Sequoia Financial Group Limited, Kelly Partners Group Holdings Limited and HiTech Group Australia Limited have released their full-year results for FY2019 ended 30 June 2019. Letâs see how these companies performed during the period.

Sequoia Financial Group Limited

An integrated financial services company, Sequoia Financial Group Limited (ASX:SEQ) offers investment and superannuation products, retail, wholesale and institutional trading platforms, and wealth management and advisory services. Headquartered in Sydney, Australia, SEQ caters to wholesale as well as self-directed retail customers. It also serves 3rd party professional service businesses.

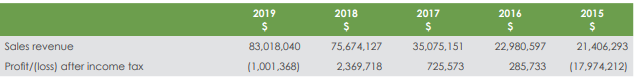

On 20 August 2019, Sequoia Financial Group released its full-year results for the period ended 30 June 2019. The company reported an increase of 9.7% in revenues from ordinary activities to $ 83.02 million. However, its loss for the period stood at more than $ 1 million.

Source: Companyâs Report

In the first nine months, the Group made heavy investments in improving the capability to deal with the heavy growth aspirations. The company also took a conservative stance and wrote down the value of the non-core business, intangibles, fixed assets in addition to writing off some of the historical accrued revenues as bad debts. The group incurred some heavy costs related to acquisitions, as well as redundancy costs and contract renegotiation costs related to its work concerning the enhancement of the technology solutions around clearing, direct to market sales units and the legal document business. The sum of all the non-recurring items is around $ 1.5 million (including actual write downs).

On 24 July 2018, the company secured $ 5 million in a placement through the issue of 15,151,515 new fully paid ordinary shares at a price of $ 0.33 per share. These funds were raised from existing and new institutional and sophisticated investors to support the company in paying its short-term debt as well as improve the financial position. Additionally, the company divested its entire private share investment of $ 1,657,850 in Noble Oak in the month of February 2019.

Recently, the company, on 7 August 2019, unveiled the acquisition of a successful financial advice dealer group, Libertas Financial Planning Pty Ltd, which has approx. seventy authorised representatives. The acquisition would help the company in boosting its operations in the advice marketplace.

Outlook:

In FY2020 and beyond that, the company would target a net revenue growth (after sales costs) of 23% with a spread in the range of 15% to 40% across various operating divisions.

The short-term goals of SEQ include:

- Generation of strong cash flow from all divisions.

- Provide a return on equity on non-cash equity of 15% and even more than that.

- Rebuild investorsâ confidence.

- Achieve the share price trading at or more than equity per share.

- Restart paying dividends to shareholders at 20% to 50% of net profit after tax.

Stock Performance:

By the end of dayâs trading on 21 August 2019, the price of the share of SEQ was A$ 0.175, down by 2.778% as compared to its previous closing price. SEQ has a market cap of A$ 21.46 million with ~ 119.19 million outstanding shares, an annual dividend of 2.78% and a PE ratio of 30.510x.

Kelly Partners Group Holdings Limited

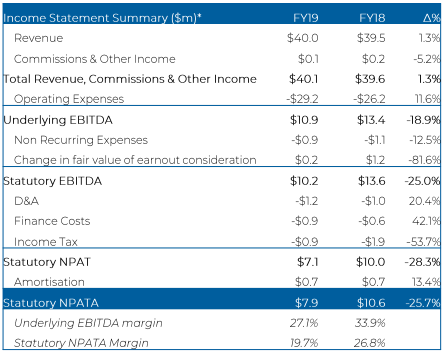

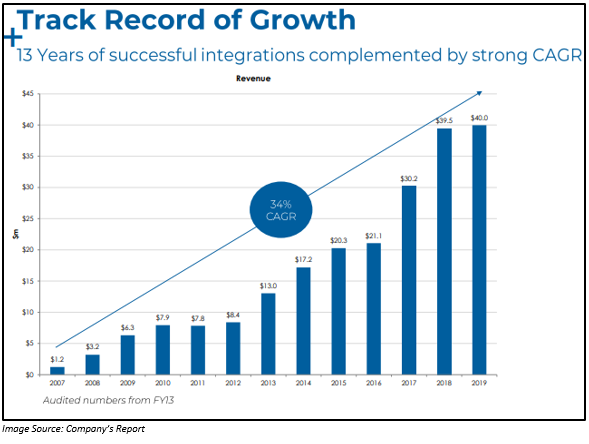

Kelly Partners Group Holdings Limited (ASX: KPG) is a specialist chartered accounting network that offers better services to private clients, businesses as well as their owners and families. On 20 August 2019, the company announced its FY2019 results for the period ended 30 June 2019. It reported group revenue of $ 40 million during FY2019, in line with the prior guidance. There was an increase of 7.5% in organic revenue to $ 31.6 million, which excludes Sydney CBD. The total revenue growth, excluding Sydney CBD, increased by 11.9%.

