The S&P/ASX200 A-REIT Index declined 0.13% to settle at 1,643.9 on 29 August 2019 and the S&P/ASX 200 Real Estate Index closed at 3,817.4, down 0.19%. National Storage REIT and Cedar Woods Properties Limited recently released their full year 2019 results, each one reporting impressive performance with profits recorded over the period.

National Storage REIT

National Storage REIT (ASX:NSR) is a self-storage provider with 168 centres located across Australia and New Zealand, offering tailored storage solutions to over 60,000 residential and commercial clients. It is a private fully-integrated business with self-storage centres and the first of its kind to be listed on the ASX. The companyâs market capitalisation stands at around AUD 1.47 billion with ~ 781.26 million shares outstanding. On 29 August 2019, the NSR stock price closed the trading session at AUD 1.830, down 2.918% by AUD 0.055 with ~ 3.8 million shares traded.

Besides, the NSR stock has delivered positive returns of 6.80% YTD and 12.87% in the last one month. The company has an annual dividend yield of 5.09% to date.

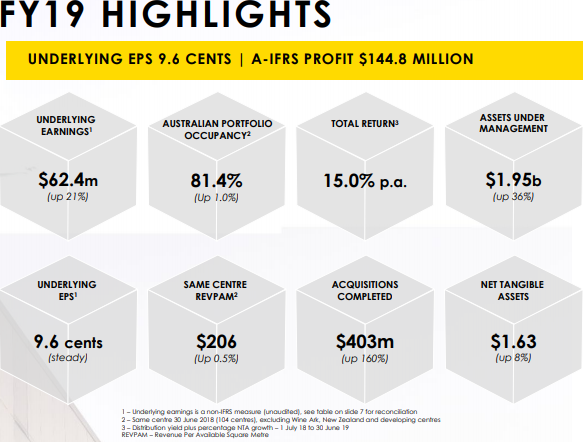

FY19 Results- Recently National Storage REIT disclosed its financial results for the year ended 30 June 2019 (FY19), posting an A-IFRS profit after tax of $ 144.8 million. The overall results were in line with the prescribed guidance, as the company continues to deliver on its growth strategy.

Source: Companyâs Presentation

The underlying earnings for the period increased by 21% to $ 62.4 million. FY19 marked a record year for acquisitions, with 35 centre acquisitions and four new development sites settled, comprising more than $ 400 million in total value. The company now has a total of $ 1.95 billion in assets under management (AUM), depicting an increase of 36% on FY18, underpinning NSRâs position as the largest self-storage owner-operator in Australasia.

Source: Companyâs Presentation

The underlying EPS for FY19 was 9.6 cents per share in line with guidance and there was an improvement of 8% in the net tangible assets to $ 1.63 per stapled security. NSR also confirmed the final distribution of 5.1 cents per share (totalling 9.6 cents per share for FY19) as earlier estimated on 24 June 2019 and the payment date for the same is 5 September 2019.

Regardless of the challenging economic conditions that were experienced in some regions, NSR continued to demonstrate the strength and resilience of its business. The company reported that the organic occupancy growth for both Australia and New Zealand stood at 1%, with its Australian portfolio occupancy reaching 81.4% and New Zealand at 85.7% for FY19.

The company informed that ~ 60% of centres now trade consistently at or over 80% with 17% trading at or over 90%. The occupancy in Western Australia increased by around 5% in FY19 and as this number continues to build, NSRâs overall occupancy will benefit, which is noteworthy.

Managing Director Mr. Andrew Catsoulis stated that the company is currently pursuing an operational transformation plan, which would target specific areas such as achieving continued organic growth through improvements in people management, increased automation, more organised and timely reporting, and leveraging technology and innovation for improving the bottom line.

Several strategic initiatives are also being pursued including New Zealand Expansion, acceleration of development pipeline, and joint ventures. Going forth, NSRâs FY20 guidance is for underlying earnings per security to grow by greater than 4%, subject to no material changes or unforeseen events in the market.

Cedar Woods Properties Limited

Cedar Woods Properties Limited (ASX: CWP), established in 1987, is one of the leading national developers of residential communities and commercial properties, with the primary focus on delivering long-term shareholder value underpinned by its disciplined approach to acquisitions, the rigour and thoughtfulness of its designs, and attention to meeting the evolving needs of its customers.

âDeveloping and maintaining a high-performance culture is one of Cedar Woodsâ Strategic Prioritiesâ- William Hames, Chairman. The staff surveys have demonstrated high engagement and high levels of role satisfaction in the company.

