are a form of financial instruments or contracts that offer bearer the right to either purchase or sell a particular amount of an underlying asset at a pre-set price at or before the expiry of the contract.

Most of the options are either American or European (style) options, that have almost similar characteristics but carry a significant difference. Owners of European-style options can only exercise the option on the day it expires, while owners of American-style options can exercise it on any trading day until the option expires. These options are commonly referred to as âVanilla Optionsâ.

Understanding Vanilla Options

A vanilla option is a type of financial derivative contract between two parties that gives the right but not an obligation to the buyer to buy or sell an underlying asset at a certain price (strike price) on a pre-defined time (expiry date). It refers to a normal option with no special or unusual features. While buying a vanilla option, the trader has to pay a cost for obtaining this financial instrument, which is termed as âpremiumâ.

Vanilla options can be classified into call options and put options. Let us understand both of these options in some detail below:

Call Options

The call option offers the buyer right but not an obligation to buy an underlying asset at a pre-set price within a given timeframe. The traders who believe that the price of the asset is likely to rise within a certain time frame, buy call options. Such traders are usually referred to as bull traders.

For instance, suppose a trader purchases one call option contract (for 100 shares) that expires in one month on some XYZ stock, at a strike price of $40 by paying a premium of $240 for the option. If the XYZ stock trades at $50 at the time of expiry of the option, the buyer can exercise his right to buy 100 shares of XYZ stock at $40 a share. He may choose to immediately sell the shares at the current market price ($50), thus gaining profit. The buyer thus makes a profit of $760 ($5000 - $4000 - $240).

In case the price of XYZ stock does not rise above the strike price within the specified timeframe, the buyer of the call option contract loses the premium paid for the option.

Put Options

The put option offers the buyer the right but not an obligation to sell an underlying asset at a pre-set price within a certain timeframe. The traders who speculate that the price of the asset would fall within a certain time frame, buy put options. Such traders are usually referred to as bear traders.

For Instance, suppose a trader purchases one put option contract (for 100 shares) that expires in one month on some ABC stock at a strike price of $30, by paying a premium of $180 for the option. If the price of the stock falls to $20 a share at the time of expiry, the buyer has the right to sell the option contract to at $30. The buyer thus makes a profit of $820 ($3000 - $2000 - $180).

Even in this case, the possible loss to the buyer is the cost of the put option contract.

Determinants of Option Value

Let us now take a look at the factors that most likely affect the value of an option:

- Value of an Underlying Asset: When the value of an underlying asset increases over time, the right to sell the option contract (put option) at a fixed price becomes less valuable, and the right to buy the option contract (call option) becomes more valuable.

- Dividends: The value of an underlying asset increases with dividends which usually drives the option prices up. Options are generally valued considering the projected dividends up to the option expiration date.

- Strike Price of Options: The put option becomes more valuable at a lower strike price.

- Life of the Option: The longer life of options makes the call and put options more valuable.

Advantages of Vanilla Options

Investors get attracted to vanilla options for their various benefits, including:

Protection Against Unfavourable Market Price Movements: A vanilla option protects investor or trader against unpredictable volatility in the market during the term of a vanilla option. Especially in case of economic downturn when prices of shares usually drop, put options can protect the shares of investors against a fall in value.

Flexibility: A vanilla option offers flexibility to an investor to choose strike price, maturity and type of instrument on his own, providing greater flexibility.

Free from Obligations: The best part of a vanilla option is that it offers the right but not an obligation to exercise the option. This means one can take advantage of favourable movements in the market without any compulsion to exercise a vanilla option.

Time to Decide: At times when an investor is not sure that whether he should move ahead with purchase or sale of shares or not, the option contract enables him to postpone the decision till the option expires.

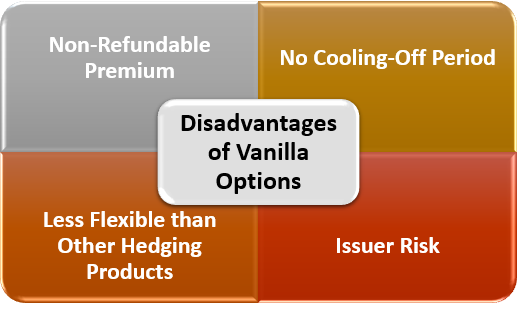

Disadvantages of Vanilla Options

Although vanilla options do come with multiple benefits, the following risks are also associated with vanilla options:

Non-Refundable Premium: The premium paid to the option writer while purchasing the option contract is non-refundable regardless of whether the option expires or is terminated on or prior to the expiry date.

No Cooling-off Period: There is no cooling-off period in vanilla options. This means that if an investor has already entered into an option contract, there is no facility to cancel the contract without incurring a cost.

Less Flexibility than Other Hedging Products: Investor does not have a choice to change or amend the expiry date of the vanilla option contract. In this direction, a vanilla option offers less flexibility than other hedging products.

Issuer Risk: While entering into a vanilla option, the investor relies on the financial ability of the issuer of an option contract as its ability to perform the obligation at the time of expiry of the contract. As a result, the investor gets exposed to the insolvency risk, which can refrain the issuer from meeting its obligations under the vanilla option.

It can be inferred that though vanilla options are an interesting form of investment instrument that can enhance an investorâs portfolio, one should choose the appropriate option after determining the risk-reward payoff and identifying the suitable option strategy.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.