Underlying EBITDA of the group was also in line with the previous guidance, reaching $ 10.9 million during the period, while underlying attributed NPATA for the period was $ 3.2 million. The company reported a strong cash inflow through operating activities, up 51% when compared with the previous corresponding period, to $ 10.0 million. Total dividend for FY2019 was 4.3 cents per share, representing a growth of 10% on FY2018.

FY19 Income Statement (Source: Companyâs Report)

Operational Highlights:

- The growth in organic revenue was driven by increase in volume and price.

- The company made three Tuck-in acquisitions and 1 Marquee acquisition. It expects a full-year revenue contribution of $ 3.0 million - $ 4.0 million during FY2020 from the acquisitions made in FY19.

- KPG implemented upgrades to the IT server in FY2019, while trainings for client managers and business managers are ongoing.

- The company also reported a 56% increase in revenue from other services including wealth management, corporate advisory and investment office.

Stock Performance:

The shares of KPG last traded on 20 August 2019 and closed at a price of A$ 0.880. KPG has a market cap of A$ 40.03 million with ~ 45.49 million outstanding shares and a PE ratio of 19.3x.

HiTech Group Australia Limited

HiTech Group Australia Limited (ASX: HIT), a provider of recruitment and ICT (Information and Communication Technology) consulting services, released its investor presentation focusing on its full-year results for the period ended 30 June 2019, on 20 August 2019.

FY2019 Highlights:

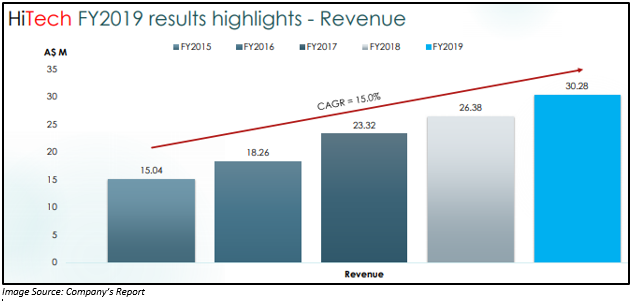

FY2019 remained another record year for HiTech Group Australia Limited. Revenue of the company during the period improved by 15% to $ 30.28 million, while EBITDA grew by 10% to $ 4.09 million and net profit after tax increased by 13% to $ 2.89 million when compared with the same period a year ago.

Net tangible assets in FY2019 remained at par with respect to FY2018 at $ 0.19 per share. The company also announced a fully franked final dividend of 4 cents per share, scheduled for payment on 12 September 2019 to all the registered shareholders by the closure of the business on 29 August 2019.

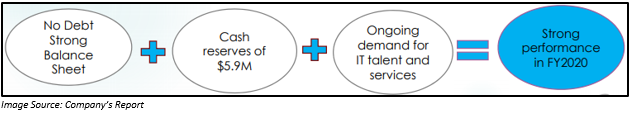

At the end of the reported period, the company had a cash balance of $ 5,927,690, which was up 1% from $ 5,862,986 recorded in the same period a year ago.

The presentation also covered the 2 Tier growth strategy of the company. It includes organic growth and M&A growth.

Organic Growth:

Organic growth comprises of:

- On-boarding of new clients.

- Improving the service offerings to the companyâs existing customers by providing them with a wider suite of ICT consulting as well as recruitment solutions along with base contracting agreements.

- Expansion of the ICT offering into high margin consulting and service space to meet the clients' objectives.

M&A Growth:

M&A growth comprises of:

- Pursuing acquisitions in a highly fragmented market, with the targets matching the culture of the company as well as fitting into the industry. It should be EPS and CFPS accretive and should provide positive returns to shareholders.

- Multiple probable targets being considered.

- The board is committed to focus on employing a disciplined M&A growth strategy that is in the best interest of shareholders and beneficial for the company.

Outlook for FY2020:

The company has placed itself well to capitalise on the demand for its ICT talent and services. The focus of the company would be to provide its clients with high-grade services and simultaneously maintaining the profitable growth.

The FY2020 outlook would rely on the prevailing economic situations along with the demand and supply forces for its ICT talent as well as services.

Stock Performance:

By the end of dayâs trading on 21 August 2019, the price of the share of HIT was A$ 1.170. HIT has a market cap of A$ 44.52 million and ~ 38.05 million outstanding shares, an annual dividend yield of 6.84% and a PE multiple of 15.29x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.