The Groupâs diversified product mix comprises land subdivisions in emerging residential communities, medium and high-density apartments and townhouses in vibrant inner-city neighbourhoods and supporting retail and commercial developments.

The market capitalisation of Cedar Woods Properties is around AUD 523.57 million with ~ 80.18 million shares outstanding. On 29 August 2019, the CWP stock closed the dayâs trading at AUD 6.500, down 0.459% by AUD 0.030, with ~ 109,404 shares traded. Besides, the stock has delivered positive returns of 33.27% Year-to-date and 21.83% in the last six months. The companyâs annual dividend stands at around 4.82% to date.

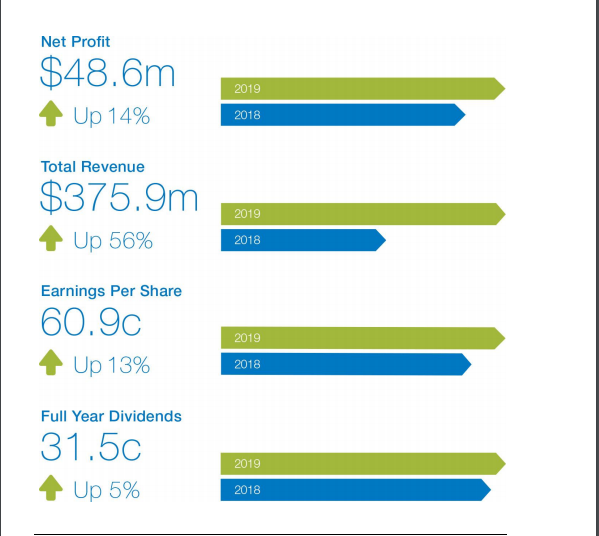

Full-Year FY19 Results â On 28 August 2019, Cedar Woods Properties announced its full year results for the financial period to 30 June 2019 (FY19). A snapshot of the same is as follows-

Source: Full Year 2019 Statutory Accounts

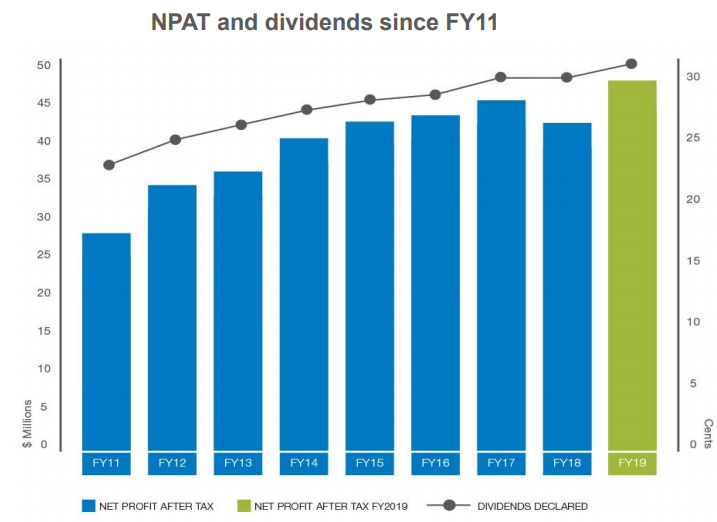

The company has a strong track record of consistent profitability and fully franked dividends. On 27 August 2019, the company announced an ordinary fully paid dividend of AUD 0.135 (Record Date: 26 September 2019, Payment Date: 25 October 2019), relating to a period of six months to 30 June 2019. With a full year dividend of 31.5 cents, Cedar Woods delivered a sound 5.3 % return to its highly valued shareholders.

Source: Full Year 2019 Statutory Accounts

The adherence to CWPâs Strategic Priorities - by geography, product type and price point led to the achievement of some record results for Cedar Woods in FY19.The company posted record sales of $ 375.9 million (up 56 %), record net profit of $ 48.6 million (up 14 %) and 13% growth in earnings per share for the 2019 financial year.

Specifically, Cedar Woodsâ competitive advantage is its focus on creating a progressive, high-spirited work environment with strong alignment to values and objectives, where top talent works collaboratively, and high performance is rewarded. The companyâs operational excellence may be attributed to renewed and integrated systems and technologies and having a strong corporate brand with quality projects.

Going forth, the company believes that the market sentiments are improving, and gains are expected in some markets over FY20 amidst lower interest rates, continuing population growth and government incentives supporting demand.

Disclaimer This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.