2018 marked strengthening of economy that was creating opportunities to reorient policy towards the longer-term pursuit of sustainable development, after a long period of stagnation. While 2019 depicts contradiction, given that disrupting forces have been sweeping the global economy. Sensitive to micro and macro-economic forces, trade flows are adversely impacted by the protracted trade wars. Automation and digital disruption are boosting productivity for a few economies, while eroding sources of advantages for others. The constant threat of climate change looms volatile than ever, along with geopolitical pressures and the prospect of a sharper-than-projected global slowdown.

The Current Global Economy

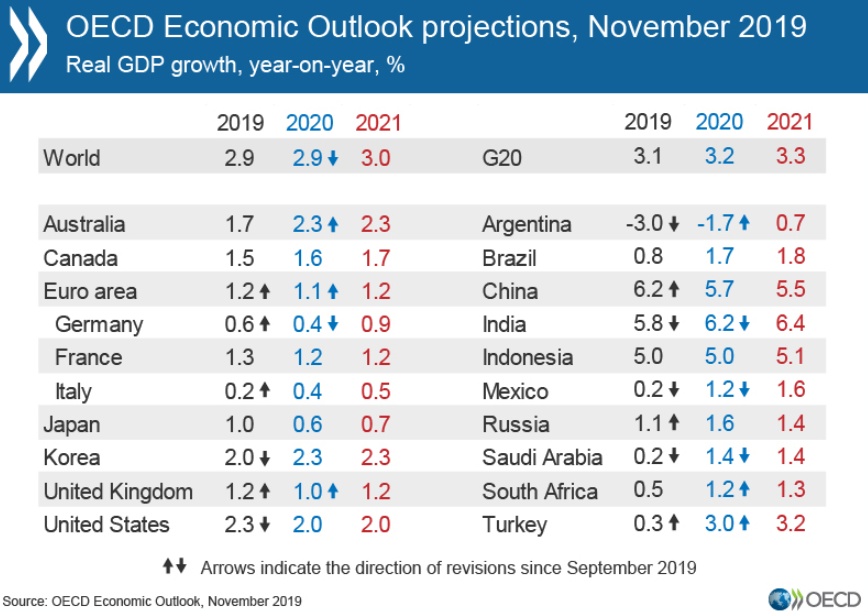

Currently, global trade is decaying and dragging down economic activity in nearly every major economy. According to the latest release by The Organisation for Economic Co-operation and Development (OECD) in November 2019, the weak trade and investment and persistent political uncertainty are weighing on the world economy, threatening long-term growth in the current time. In 2019, the World GDP growth is expected to be 2.9%, the lowest annual rate since the Great Financial Crisis of 2008. In 2018, the Global GDP had expanded by 3.5% in 2018.

Whatâs triggering and rather thought-provoking is the fact that this GDP growth is likely to remain subdued at 2.9% to 3.0% in 2020 and 2021. The slowdown has taken both advanced and emerging-market economies into its radar, though the gravity depends on the importance of trade in different countries. In the current global economy:

- Escalating tariff conflicts between the US and China, the worldâs biggest economies has majorly catalysed the slump;

- It has further undermined business investment and put jobs at risk;

- GDP growth slowed to 0.3% in the third quarter of 2019 in the OECD area;

- Household spending has been holding up, though signs of it weakening are emerging;

- Car sales have declined sharply over the past year.;

- Digitalisation is transforming business models;

- Climate and demographic changes are already disrupting existing patterns of activity;

- China has been currently rebalancing away from a reliance on exports and manufacturing towards consumption and services.;

- Aggregate investment growth in the G20 countries, excluding China, slowed from annual rate of 5% at the start of 2018 to only 1% in the first half of 2019;

- Global trade volume growth of goods and services is estimated to have slowed to 1% this year â its lowest rate since 2009;

- Uncertainty about a future EU-UK trade relationship poses a further risk to growth as does the current high level of corporate debt.

