Nuclear Power and Uranium still hold some stigma around safety; however, nuclear energy is, in fact, a clean and sustainable source of energy along with being the second largest source of low-carbon electricity in the world.

According to the World Nuclear Association (WNA), global uranium production in the year 2017 totalled around 59.5k tonnes of uranium, on account of major contributions from key producers like Kazakhstan, Canada, Australia, Niger and Namibia. Currently, the number of civilian fission reactors in stands at 449, globally. Moreover, 58 civilian fission reactors are under construction, while 154 are under planning. Also, civilian nuclear power plants contributed 2,488 terawatt hours of electricity, accounting for ~10% of the global power generation, as per WNA.

Did you know? Nuclear energy emits zero harmful by-products like carbon dioxide and only harmless water vapour is secreted from nuclear power plants due to the high density of nuclear fuel.

The Compelling Uranium Story

There may be a solid long-term outlook for the uranium market. On the supply side, the rate of development of new mines cannot match the anticipated demand and would be unable to respond in time to price hikes. With this backdrop, the mines currently on C&M have a significant restart timeline advantage.

As for the demand side, it is given that nuclear energy is a low cost and low emission base load energy source while there is also a greater global impetus to bring down carbon emissions as the phenomenon of global warming intensifies. In addition, the Intergovernmental Panel on Climate Change (IPCC) report suggested to limit the global warming increase to 1.5?C which has prompted many nations to act accordingly-

- The Republic of China intends to have 56 reactors operating by 2020 and 180 reactors, or 220% increase, by 2030 to reduce its reliance on coal.

- Another Asian country, India plans to have 21 reactors into operation by 2031.

- 17 new reactors in Saudi Arabia announced in 2018.

Moreover, the demand for uranium is being further stimulated by the burgeoning electric vehicle (EV) revolution and reliable forecast shows that sales of EVs are expected to increase from a record 2 million worldwide in 2018, to a staggering 10 million in 2025, further surging to 28 million by 2030.

Nuclear energy is gaining increased support and renewables are not the answer by themselves.

Some of the uranium focussed companies in Australia include Paladin Energy Ltd (ASX: PDN), Leigh Creek Energy Limited (ASX: LCK), Energy Resources of Australia Limited (ASX: ERA), Deep Yellow Limited (ASX: DYL) and Toro Energy Limited (ASX:TOE). Letâs take a detailed look through Paladin Energy Ltd.

Paladin Energy Ltd

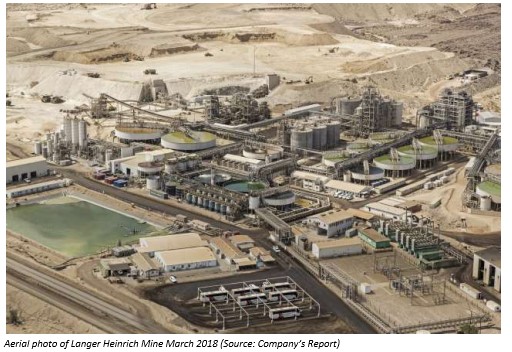

Australia-based Paladin Energy Ltd (ASX: PDN) is a global uranium leader with a focus on Africa, Australia and Canada. The company has a production history of 14 years from its two key mines in Africa, being Langer Heinrich Mine (LHM) located in Namibia and Kayelekera Mine located in Malawi. Both mines are presently on care and maintenance (C&M), preserving Paladin Energyâs resource and shareholder value in the current low uranium price environment.

In addition, the company owns a diversified portfolio of development assets in Australia and North America with unsurpassed uranium price leverage (~8Mlbpa idled capacity).

PFS Delivers Improved Metrics for LHM

On 14 October 2019, Paladin Energy announced improved economics to re-start its flagship Langer Heinrich Mine in Namibia (refer to the figure below) following the completion of the first stream of the Pre-Feasibility Study (PFS1), which focused on a rapid, low capital and low risk restart.

Background- The mine was transitioned to C&M in August 2018 due to the sustained low uranium price. Subsequently in February 2019, Paladin Energy finished a concept study, which identified multiple options to reduce operating costs, improve process plant performance and potentially recover a saleable vanadium product.

Paladin then commenced a two-stream Prefeasibility Study in March 2019 (PFS1 and PFS2), targeted towards improving the details of the Langer Heinrich restart plan and to pursue further improvement options to clearly present a compelling investment case. PFS1, now completed, has delivered a further optimised plan for the restart with a level of accuracy of +25%/-15% while it has also confirmed that LHM could be back in production within 12-months of financing being in place.

The highlights include-

- Estimated capital of USD 80 million confirmed for restart at production levels of ~5.2Mlb per annum.

- Opportunity to increase production to 6.5Mlb pa through additional high return, discretionary capital of USD 30 million enhancing access to offtake and financing.

- Aspirational average life of mine (LOM) All in Sustaining Cost (AISC) target of USD 30/lb achievable.

- Potential for further AISC improvements of approximately USD 4.50/lb through significant process changes after restart.

- Maiden Vanadium Mineral Resource of 38.8Mlb V2O5 declared (122.1Mt @ 145PPM V2O5).

Going forth, the PFS2 scope has been reduced to focus on completion of in-progress test work and updating the pipeline of improvements for further development after the mine is restarted. The scope of the proposed rapid restart Feasibility Study (FS1) in FY2020 has also been reduced to focus on further optimisation and governance of C&M and the rapid restart plans.

Moreover, completion of the full scope of feasibility study work to Paladinâs standards has been deferred to when restart is imminent. The feasibility study work was budgeted to take nine months (June 2020) with the reduced scope now expected to be completed in March 2020.

The estimated cost required for the prefeasibility study from start to completion and the proposed feasibility study scope scheduled in FY2020 is USD 5.2 million. However, the original budget was USD 6.2 million for the prefeasibility study, reflecting a saving of ~USD 1 million.

Share Purchase Plan

On 8 October 2019, Paladin Energy informed that its Share Purchase Plan (SPP) had closed with subscriptions for 12,994,100 shares, raising approximately AUD 1.49 million, in addition to the companyâs placement of 262,812,641 ordinary fully paid shares to qualified, institutional and sophisticated investors that raised AUD 30.2 million (before costs). The allotment of shares issued under the SPP occurred on 11 October 2019.

Retirement of Chairman

On 19 September 2019, Paladin Energy advised that its Non-Executive Chairman, Mr Rick Crabb had expressed his intent to retire from the Board of the company, effective 31 December 2019, after having served as a Non-Executive Independent Director of Paladin Energy since 1994 and as Non-Executive Chairman since 2003.

He anchored the company through a significant phase of growth to become a top five uranium company by production and also through a significant prolonged market decline after Fukushima, the repercussions of which led to Voluntary Administration in July 2017.

Stock Information

Paladin Energyâs market capitalisation stands at around AUD 190.62 million with ~ 2.03 billion shares outstanding. On 15 October 2019 (AEST 01:38 PM), the PDN stock was trading at a price of AUD 0.091, down 3.191% by AUD 0.003.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.