Gold is recognised as a valuable commodity amongst investors worldwide for obvious reasons that it provides hedging against inflation, uncertainty and weakness in the global market which is presently at a high while it also allows for diversification of the portfolio.

The bond yields are falling across the globe including those of the United States, Germany and Japan. Also, the escalation of the US-China trade and technology conflict, developments in the Middle East, problems in Hong Kong along with issues between Japan and South Korea, to the consistent setback Brexit deal, all are indicating a bleak outlook for the world.

Central banks of all key economies are increasingly resorting to liquidity measures to mitigate the impacts on their respective economies in a recession scenario, pushing down bond yields which have reached a negative in many cases, increasing money supply.

Sometimes, these measures fail to stimulate demand and cause significant inflation and loss of purchasing power. In such phases, people flock to the yellow shiny metal which maintains its purchasing power in times of inflation unlike normal currencies.

Over the last few months, the gold price has experienced consistent rally, trading near its record high, owing to the increased buying from the global gold-backed exchange traded funds (ETFs). Also, an investor may opt for buying gold mining stocks that give exposure to gold indirectly amid the business model of a gold miner.

Now, letâs take a close look at the following three Australia-based gold exploration companies.

Northern Star Resources Ltd

Northern Star Resources Ltd (ASX: NST) is an Australian gold producer that has developed a portfolio of low-cost, high-grade Tier-1 world-class projects located in highly prospective and low sovereign risk regions of Australia and North America. The company continues to identify, acquire and aggressively explore to extend the mine lives across its operations.

On 3 October 2019, Northern Star Resourcesâ Director Mary Hackett acquired 4,468 ordinary fully paid shares (Indirect interest) in the company at a value consideration of AUD 11.19999 per share on market trade.

Echo Resourcesâ Unconditional Offer

On 23 September 2019, Northern Star Resources announced to have waived off all the remaining defeating conditions on the recommended cash takeover offer of AUD 0.33 per share for all of the issued shares of Echo Resources Limited. The offer is now unconditional. Northern Starâs current stake in Echo stands at 21.99%. The offer is currently scheduled to close at 7.00pm (Sydney time) on 14 October 2019.

Pogo Plant Expansion

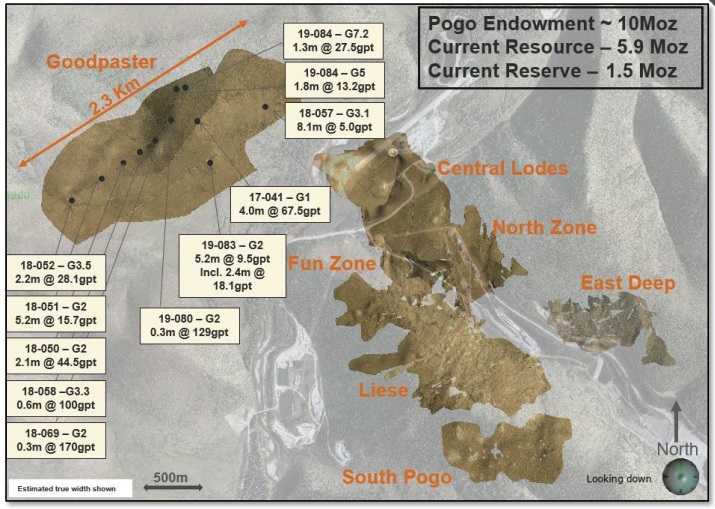

On 16 September 2019, Northern Star announced its plan to invest AUD 43 million (USD 30 million) in the expansion of the processing plant at its Pogo gold mine in Alaska, which would take the annual throughput capacity of the Pogo plant from one million tonnes to 1.3 million tonnes.

The work on the expansion project is expected to begin this financial year and targeted to be completed in early CY2021. Northern Star expects to invest USD 10 million during this financial year in the expansion project, with the remaining to be invested in FY2021. The USD 30 million investment is in addition to Northern Starâs current capital expenditure budgets and would be funded from ongoing cashflow.

Northern Star Executive Chairman Bill Beament stated that the outlook for Pogo is also underpinned by the strong exploration results being generated from the new discovery in the Goodpaster prospect located just 1 km from the existing mining areas.

Source: Pogo Site Visit Presentation

Stock Performance

Northern Star Resources has a market capitalisation of around AUD 7.48 billion with ~ 639.59 million shares outstanding. On 4 October 2019, the NST stock closed the dayâs session at AUD 11.700, up 0.086% by AUD 0.010 with ~ 3.24 million shares traded. In addition, NST has delivered positive returns of 34.52% in the last six months and 26.52% year-to-date.