The Global Economy By 2030

Given the current turmoiled economic stance hovering over the world, economies are in dire need of co-ordinated political action to restore confidence, boost inclusive growth and raise living standards. However, there is a pervasive agreement among economy experts that by 2030, the world will be older and wealthier with reduced differences in GDP/capita throughout nations. An inclusive and dynamic global economy is integral to providing the aspiring targets of 2030.

Let us graze through the global economic outlook of the years to come:

- 470 million jobs are needed globally for new entrants to the labor market between 2016 and 2030. Moreover, without decisive action, it will take ~68 years to achieve equal pay, given that the global gender pay gap stands at ~23%;

- With persistently high levels of inequality, the goal of poverty eradication by 2030 is moving increasingly out of reach;

- The year 2030 might mark an historical point in human demography: the global population might reach a plateau and start to decline;

- A study conducted by PwC projects that the world economy will grow at an average of just over 3% per annum in the period 2014 â 50, doubling in size by 2037 and nearly tripling by 2050;

- India has the potential to become the second largest economy in the world by 2050 in PPP terms, and Nigeria and Vietnam could be the fast-growing large economies over the period to 2050;

- By 2030, the growth rate of China is subject to considerable structural uncertainty and depends on two key policy challenges- domestic rebalancing and political and institutional reform;

- Europe is expected to deliver a weak GDP growth, at an average annual growth rate of about 1.5% until 2030;

- Risks from marine inundation of coastal infrastructure will increase substantially when global warming reaches 1.5°C, which may be reached as early as in the 2030;

- Discussing climate change, the current estimates put electric vehicle sales at 11 million in 2025 and 30 million in 2030;

- The United Nations believes that achieving the target of eradicating poverty by 2030 will require dramatic shifts in countries where poverty rates remain high, both in terms of sharp accelerations in economic growth and steep reductions in income inequality (Longer-term growth projections point to nearly 30% of the population in least developed countries remaining in extreme poverty by 2030).

The Fed Rates Cuts Amid A Slow Economy

The Federal Reserve is the central bank of the US, and aims to give a secure, flexible and steady monetary and fiscal system. To attain its ultimate objective, the Bank has been making headlines through 2019, driven by its rate cuts, to boost the US economy, which is currently vulnerable to recession, exposed to trade war with China and a global slowdown, which threatens to drag the U.S. economy down.

In 2019:

- The first cut was announced in July, wherein the rates were cut from 2.5% to 2.25%;

- The second cut was announced in September- from 2.25% to 2%;

- The third and most recent rate cut by the Fed was announced in October wherein the rates were cut down to 1.75% from 2%.

But why must the Fed keep cutting interest rates? Let us find out-

High corporate debts and faltering profits are a bane to every economy. The US, one of the worldâs powerhouses is currently stuck between a booming economy amid whispers of a financial crisis around the corner. The main reason for cutting rates as much as thrice in a mere four-month span suggests that the Fed intends to aid the corporate sector, which is dangerously over-indebted, creating a financial bubble.

Secondly, the ongoing trade conflict with China and thirdly, a global economic slump are reasons enough for the Bank to shun the rates, to improve the debt figures.

Yet Another Rate Cut in 1H2020?

In its last Federal Open Market Committee meeting in October, the Fed indicated that it has no plans of a further cut except in a situation wherein it finds strong evidences that the economic outlook has deteriorated and needs to be checked upon.

This is reason enough for marker experts to believe that given the current sustained downturn in inflation and macro and micro economic factors causing the US (and global) economy to slow, could make the Fed announce more rate cuts in or around the first half of 2020, or as soon as in its next meeting in December.

Experts close to the Government indicate that even Mr Trump wishes for more aggressive rate cuts to aid the economy and help itâs not-so-likeable outlook. This is compared to economies like Australia, Japan and the EU, where Central Banks have been slashing rate cuts to boost their respective economies.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.