As per recent media reports, the economy of Australia is witnessing domestic and offshore headwinds, which might push slow economic growth in 2019. Adding to that, it will negatively impact property markets. The real estate industry has capital intensive projects with moderate barriers to entry. Letâs have a look at two real estate stocks, CWP and CIM, with their recent updates.

Cedar Woods Properties Limited (ASX:CWP)

A real estate sector company, Cedar Woods Properties Limited (ASX: CWP) is a property developer and investor. It was officially listed on ASX in 1994. On 1st July 2019, the company via a release updated the market about the modification and extension of its corporate finance facility subsequent to the completion of an annual review. The company stated that the modifications include the longer facility tenure, with the previous three year facility now comprising a mix of three year and five year debt as well as the introduction of National Australia Bank to the $205 million corporate finance facility.

The updated terms of the facility consist of:

- Extension of an additional year for approximately 80% ($165 million) of the facility to June 2022;

- Facility term extended to five years for approximately 20% ($40 million) of the total facility to June 2024; and

- Designing the facility terms to suit the companyâs current and future needs.

Furthermore, subject to consent by lenders, the facility will be reviewed annually and has the potential to be extended for an additional year on 30 December each year, refreshing both the three and five year terms.

Looking at the companyâs recent acquisitions. Recently, the company inked a conditional contract in order to acquire a former TAFE site, 133 Salvado Road, Subiaco located only 4km from the CBD in the sought-after western suburbs of Perth for an amount of $15.05 million, plus GST. The inking of the contract confirms the company as the preferred proponent in order to purchase the 1.4-hectare site. The completion remains conditional on the final acceptance by the City of Subiaco, and thereafter, the approval of the companyâs Board.

Financial Performance

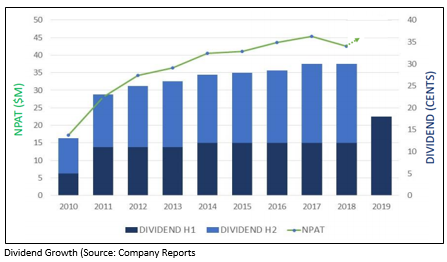

In Q3 FY19, the company remains on track to report a strong rise in earnings in FY19 and significant progress on several key projects. During the quarter, the construction of multiple stages and projects were completed by the company, with many further stages anticipated to be completed and settled by the end of FY19. On the flip side, the company reported revenue of $204.1 million in 1H FY19, reflecting a growth of 268% on pcp. The net profit of the company stood at $30.8 million in 1H FY19, reflecting an increase of 857% as compared to 1H FY18. The company declared an interim dividend of 18 cents per share, outlining the growth of 50%. Cedar Woods further described the major factors such as slower home loan processing by banks, investor uncertainty on taxation policy, a downward shift in consumer sentiment in Melbourne and Sydney and banks imposing tighter lending criteria on purchasers, which have affected sales and enquiry levels in 1H FY19.

The net margin of the company amounted to 15.1% in 1H FY19, reflecting a growth of 9.2%, which indicates that the company is improving its capability to convert its top line into the bottom line. The return on equity for the period stood at 8.5% against the industry median of 5.0%. This implies that the company is providing better returns to its shareholders as compared to the broader industry. Furthermore, the company reported liquidity position (current ratio) of 4.60x in 1H FY19 when compared to the industry median of 1.47x, representing that the company is in a sound position to address its short-term obligations.

Outlook

The company presented positive medium term outlook, supported by $249 million in pre-sales as compared to $230 million on pcp. Cedar Woods expects challenging FY20 as the current market conditions have weakened nationally. However, the company is well-placed to endure the current market conditions and perform strongly over the medium term.

At the time of writing on 2nd July 2019 (AEST 2:30 PM), the stock of CWP was trading at a price of $5.690 per share, down 0.175%, with a market capitalisation of $456.67million. The stock has exhibited returns of -3.39%, 6.54% and 11.98% for the one month, three months and six month period, respectively.

CIMIC Group Limited (ASX:CIM)

CIMIC Group Limited (ASX: CIM) is involved in providing services related to mining and operations, construction and maintenance to its clients. It was officially listed on the Australian exchange in 1962. On 1st July 2019, the company published a release stating the finalisation of Cross River Rail public private partnership package. The company further elaborated that its group companies, CPB Contractors, UGL and Pacific Partnerships have reached contractual close with the State of Queensland as part of the Pulse consortium. In addition, the State Government has offered a capital contribution of $5.4 billion for construction. The contractual close took place on 30th June 2019, with the construction to begin later this year. Accordingly, the companyâs revenue stands at around $2.73 billion.

Importantly, the company pointed out that it has led the development of the projectâs proposal with Pacific Partnerships, a lead sponsor, providing 49% of the equity finance and 51% of the equity finance will be provided by BAM PPP PGGM, Ghella Investments & Partnerships and DIF. While UGL will provide maintenance services for the project over 24 years, the CPB Contractors will be delivering the construction and design in a joint venture with BAM International, UGL and Ghella.

Financial Performance

The group reported revenues of $3.4 billion, reflecting a growth of 6% on a Y-o-Y basis, with a solid performance throughout all operating companies. CIM reported stable PBT, NPAT and EBIT margins of 7.3%, 5.3% and 8.2% respectively, driven by a diligent focus on project delivery and cost discipline. The rise in net finance costs from a higher level of bonding, additional working capital initiatives and an increase in leased asset expenses have supported the growth of the business.

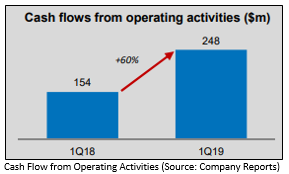

CIM delivered strong EBITDA cash conversion rate of 108% in the last 12 months and reported gross capital expenditure on the back of investment in tunnelling equipment with continued spend on mining equipment driven by revenue growth. The cash flow from operating activities stood at $247.5 million in Q1 FY19 against $154.3 million in Q1 FY18, reflecting a rise of 60.4% on pcp.

The net margin of the company amounted to 5.3% in FY18 compared to the industry median of 2.7%, which showcases that the company is effectively converting its top line into the bottom line. The gross margin of the company for the period stood at 42.5% in FY18 against the industry median of 12.9%. The return on equity stood at 27.1% in FY18 as compared to the industry median of 9.9%, reflecting that the company is providing better returns to its shareholders compared to the broader industry.

At the time of writing on 2nd July 2019 (AEST 3:00 PM), the stock of CIM was trading at a price of $45.960 per share, up 1.435%, with a market capitalisation of $14.69 billion. The stock has generated returns of 3.57%, -7.51% and 5.94% for the one month, three months and six month period, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.