Resolute Mining Limited

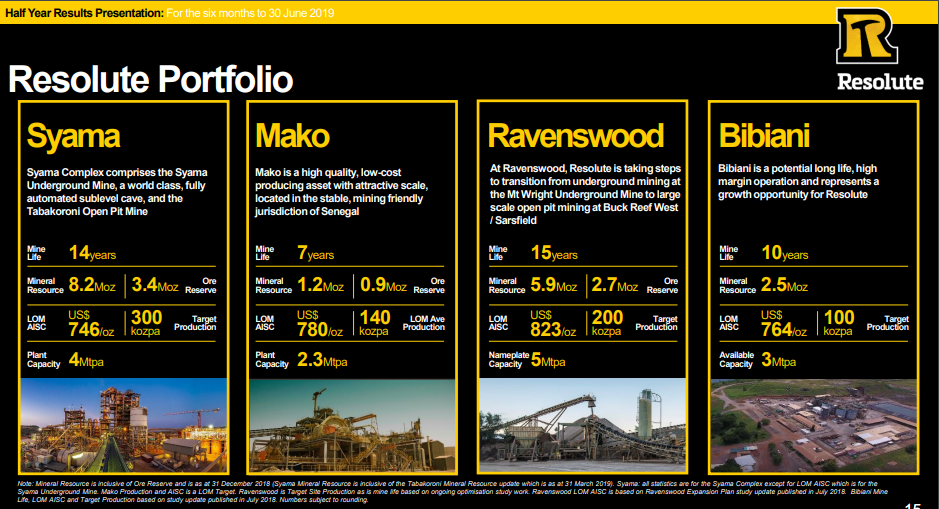

Resolute Mining Limited (ASX: RSG), also listed on the London Stock Exchange (LSE), is an Australia-based gold exploration and development company operating for more than 30 years. Currently, Resolute has four gold mines in its portfolio including its flagship asset being the world-class Syama Gold Mine in Mali, which has the production potential of over 300,000 oz gold per annum from its existing processing infrastructure.

Source: Half Year Results Presentation

Half Year 2019 Results

On 30 August 2019, the company disclosed its half yearly results for the six months to 30 June 2019 (H1 FY19), reporting revenue of AUD 324 million from gold and silver sales (H1 FY18: AUD 243 million), earnings before interest, tax, depreciation and amortisation of AUD 78 million (H1 FY18: AUD 29 million) and net profit after tax of AUD 39 million (H1 FY18: AUD 39 million).

During the half year, Resolute produced 176,237 ounces (oz) at an All-c (AISC) of USD 828/oz (AUD 1,173/oz) with total gold sales of 176,294 oz at an average realised gold price of USD 1,275/oz (AUD 1,800/oz).

The companyâs operating cash flow increased by 79% to AUD 95 million while it continued to significantly invest in development, property, plant and equipment with total expenditure being ~AUD 150 million. Also, during the year, the Syama Underground Mine achieved commercial production rates in June 2019, and it is expected to touch its full production capacity by 2019 year end.

Stock Performance

Resolute Miningâs market cap stands at around AUD 1.26 billion with ~ 903.15 million shares outstanding. On 4 October 2019, the RSG stock settled the dayâs trading at AUD 1.400, with ~ 8.3 million shares traded.

In addition, the RSG stock has delivered positive returns of 21.40% year-to-date, 19.31% in the last six months and 6.11% in the last three months.

Recently, Van Eck Associates Corporation increased its shareholding in RSG from 9.10% to 10.64% while L1 Capital Pty Ltd purchased 53,029,631 fully paid ordinary shares, translating into a voting power of 5.87% in RSG.

Gold Road Resources Limited

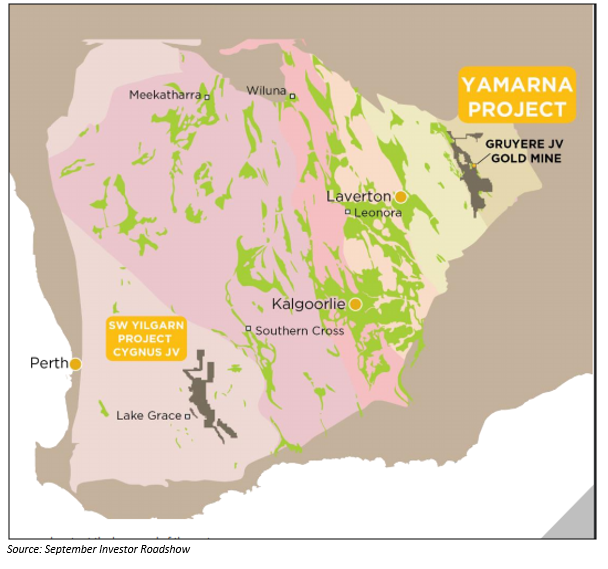

Gold Road Resources Limited (ASX: GOR), based in West Perth, Australia is a mineral exploration and production company, focused on the development of Australiaâs newest goldfield, the Yamarna Belt, 200 kilometres east of Laverton in Western Australia, where Gold Road holds interests in tenements covering ~ 6,000 km2.

Gold Road uses a staged Project Pipeline approach to manage, prioritise and measure success of the exploration portfolio.

Yamarna Exploration Update

On 9 September 2019, Gold Road Resources announced positive diamond and reverse circulation (RC) assay results from its recent exploration programmes.

At the Yaffler South prospect within the Southern Project Area â Milestone 3 Projects, bedrock RC drilling intersected coherent and consistent mineralisation across one traverse on a new trend to the west of the previous drilling. Best intersections include- 11 metres at 5.94 g/t Au; 12 metres at 3.40 g/t Au; 12 metres at 2.71 g/t Au and 4 metres at 3.37 g/t Au.

Secondly, the company also nearly completed diamond drilling at Gruyere JV prospect (50%-owned) to enable conversion of Inferred Resources to Indicated Resources to support optimisation of the mine plan and the placement of mine infrastructure. Till the date of the release, six of the 20 hole-programme returned assays, better results include- 36.2 metres at 2.44 g/t Au; 44.9 metres at 1.80 g/t Au and 73.4 metres at 1.80 g/t Au.

In addition, the company stated that the interpretation of drilling results from the Gilmour?Morello prospects continues and will be incorporated in a Maiden Resource Estimate which is due for completion in the c 2019 quarter.

Stock Performance

Gold Road Resourcesâ market cap is around AUD 1.07 billion with ~ 878.88 million shares outstanding. On 4 October 2019, the GOR stock closed the dayâs trading at AUD 1.205, down 0.823% by AUD 0.010 with ~ 3.95 million shares traded.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.